World gold price increases after many months of suppression

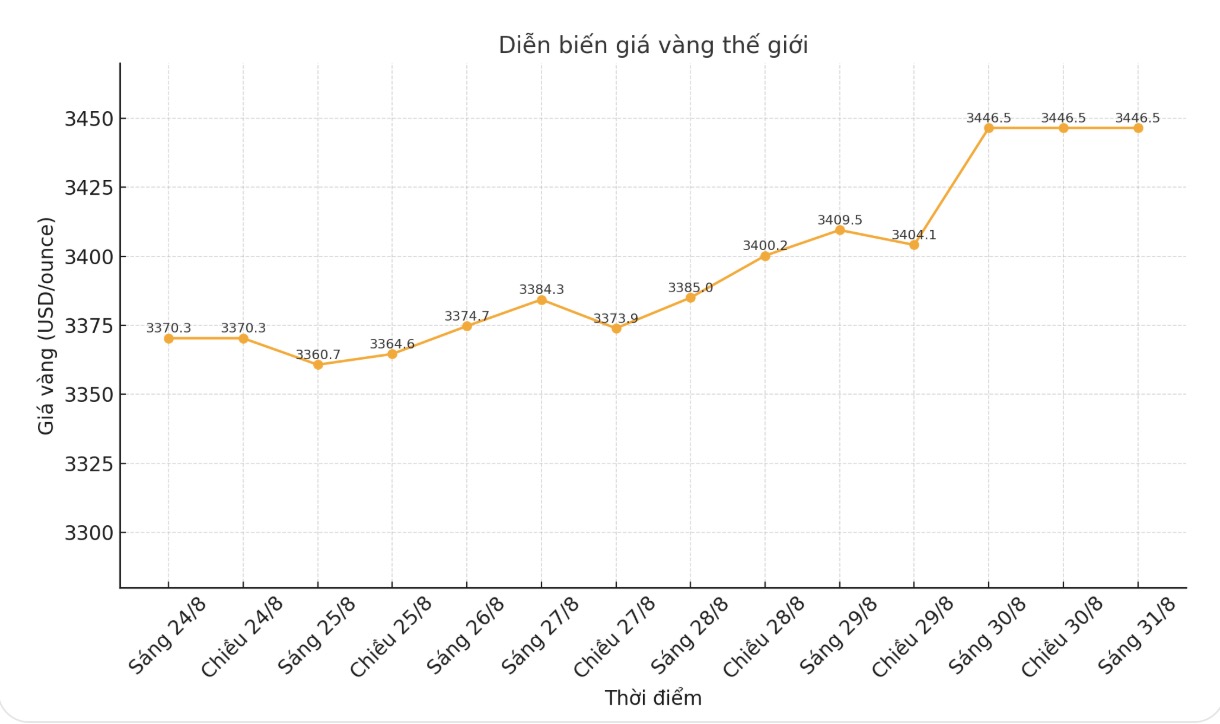

World gold prices have gone through many weeks of struggling. However, this trend ended before the breakout last week.

In just 1 week, the world gold price has skyrocketed by 76.2 USD, to 3,446.5 USD/ounce. The precious metals market received many positive forecasts from Wall Street experts. Many believe that gold prices could soon regain the peak of $3,500/ounce.

It is worth mentioning that the gold market last week did not have much big information, enough to have the impact of causing prices to increase.

Its hard to explain why gold and silver are rallying strongly, while stocks are only falling slightly, said John Weyer, director of commercial hedging at Walsh Trading. Normally, when capital flows to shelter, the stock market has to decrease much more strongly".

He said this could be an early signal from the precious metals market, reflecting a lack of positive economic data. Traders may feel that the employment picture is not as bright as it is floating, or are reacting to inflationary pressures in some sectors. In addition, geopolitical tensions, especially the Russia-Ukraine conflict, have shown no signs of cooling down, contributing to boosting gold.

According to Weyer, the recent increase is likely to be due mainly to technical factors and low liquidity. If comex futures exceed $3,534 an ounce, it will create a psychological effect, attract more buying power and take prices further. This is the mechanism of "self-fulfilling prophecy" commonly seen in the market".

From another perspective, Alex Kuptsikevich - senior expert at FxPro explained that gold has been suppressed since April. Gold is trading around $3,400 an ounce. The resistance level above is 3,430 USD/ounce.

To truly return to the strong uptrend, prices must break out in this zone. Otherwise, the risk of a correction to the $3,300-3,315/ounce zone still exists. He emphasized that after many months of accumulation, any breakthrough will create strong waves, in any direction.

Adrian Day - Chairman of Adrian Day Asset Management believes that the catalyst for the explosion could come from the US Federal Reserve (FED) officially cutting interest rates in September, or from the decline in the stock market.

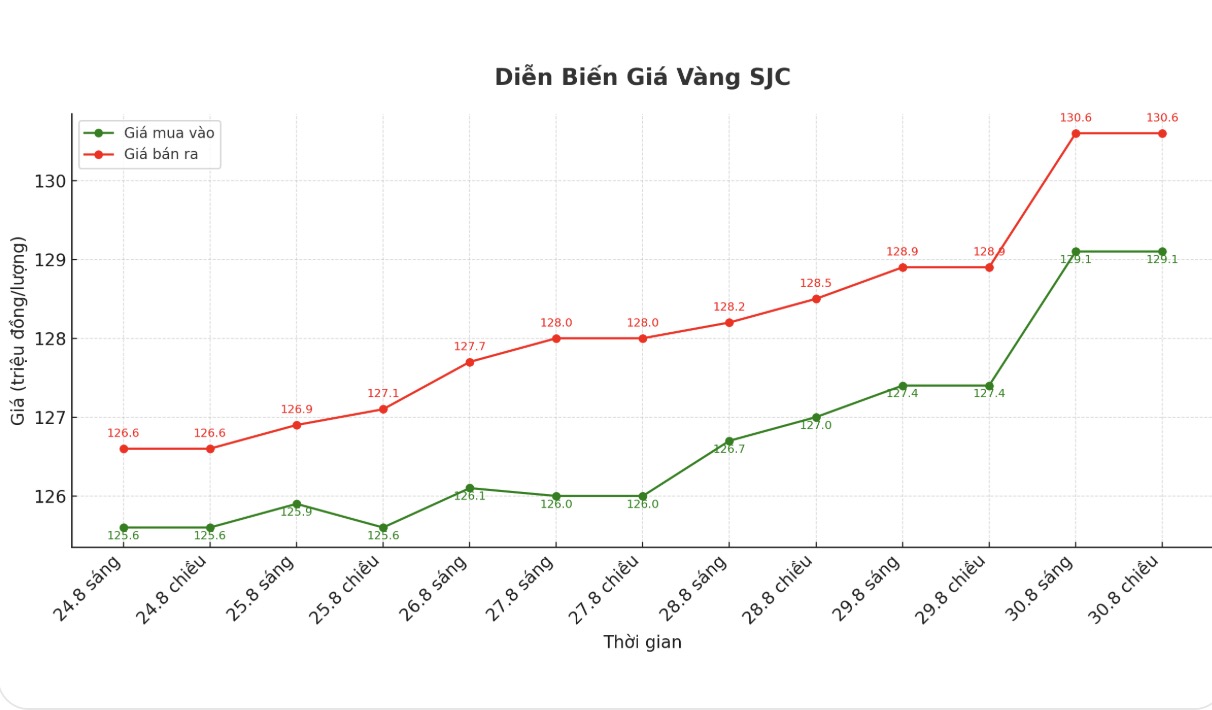

Domestic gold breaks historical peak

The domestic gold market last week recorded a much stronger increase than world gold. At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 129.1-130.6 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (August 24, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 3.5 million VND/tael for buying and increased by 4 million VND/tael for selling.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.6-130.6 million VND/tael (buy in - sell out). Compared to a week ago, the price of SJC gold bars was increased by 3 million VND/tael for buying and increased by 4 million VND/tael for selling.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau in the session of August 24 and selling in today's session (31.8), buyers will make a profit of 2.5 million and 2 million VND/tael respectively.

For gold rings, Bao Tin Minh Chau listed the price at 122.6-125.6 million VND/tael (buy - sell); increased by 3.6 million VND/tael in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 122.3-125.3 million VND/tael (buy - sell), an increase of 4 million VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of August 24 and selling in today's session (8.31), buyers at Bao Tin Minh Chau will make a profit of VND600,000/tael, while the profit when buying in Phu Quy is VND1 million/tael.

See more news related to gold prices HERE...