Francisco Blanch - head of global commodity and derivatives research at Bank of America Securities said that the current adjustment of gold prices is the result of reducing geopolitical instability in the short term. However, this expert believes that gold and silver will continue to record an increase in the second half of 2025.

We have forecast gold prices to reach $3,500/ounce in the first half of this year. We have achieved that goal, and we now think the market is going through an adjustment that could last for several months.

However, we are still optimistic in the long term. We think that in the long term, it could be in the second half of 2025 or by 2026, gold prices will surpass $4,000/ounce, but we are currently going through a correction because some of the extreme uncertainty we have seen in recent months seems to be easing.

We have been very close to $3,500/ounce a few times, but to get past that level and continue to increase, we need the return of some geopolitical uncertainty and policy uncertainty. We predict this will happen by the end of this year, in 2026, but now we believe that a continuous increase in gold prices from now on is not feasible, Blanch said in an interview with CNBC.

When asked about the BoA's view on silver prices, which are falling behind gold prices due to weak industrial demand, Blanch said: "We are looking at $40/ounce."

We think silver is one of the better investments, because remember that silver is both a precious metal and an industrial metal. The precious metal part of silver has helped its price increase, while the industrial part has not affected much, but this will eventually change.

Of course, tariffs mean weaker trade conditions, and we have had a fairly strong window between the fourth quarter of last year and the first quarter of this year, when investors bought in the hope of tariffs. Now we have tariffs, so we will enter a two-quarters slowdown period, and we will eventually see a re-upturn in industrial activity," the expert said.

According to Blanch, weak industrial activity is one of the reasons why silver prices do not increase as strongly as gold prices.

Siliver is related to solar panels, and we still expect a huge investment in solar panels and the electrification of everything, and we think silver will play an important role.

Remembering that silver is the best electrical conductor material in the world, so it will play a very important role, and we think that in the future, when the industrial environment returns to stability, silver will shine again" - Blanch said.

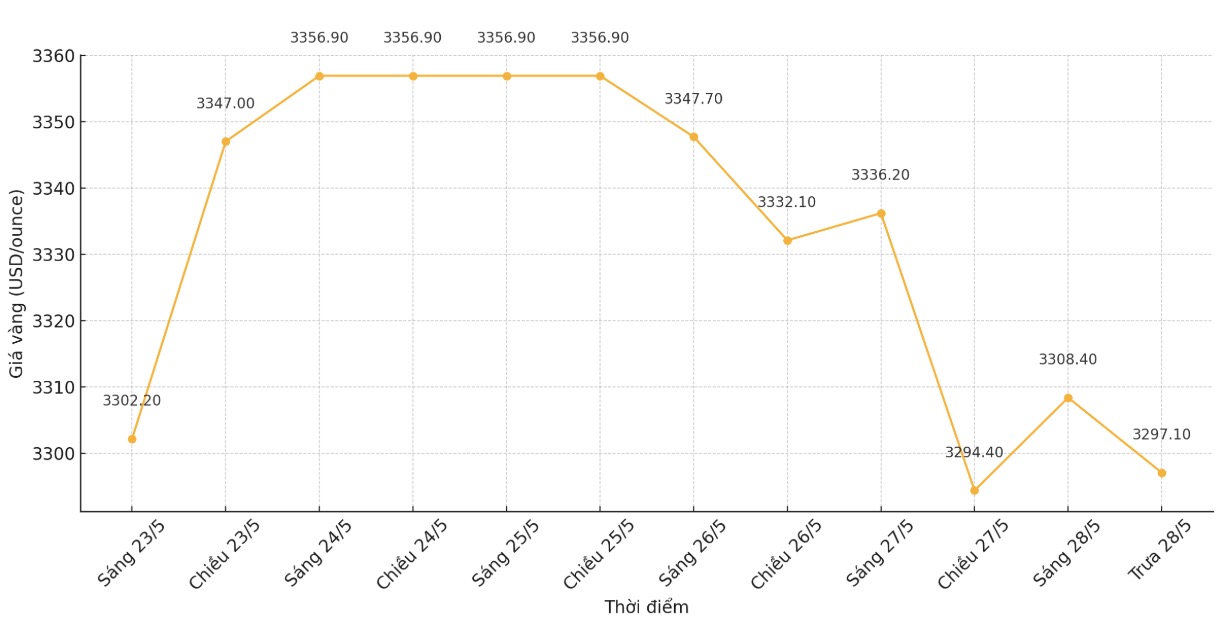

Gold prices are still struggling as they have repeatedly lost $3,300/ounce. Silver prices also fell on Tuesday, but the metal is showing fluctuations in both up and down directions. The price of silver for the last handover was traded at 33.068 USD/ounce, down 1.27% in the trading session.