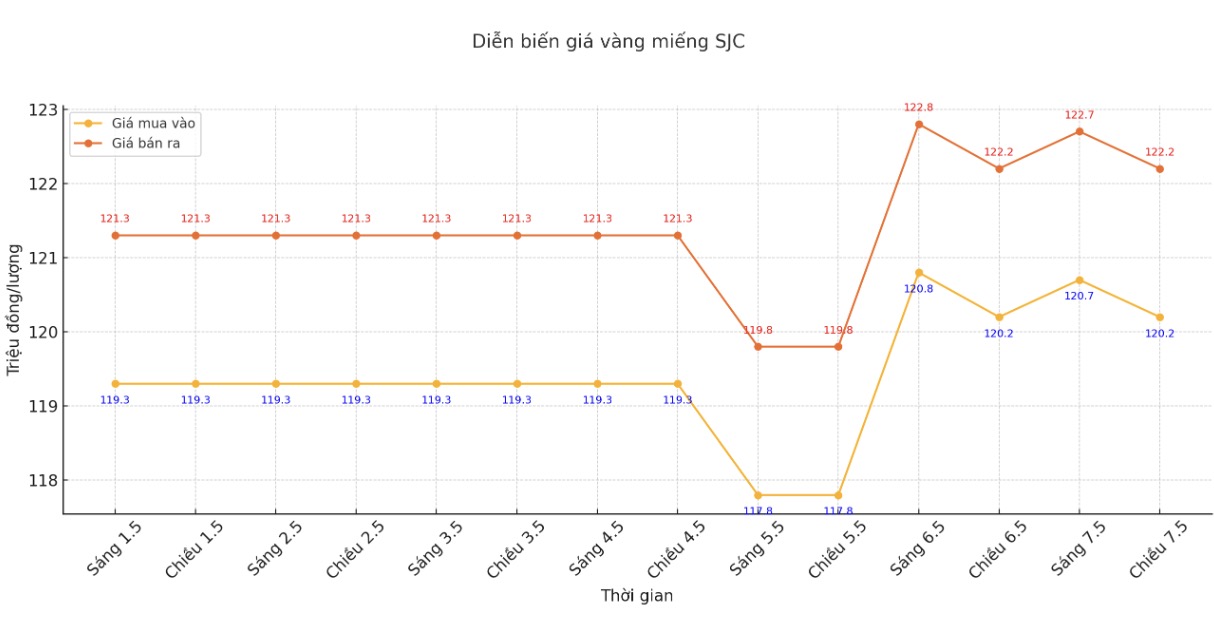

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 120.2-122.2 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 120.2-122.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120.2-122.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 118.7-121.7 million/tael (buy in - sell out), down VND 1.1 million/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

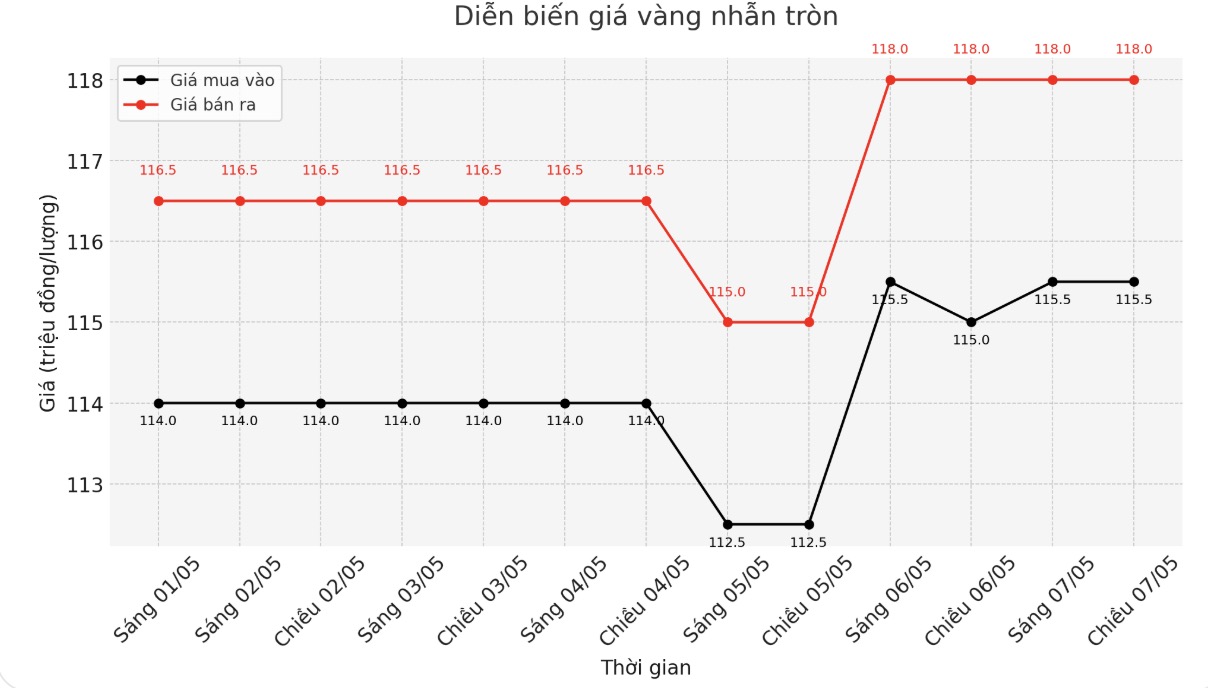

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND115.5-118 million/tael (buy - sell), an increase of VND500,000/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.5-120.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.5-118.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

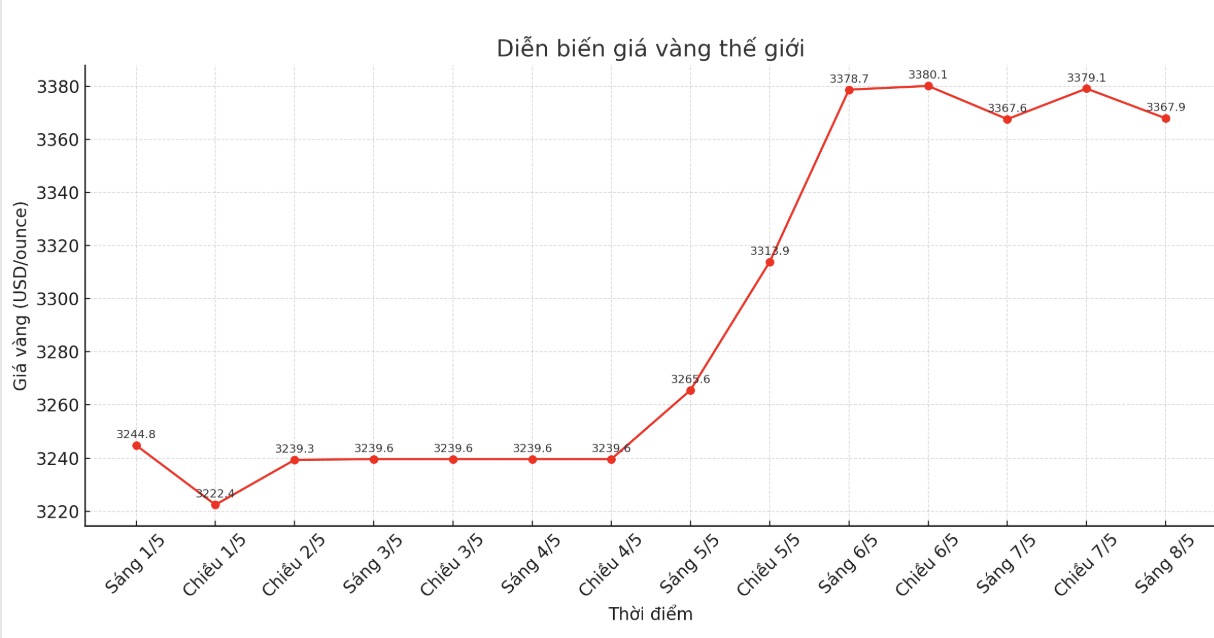

World gold price

At 6:00 a.m., the world gold price listed on Kitco was around 3,367.9 USD/ounce, down 26.6 USD.

Gold price forecast

According to Kitco, gold and silver futures fell in the US midday trading session on Wednesday, due to profit-taking activities after the increase at the beginning of the week and risk-off sentiment improving somewhat during the day.

The Federal Open Market Committee (FOMC) just released a statement after a two-day meeting with no changes to monetary policy as the market had predicted.

The US Federal Reserve (FED) said the US economy is still growing steadily, but the risks of inflation and unemployment are increasing. In addition, FOMC members believe that the US economic outlook is becoming more unpredictable.

However, gold and silver prices did not react strongly to this information. Gold prices for June delivery fell by 28.9 USD, to 3,393.9 USD/ounce; silver prices for July delivery fell by 0.596 USD, to 32.785 USD/ounce.

Investors are waiting for the press conference of Fed Chairman Jerome Powell - which is considered very important to grasp the next direction of monetary policy. Speeches related to inflationary pressures, tax policies and the global trade war will receive special attention.

The US stock market weakened in the afternoon. The risk psychology is a bit improved thanks to the information of the US and China may meet in Switzerland this weekend to negotiate trade, led by US Finance Minister Scott Bessent. However, the market did not expect much on the results and the US stock index has decreased again in the session.

In other developments, the People's Bank of China announced that it would cut interest rates and pump more liquidity to support the economy, but these moves are not considered drastic.

Investors are also monitoring the tense situation between India and Pakistan.

Technically, investors price for gold contracts in June still retain technical advantages in the short term. The next goal of the buyer is to exceed the resistance of 3,509.9 USD/ounce - the highest level of the contract history. In contrast, the goal of the seller is to pull the price below the support level of 3,209.4 USD/ounce.

The most recent resistance was $3,448.2 and then $3,475/ounce; the most recent support was $3,367 and then $3,332.1/ounce.

In outside markets, the USD index increased slightly. Nymex crude oil prices fell, trading around 58.5 USD/barrel. The yield on the 10-year US government bond is currently at 4.275%.

See more news related to gold prices HERE...