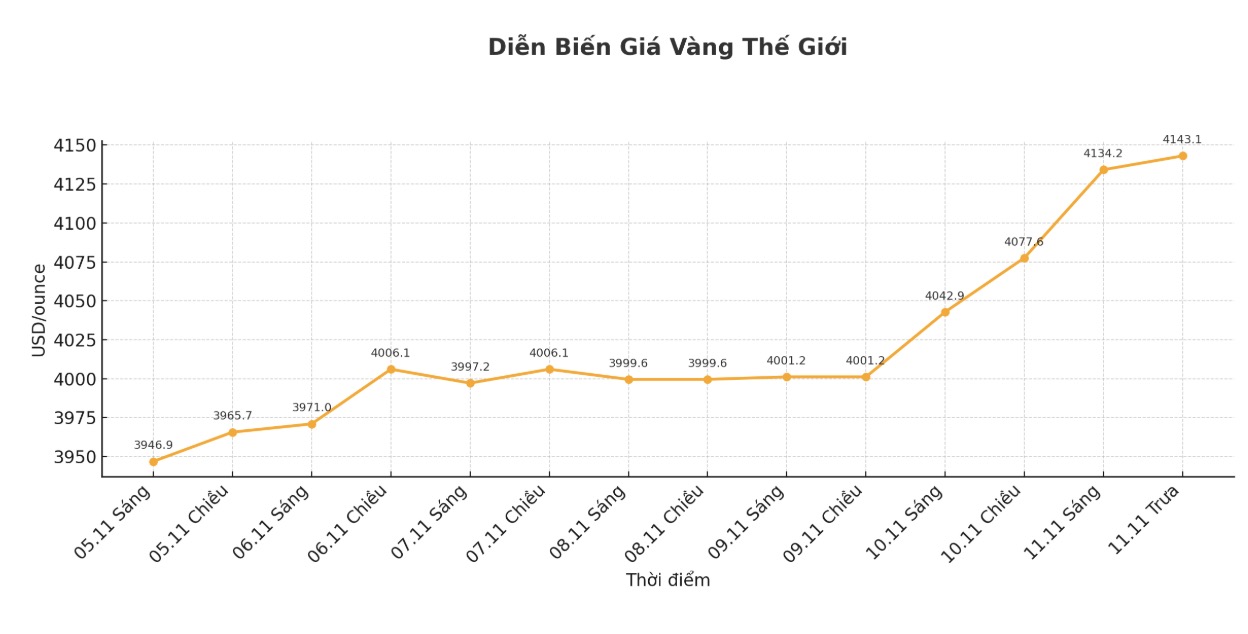

The gold market started the new week with a strong increase, when prices surpassed the 4,100 USD/ounce mark. Despite breaking important resistance levels in the short term, gold still has a long way to go to return to the record level of last month.

According to Tim Hayes - Director of Global Strategy of Ned Davis Research (NDR), the new increase in the context of high gold price fluctuations may signal that the recent short adjustment period has ended. In a report released on Friday, Mr. Hayes said he remains optimistic about gold, saying that the recent price drop is a buying opportunity for investors.

The current macro environment is not much different from before the market adjusted. The recent sell-off can be considered the profit-taking stage. As selling pressure has passed, gold is in a favorable position to continue to increase and move towards new price peaks. We still maintain the buying position that we have maintained for the past two years, he said.

For stock investors, increased volatility often evokes risks. When the VIX index exceeds 28.5, the global stock index typically decreases by an average of 20%. But for gold, increased fluctuations are a positive signal. With the 150-day gold volatility index 15% above the annual average, gold prices tend to increase at a double-digit pace per year. The past two strong increases in gold have occurred in the context of the index continuously increasing" - he said.

In addition, he said that the synthesis of NDR's "Gold Watch" indicators is currently showing a clear increase in price, with the reading exceeding 70%.

The only factor that is putting pressure on the NDR's gold price model is the recovery of the USD. The greenback attracted attention after the Federal Open Market Committee (FOMC) meeting, when Federal Reserve Chairman Jerome Powell said the possibility of a rate hike in December could not be ruled out.

However, despite this statement, the market still forecasts a 60% chance that the FED will cut interest rates next month. It is unlikely that the US dollar will continue to rise, given the bearish signals of the long-term synthesis model that has been maintained since March, the unfavorable interest rate differential trend for the US dollar, and the current level of excessive optimism, Hayes said.

He also noted that positive technical signals that emerged after the two-week sell-off helped cool the market and eliminate much of speculation. Short-term indicators show that investor sentiment has shifted from being too optimistic to being too pessimistic.

As the long-term model remains upward, we are waiting for the signal from the short-term model to reverse from down to upward, agreeing with the long-term model and confirming that golds rally has returned, he added.

As for the downside risk, Hayes said he is still closely monitoring real yields, as above 3.5% would be a worrying sign for gold prices.

See more news related to gold prices HERE...