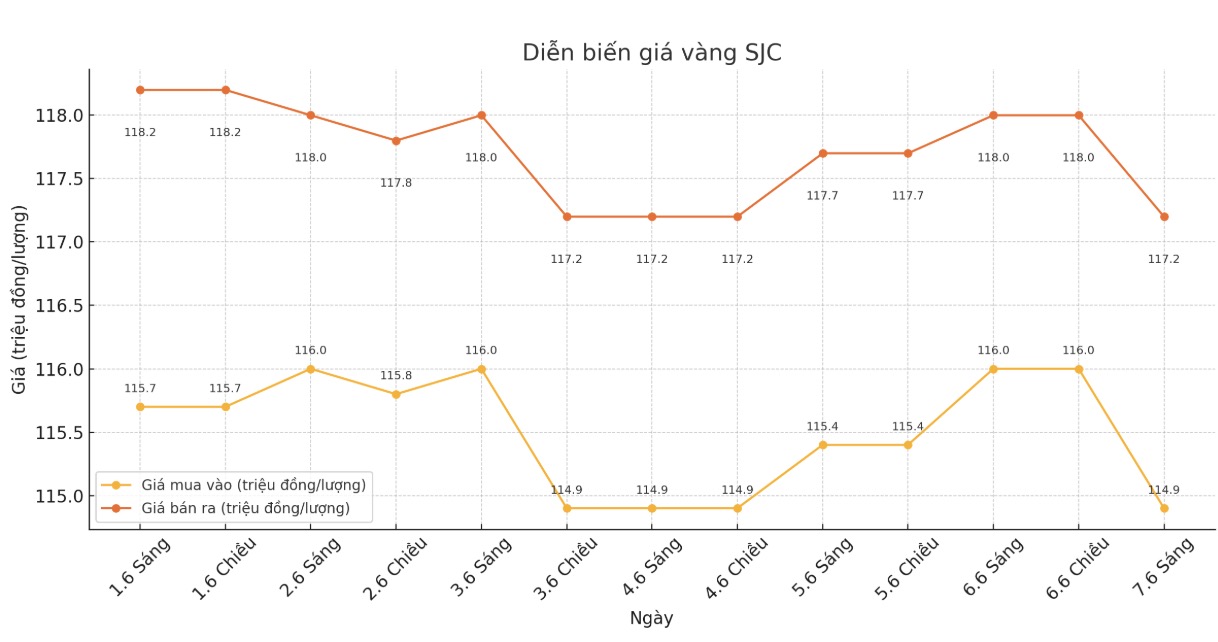

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 114.9-117.2 million/tael (buy - sell), down VND 1.1 million/tael for buying and down VND 800,000/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND 114.9-117.2 million/tael (buy - sell), down VND 500,000/tael in both directions. The difference between buying and selling prices is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 114.9-117.2 million VND/tael (buy - sell), 1.1 million VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 114.5-117.2 million/tael (buy - sell), down VND 500,000/tael for buying and down VND 800,000/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

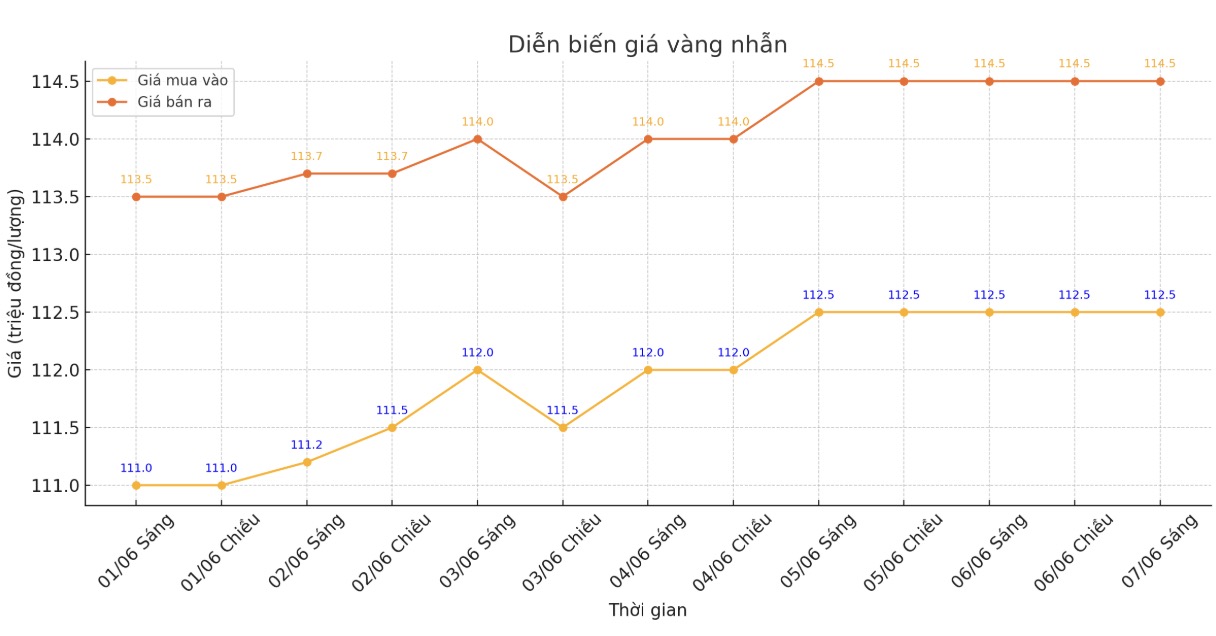

9999 round gold ring price

As of 9:07 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-124.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113-116 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111-114 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

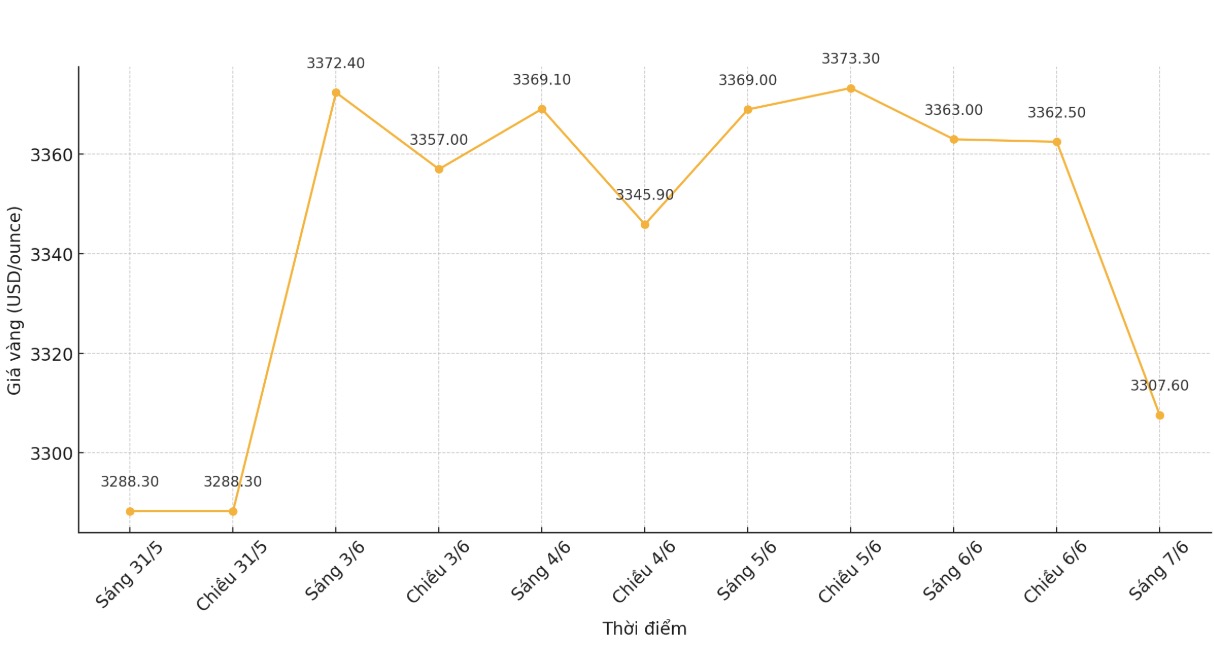

World gold price

At 9:10 a.m., the world gold price listed on Kitco was around 3,307.6 USD/ounce, down 55.4 USD compared to 1 day ago.

Gold price forecast

World gold prices fell after the important US economic report did not have a big surprise and was generally positive. Meanwhile, silver prices rose sharply, reaching their highest level in 13 years.

This month's US economic report includes the May employment report from the Department of Labor, with non-farm payrolls increasing by 139,000. This figure was forecast to increase by 125,000, compared to the adjustment of 147,000 in the April report.

The global unemployment rate remains unchanged at 4.2%. Although the ADP's national jobs report on Wednesday had lower results than expected, many investors were concerned that the US jobs report on Friday would also have negative results, but that was not the case.

In another development, the US and China will resume trade talks after a very positive phone call between President Donald Trump and President Xi Jinping on Thursday. The two leaders are seeking to ease tariff tensions amid rising global economic uncertainty. This information also affects the precious metals market.

Notably, the latest report from the World Gold Council (WGC) shows that for the first time in the past year, gold exchange-traded funds (ETFs) have recorded net inflows as investor sentiment has fluctuated, affecting global financial markets.

Despite recent fluctuations, WGC analysts expect prolonged economic uncertainty, especially related to global trade tensions, to continue to support gold prices, even as stagflation risks (depression combined with inflation) increase.

In its monthly ETF report released on Thursday, the WGC said global gold ETFs have experienced outflows of 19.1 tonnes, equivalent to $1.83 billion. These flows are largely from North American funds as investors react to fluctuating tariff threats.

According to the report, 15.6 tonnes of gold, worth $1.5 billion, have been withdrawn from North American listed funds.

The better-than-expected temporary tax cuts between the US and China have improved investor risk appetite, leading to a strong recovery in stock indexes but reducing safe-haven demand for gold, said analysts.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...