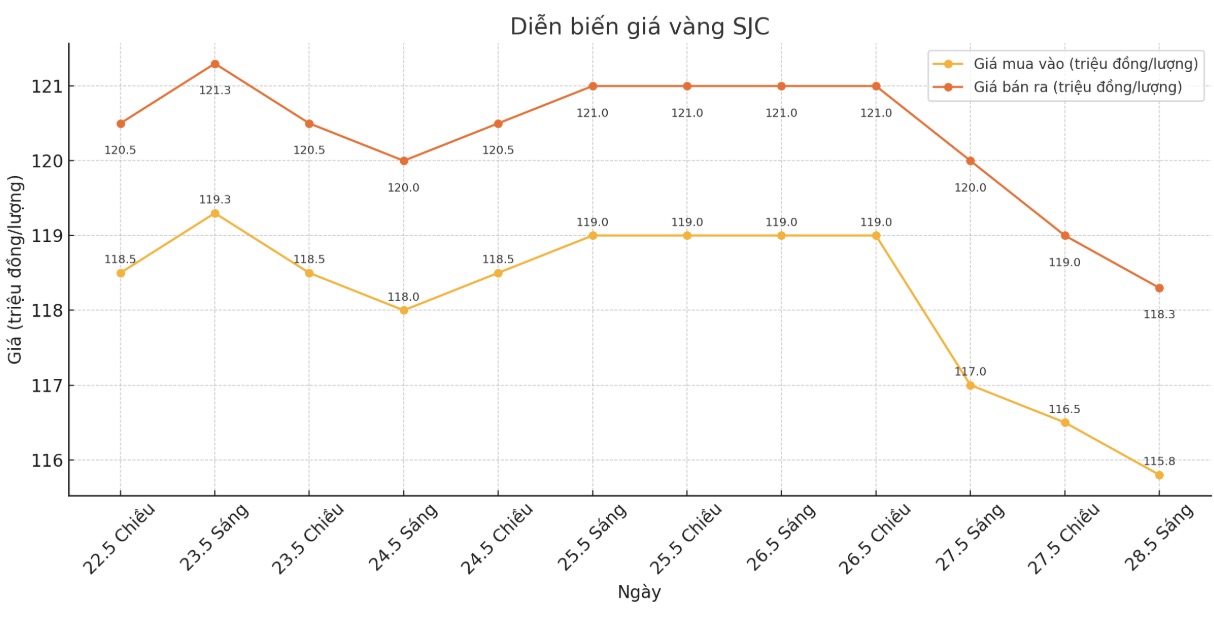

Updated SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.8-118.3 million/tael (buy in - sell out), down VND700,000/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.8-118.3 million VND/tael (buy - sell), down 700,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.8-118.3 million VND/tael (buy - sell), down 700,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 115.3-118.3 million/tael (buy - sell), down VND 700,000/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

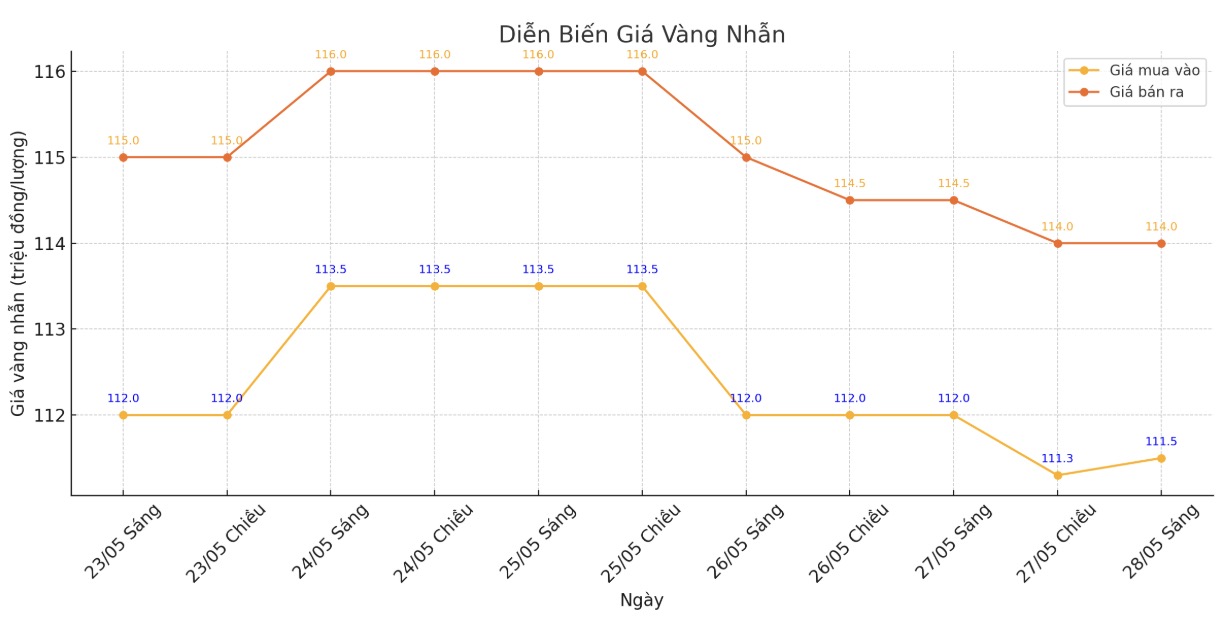

9999 round gold ring price

As of 9:30 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND111.55-114 million/tael (buy in - sell out), down VND500,000/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.5-116.5 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.5-114.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

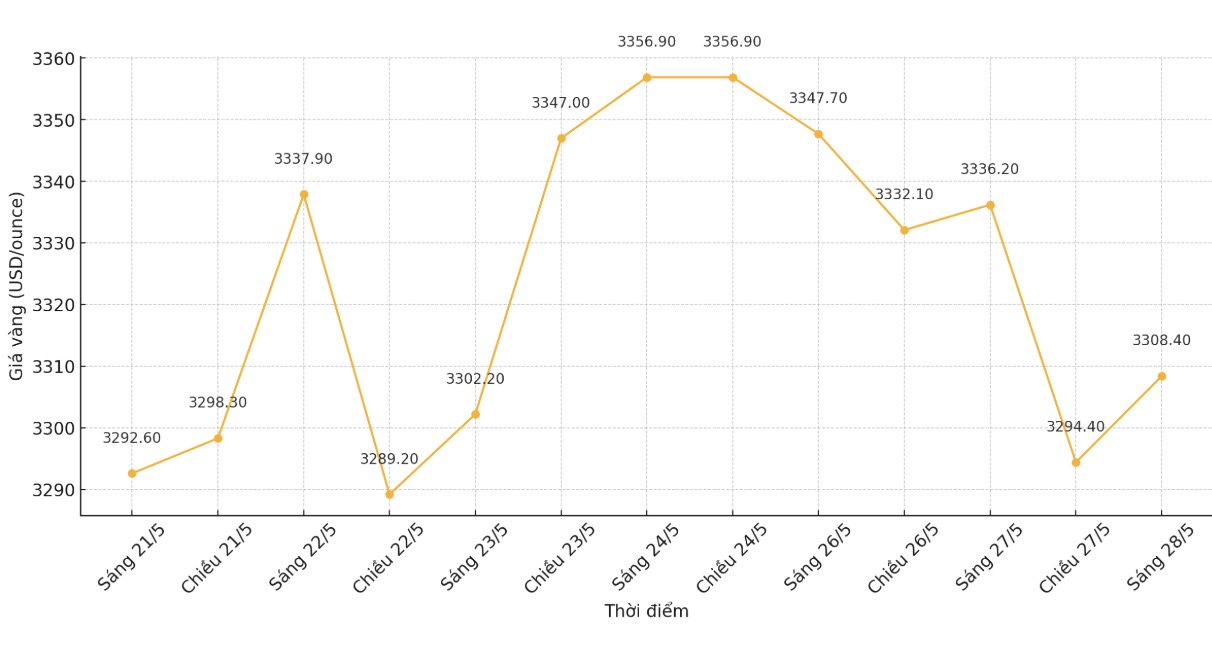

World gold price

At 9:30 a.m., the world gold price was listed on Kitco around 3,308.4 USD/ounce. Although it decreased by 27.8 USD/ounce compared to a day before, the gold price early this morning increased quite high compared to yesterday afternoon's trading session (May 27).

Gold price forecast

According to Kitco, gold prices fell due to profit-taking pressure and weak liquidity in the futures market, as investor and trader sentiment became more optimistic in a shortened trading week due to US holidays.

The precious metals market is affected by information showing that trade tensions show signs of cooling down. Investor sentiment has improved significantly after the news that Mr. Donald Trump decided to postpone the deadline for imposing a 50% tax on goods from the European Union to July 9, instead of the original plan for June 1. This move is expected to create more space for negotiations, thereby reducing demand for safe-haven assets such as gold.

In addition to profit-taking pressure, gold prices fell due to a series of positive US economic data, reducing safe-haven demand.

The US Commerce Department said that sustainable commodity orders in April fell 6.3% less than the 7.6% decline forecast by analysts. If the transport sector is excluded, this index will increase by 0.2%, contrary to the expectation of a decrease. However, orders for non-defense capital equipment excluding aircraft decreased by 1.3%.

At the same time, the US consumer confidence index skyrocketed to 98 points in May, far exceeding the forecast of 87 points. Both current assessments and expectations for income, business and employment have improved significantly.

Immediately after these data were released, spot gold prices fell 1.35% in the session.

Expert Stephanie Guichard commented: "Consulent confidence has increased after 5 months of decline, mainly thanks to a more positive outlook for the economy and income in the future".

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...