Gold price developments last week

Spot gold opened the week above $2,700 an ounce, but briefly sold off to test resistance at $2,690 an ounce around 8 p.m. ET on Sunday. That was the lowest level of the week, however, as the precious metal did not fall below $2,600 an ounce once during the week.

Trading on Monday was fairly steady, with gold prices trading in a narrow range of $2,704 to $2,712 an ounce amid the inauguration of US President Donald Trump and a series of initial executive orders. Notably, Monday was also a holiday in the US, which limited market volatility somewhat.

After last testing $2,704 an ounce around 7:45 p.m. ET, gold prices had their first strong rally of the week, rising more than $20 by 12:30 p.m. and peaking near $2,732 an ounce at 2:30 a.m. Tuesday.

Gold prices were near a weekly high when North American markets opened on Tuesday, and as US traders entered the market, the precious metal was immediately pushed to a new high above $2,745 an ounce by noon (Eastern time).

Before midnight, spot gold prices had crossed the $2,750/ounce mark and by 5:15 a.m. Wednesday, the precious metal had recorded a double peak above $2,762/ounce.

Precious metals markets remained flat on Wednesday and Thursday at new highs as traders tried to gauge the possibility of gold challenging its all-time high from late October. With no signs of weakness and plenty of safe-haven buying support, gold finally broke through $2,762 an ounce just before 9 p.m. Thursday, soaring to $2,775 by 10 p.m.

Friday's trading session established the $2,772/ounce area as an effective short-term floor for gold, with spot gold peaking at $2,786/ounce around 10:15 a.m. ET before adjusting slightly to the $2,770/ounce area for the rest of the session.

What do experts predict about gold prices next week?

The latest Kitco News survey shows that industry experts are extremely bullish on gold prices, with retail investors also increasing their confidence in the precious metal's ability to re-establish record highs.

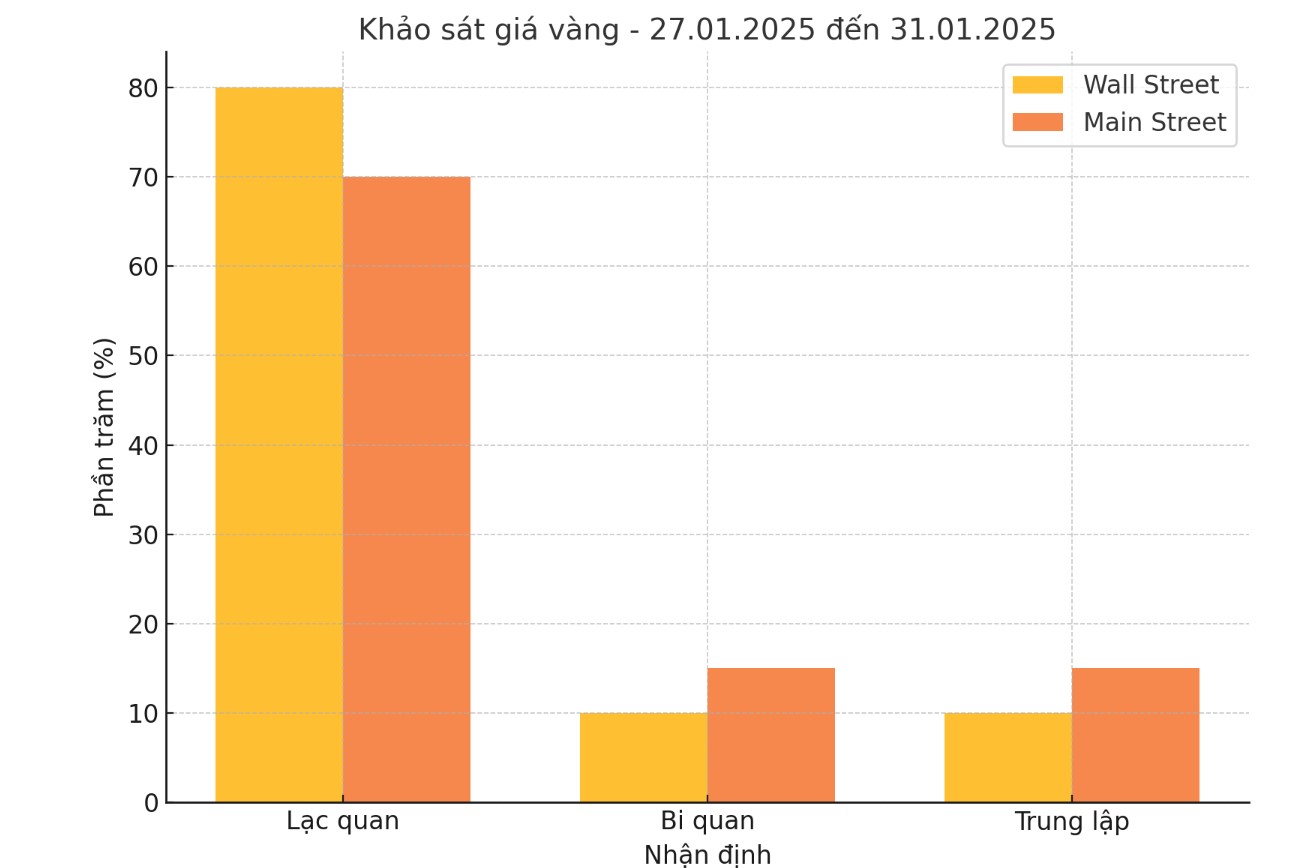

This week, 10 analysts participated in the Kitco News gold survey. Eight experts (80%) expect gold prices to rise next week, while only one expert (10%) predicts prices will fall and another expert sees gold moving sideways in the short term.

Meanwhile, 169 votes were cast in Kitco’s online poll. 118 retail traders (70%) predicted gold prices would rise next week, while 25 (15%) said they expected gold prices to fall. The remaining 26 (15%) predicted gold prices would fluctuate sideways in the coming period.

Economic calendar affects gold price next week

Next week's economic calendar will focus on central banks around the globe, with the US Federal Reserve and Bank of Canada announcing interest rate decisions on Wednesday, followed by the European Central Bank on Thursday.

Markets will also be paying attention to a number of U.S. economic data, including December new home sales on Monday, durable goods and consumer confidence reports on Tuesday, fourth-quarter GDP, weekly jobless claims and pending home sales on Thursday, and PCE, personal income and personal spending on Friday morning.

See more news related to gold prices HERE...