Asia leads the wave of gold investment through ETFs

Over the past two years, Asia has been the leading region in physical demand for gold. Now, this trend continues to spread to the "paper" gold market, with the buying volume of gold ETFs (port rate exchange-traded funds with gold guarantees) increasing the most compared to other regions, according to the latest data from the World Gold Council (WGC).

Total global gold ETF holdings increased by 115 tons in April, equivalent to 11 billion USD, bringing the total to 3,561 tons. This is the 5th consecutive month of recorded net inflows, and also the highest level since August 2022. However, this figure is still 10% lower than the record set in 2020.

Asia accounts for 65% of total global net capital flows, the highest ever. North America also recorded significant demand, while capital flows in Europe turned negative (capital flows were withdrawn) the report said.

Gold ETFs in Asia increased by 69.6 tons (7.31 billion USD) in the month. Most of China, marking the third month in a row, the flow of capital flows in is also the most powerful month in the history of this area. The reason is that the trade tensions with the United States make investors worried about weakening growth, strong stocks fluctuated and the local currency depreciated, thereby pouring into gold.

In Japan, geopolitical uncertainty related to trade has also caused investors to continue to pour capital into gold ETFs for the 7th consecutive month.

North America recorded net capital flows of 44.2 tons (1.83 billion USD). Although investment demand in North America may fluctuate as gold prices increase, the WGC believes that the uptrend will continue.

Although capital flows have decreased slightly compared to February and March, this is still the second strongest April in history. In the short term, it may fluctuate, but concerns about trade policy and inflation will help support gold demand in the medium and long term, the report wrote.

Europe is the only weakness when the ETFs here are withdrawn 0.7 tons (807 million USD). Although at the beginning of the month, the increase in gold price helps attract capital flows, but at the end of the month, the discount momentum triggered profit. In addition, the strong recovery of the stock market also reduces the attractiveness of gold.

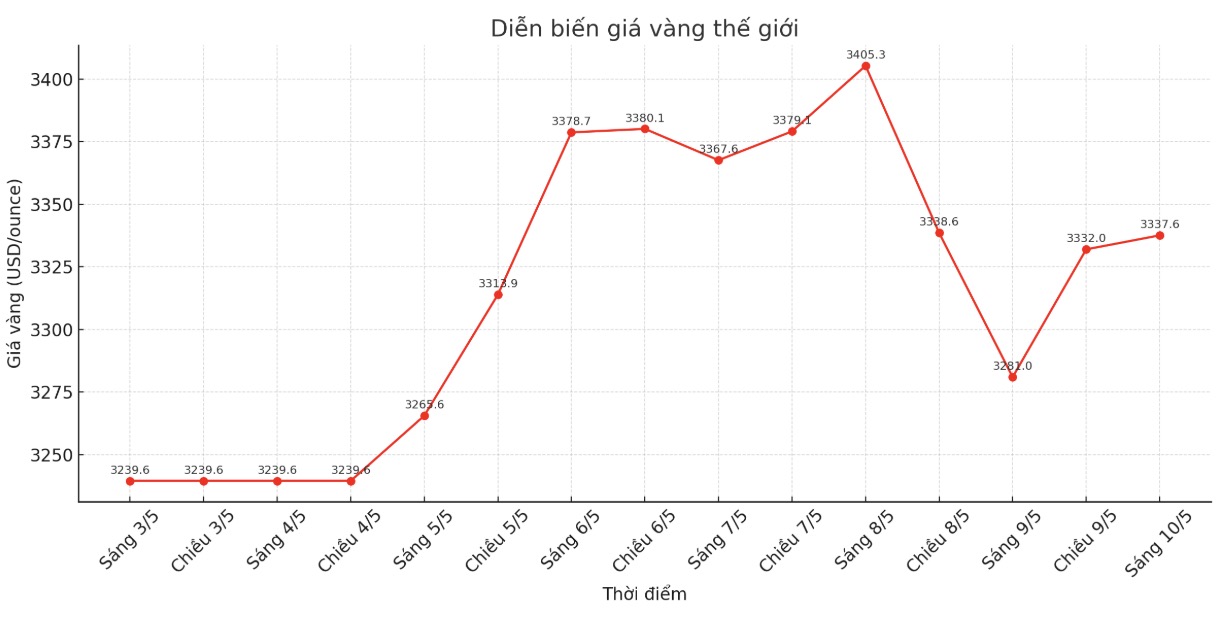

The gold price increase has not stopped

Although gold prices hit a historic peak of $3,500/ounce last month, the WGC said gold still has room to continue to increase, even in the context of strong fluctuations and increased profit-taking activities.

Large gold rallies in the past have often led to strong inflows into ETFs. However, the current holdings of gold held by Western funds are still down from the 2020 peak by 575 tons (equivalent to 15%) - the analysis report.

The number of net gold buy contracts on the COMEX exchange representing speculative capital flows is also at a year-low level (nearly 570 tons), much lower than the peak of more than 1,200 tons in 2020.

According to the WGC, global trade instability is still the biggest risk factor driving gold demand. Concerns about an economic downturn due to a trade war account for about 10-15% of the reason for gold prices to increase.

Even as trade negotiations progress, we do not expect gold to lose all its gains due to risk factors. Gold is still being bought strongly despite reduced tensions and a recovery in the US stock market since the beginning of April. International investors are still cautious about the policies that the Donald Trump administration could implement in the next 3 years, experts said.

Finally, current global monetary policy is also supporting gold. The WGC believes that the increasing protectionist trend is slowing growth and increasing inflationary pressures, thereby pushing real interest rates down, a factor that is beneficial for gold because it is a non-yielding asset.