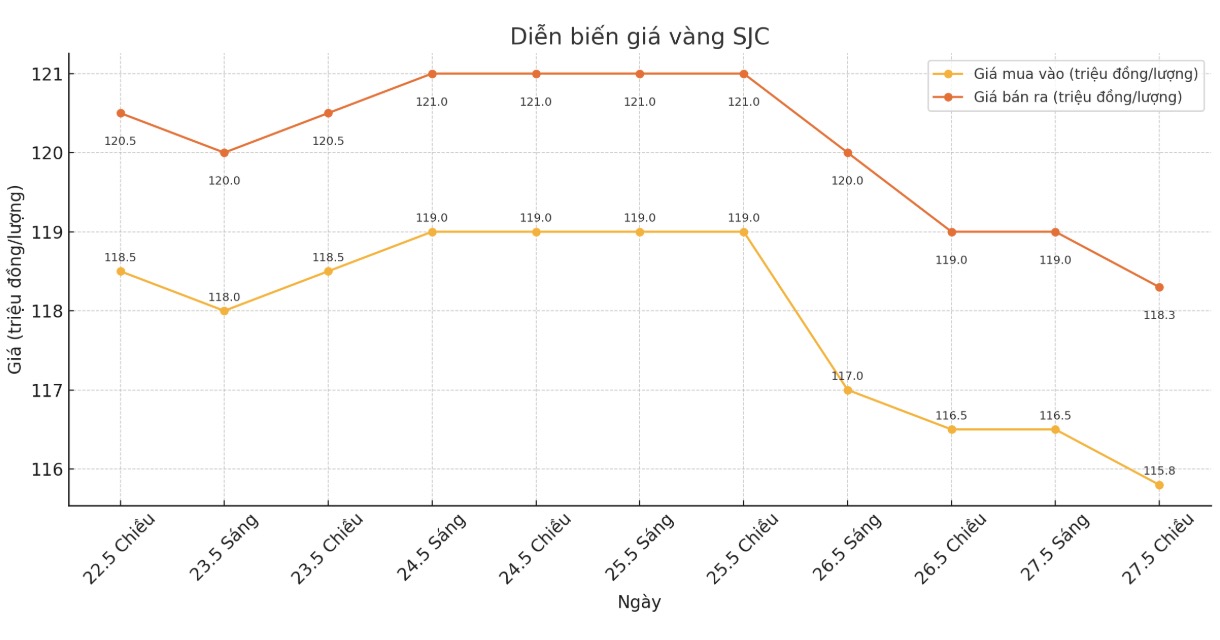

Updated SJC gold price

As of 6:00 a.m. on May 28, the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.8-118.3 million/tael (buy in - sell out), down VND700,000/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.8-118.3 million VND/tael (buy - sell), down 700,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.8-118.3 million VND/tael (buy - sell), down 700,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 115.3-118.3 million/tael (buy in - sell out), down VND 700,000/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

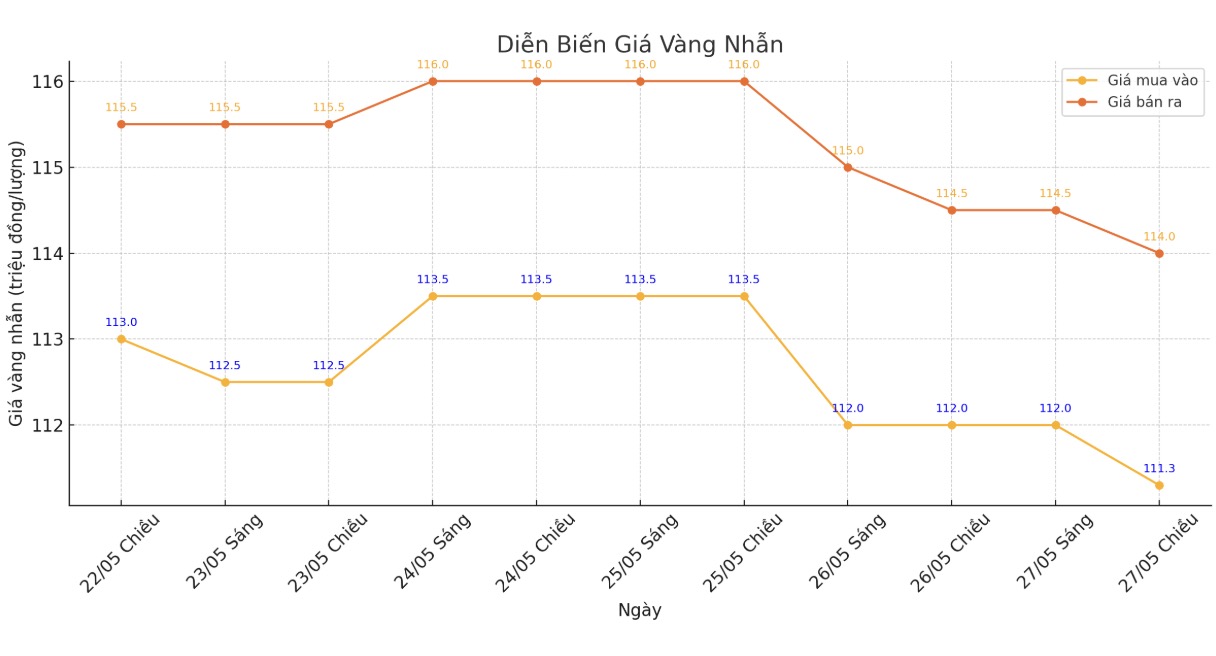

9999 round gold ring price

As of 6:00 a.m. on May 28, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.3-114 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.8-116.8 million VND/tael (buy - sell), down 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.5-114.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

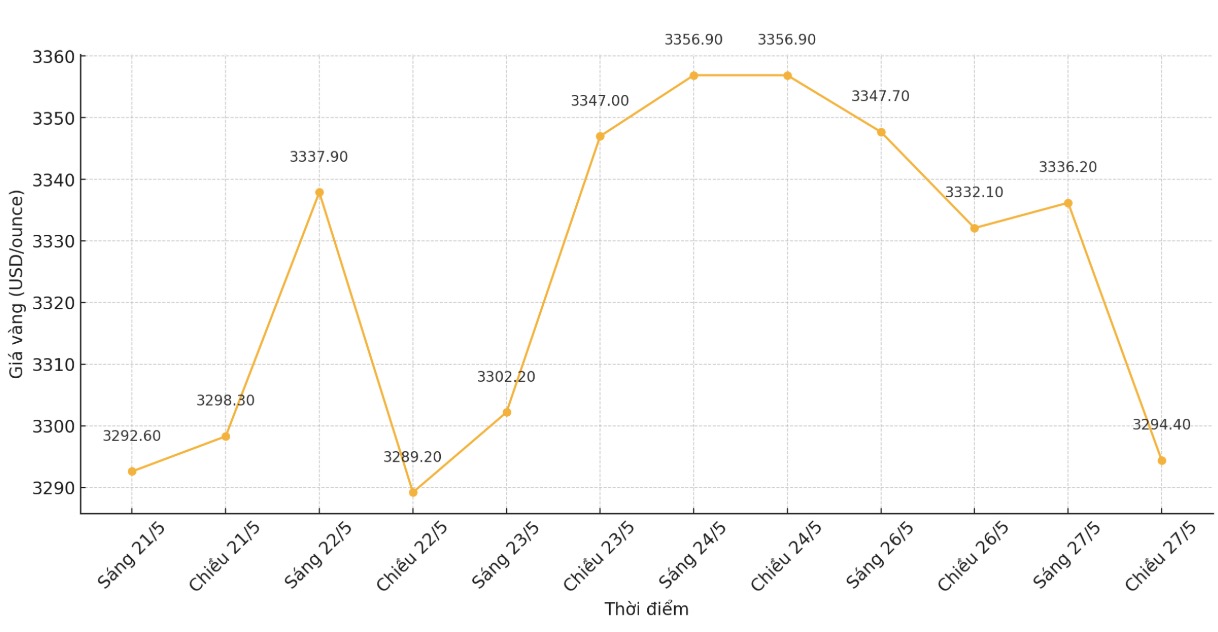

World gold price

At 9:20 p.m. on May 27, the world gold price listed on Kitco was around 3,298.6 USD/ounce, down 46.5 USD.

Gold price forecast

According to Kitco, gold prices fell sharply due to profit-taking pressure and weak liquidity in the futures market, as investor and trader sentiment became more optimistic in the shortened trading week due to the US holiday.

Silver prices also fell significantly. Gold futures for June fell $77.2 to $3,288.6 an ounce. July silver futures fell by $0.629, to $22.98/ounce.

Traders and investors became much more positive on Tuesday after last weekend's news that Donald Trump would postpone the imposition of a 50% tariff on the European Union until July 9. Previously, Mr. Donald Trump announced that the new tax would start from June 1. This delay creates more time for the two sides to negotiate.

The Asian and European stock markets traded in opposite directions but tended to increase slightly in the last session. US stock indexes are expected to open up strongly in New York today, after a three-day holiday.

Technically, June gold futures buyers are dominating the short term. The next upside price target for buyers is to close above strong resistance at $3,400/ounce. The short-term downside target for the sellers is to push the contract price below $3,123.3/ounce.

The first resistance level was recorded at 3,300 USD/ounce, then the previous week's high of 3,366.5 USD/ounce. The first support level was at 3,250 USD/ounce and then 3,225 USD/ounce.

Key markets today showed the USD index rising. Nymex crude oil futures are almost stable, trading around $61.50/barrel. The yield on the 10-year US government bond is currently at 4.456%.

Notable economic data this week

Wednesday: FOMC meeting minutes for May.

Thursday:Weekly jobless claims, preliminary Q1/2025 GDP, US pending home sales.

Friday: US PCE core inflation index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...