Updated SJC gold price

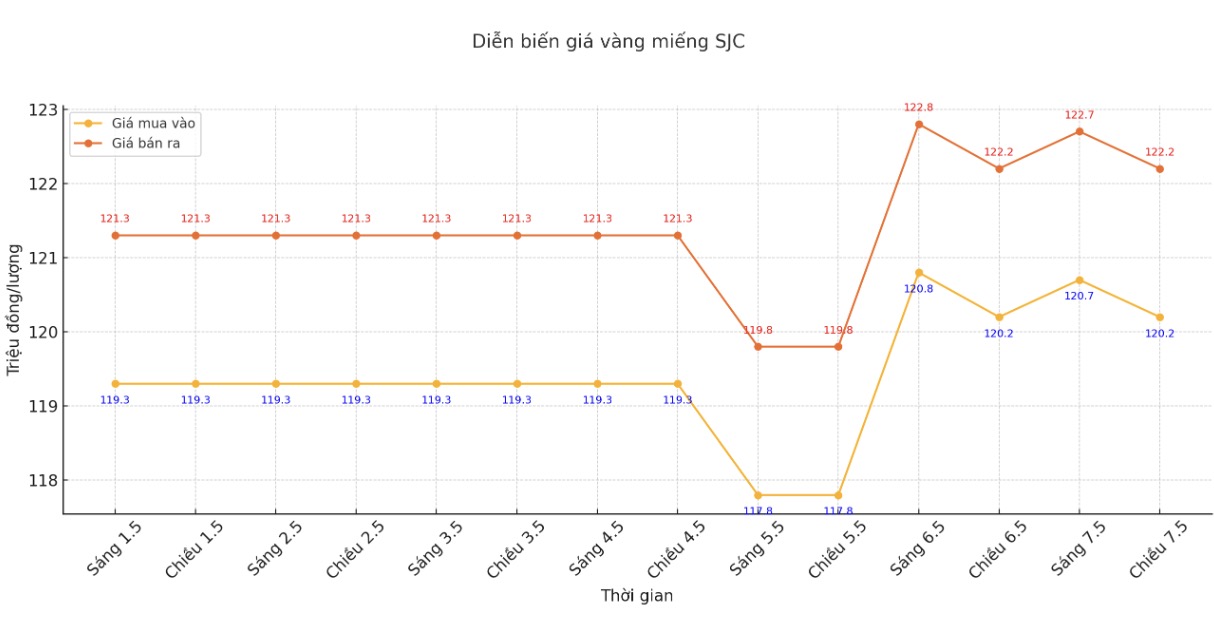

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 120.2-122.2 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 120.2-122.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120.2-122.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 118.7-121.7 million/tael (buy in - sell out), down VND 1.1 million/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

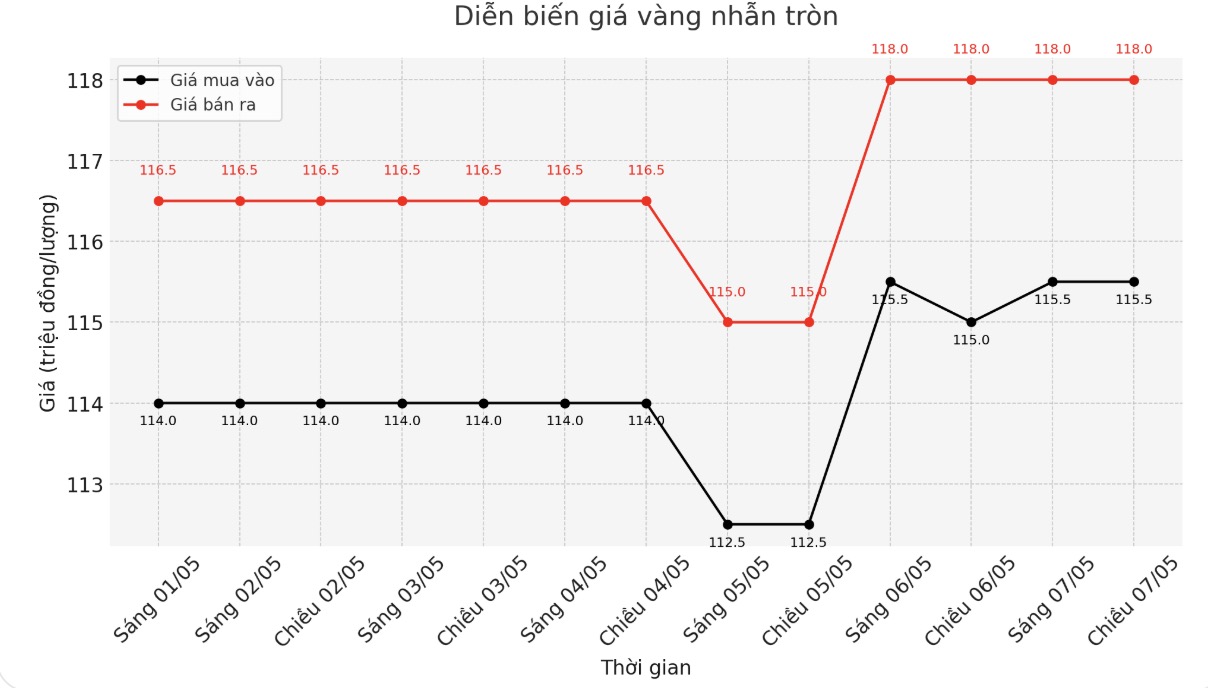

As of 5:00 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND115.5-118 million/tael (buy - sell), an increase of VND500,000/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.5-120.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.5-118.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

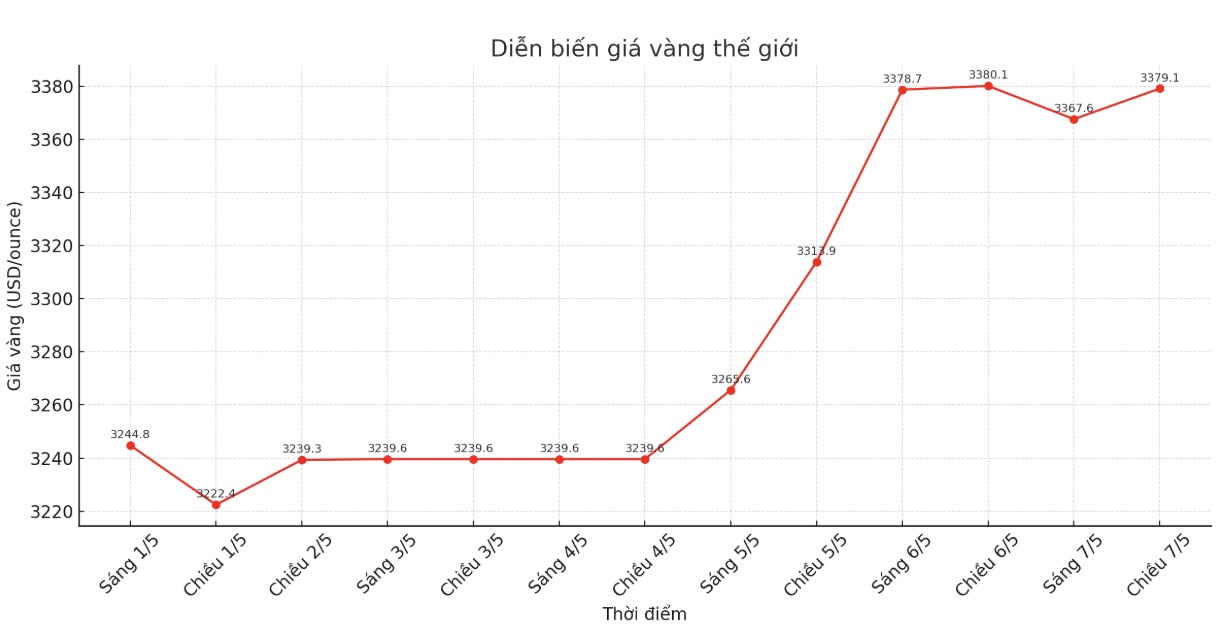

At 5:10 p.m., the world gold price listed on Kitco was around 3,379.1 USD/ounce, not much changed compared to a day ago.

Gold price forecast

World gold prices continue to stay high as investors cautiously await the results of the Federal Open Market Committee (FOMC) meeting, scheduled to be announced at 1:00 a.m. on May 8 (Vietnam time), to find clues on the FED's upcoming interest rate management orientation.

Although the market does not expect any changes in interest rates, the tone of the FED's announcement will strongly affect gold prices.

If the Fed shows downhill (cautious, maintaining low interest rates), gold could continue to be supported. Conversely, if the FED is leaning towards a hawl (supporting interest rate increases), gold prices may weaken.

According to CME's FedWatch tool, there is a 95.6% chance that the Fed will keep interest rates unchanged in the range of 4.25%-4.50%, while the possibility of interest rate cuts is only 4.4%.

Gold prices are heading for an unprecedented high in 2025, with a series of two consecutive increases showing that another strong rally could be on the way.

The precious metal has broken a series of records this year, following an impressive increase of 80% since October 2024, equivalent to an increase of 1,564.1 USD in just 14 months.

The two main reasons behind this are the weak USD and the extremely optimistic sentiment of investors. When the global economy and geopolitics are uncertain, gold is increasingly considered a safe haven.

In addition, central banks around the world are buying gold at record levels to diversify assets and reduce dependence on the US dollar. According to the World Gold Council, in 2024, central banks bought more than 1,000 tons of gold, the third consecutive year, and this trend is expected to continue in 2025.

Many countries are stepping up their de-dollar strategy to reduce their dependence on the US dollar and avoid the risk of sanctions. This has further prompted central banks to buy more gold, considering it a safe alternative.

See more news related to gold prices HERE...