Experts are giving mixed reviews about the gold price trend next week, after the precious metal fluctuated strongly last week.

I am still leaning towards gold and will seek new support so that the broader trend can continue, said James Stanley, senior strategist at Forex.com.

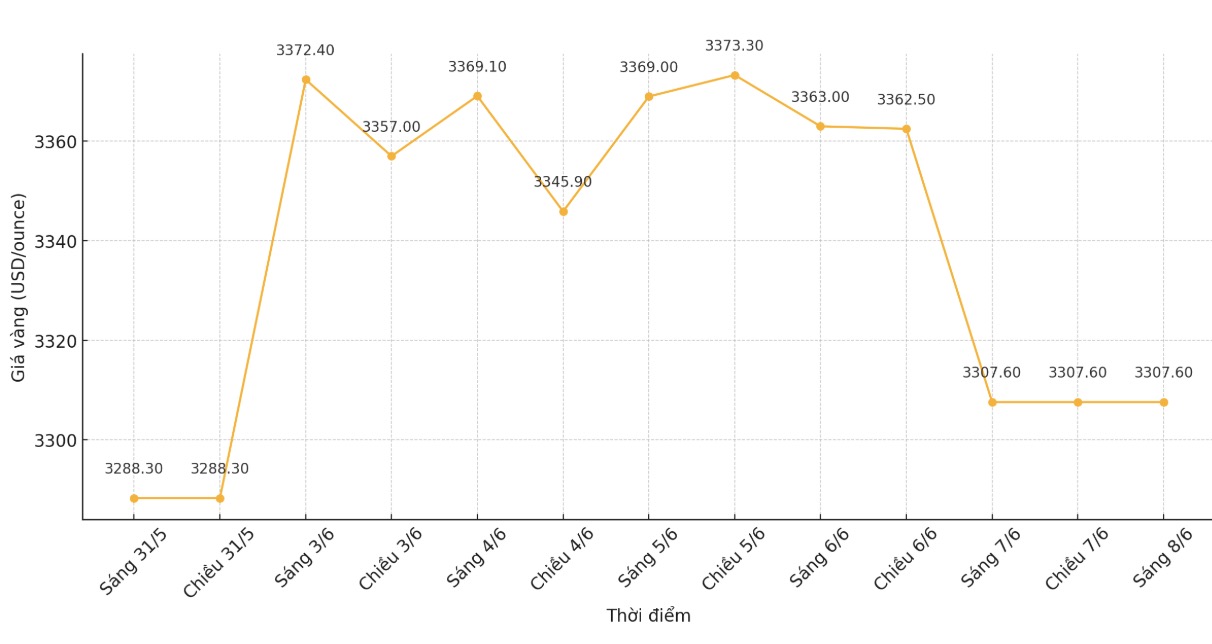

Gold has set a new high in the short term, with the price increase surpassing $3,350/ounce. Therefore, I do not rule out the possibility of this uptrend continuing, and will seek new support, especially at $3,300/ounce and $3,280/ounce," the expert said.

Rich Checkan - Chairman and CEO of Asset Strategies International commented: "Current momentum supports gold and silver. While there may be some profit-taking, I predict gold will continue to rise next week thanks to the weakness of the US dollar, political tensions in the Middle East and Ukraine, impacts from tariffs, and the approval of major US laws that will increase public debt and lead to consumer inflation. These factors will continue to drive demand for gold as a safe asset.

Adrian Day - Chairman of Adrian Day Asset Management shared: "There are signs that North American investors are increasing their gold purchases, although not a strong wave, I believe this trend is gradually changing. This is a positive signal for the gold market in the future."

Marc Chandler - CEO at Bannockburn Global Forex gave a more cautious view: "Gold may face some selling pressure in the coming days as the USD may stabilize after better-than-expected jobs data and expect a strong CPI next week. This could see gold face a slight decline and could retreat to $3,300/ounce.

Kevin Grady - Chairman of Phoenix Futures and Options said: "The decrease in gold prices on Friday may just be a normal profit-taking.

Gold has maintained support from concerns about a decline in US credit ratings, although no one expected bankruptcy to occur. Gold continues to be an attractive asset, especially as investors seek safety amid economic uncertainty," the expert said.

Meanwhile, Michael Moor - Founder of Moor Analytics said that for a longer period of time, the gold market is still in an uptrend since August 2018 and is currently in the final stage of this increase. He predicted that gold will see an adjustment and may decrease to 3,150 USD/ounce in the near future.

Finally, Jim Wyckoff - Kitco's senior analyst, believes that gold can still benefit from safe-haven demand in the short term.

He commented: "Gold may continue to increase thanks to the lack of strong risk appetite, and technical indicators still maintain an uptrend".

With mixed reviews, the outlook for gold prices continues to be a topic of interest next week. The market will focus on key metrics such as the US Consumer Price Index (CPI) for May on Wednesday, the Producer Price Index (PPI) on Thursday and unemployment rate data. These factors will significantly affect the US Federal Reserve's (FED) decision on interest rate policy and may affect gold prices in the short term.