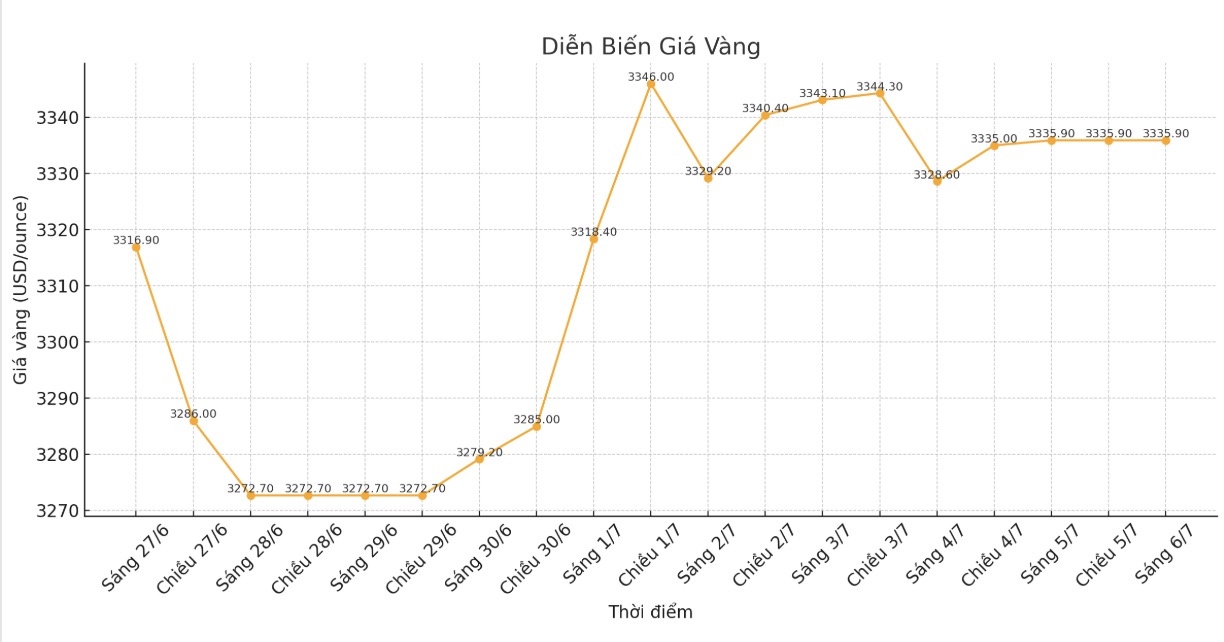

Gold price developments last week

A series of positive economic data last week were not strong enough to reduce gold prices, as geopolitical risks and concerns about sovereign debt combined, pushing the price of this precious metal up despite the risk-off sentiment returning.

Spot gold started the week at $3,271/ounce, then fell sharply to a weekly low, below $3,250/ounce, and then began to recover steadily.

At 2:30 a.m. EDT. on Monday, spot gold was only about 5:00 a.m. from $3,300 an ounce, and by 3:00 p.m. the same day, the price had surpassed that threshold. By 8:30 a.m. on Tuesday, the price had climbed to $3,356/ounce.

This price has caused strong selling, pushing gold to fluctuate in the next two days from 3,330 to 3,355 USD/ounce, before a strong increase on Wednesday afternoon, reaching the weekly peak of 3,365 USD/ounce.

Gold then tested the short-term support zone around $3,345/ounce, then continued to increase in the Asian session, but failed. Ahead of the release of the non-farm payrolls report, gold fell the most of the week, from $3,350/ounce at 8:15 a.m. to $3,312/ounce in just 15 minutes.

Immediately after that, prices rebounded, to $3,337/ounce when the US stock market opened, then traded within a narrow range of 10:00/ounce before the extended US National Day holiday on July 4.

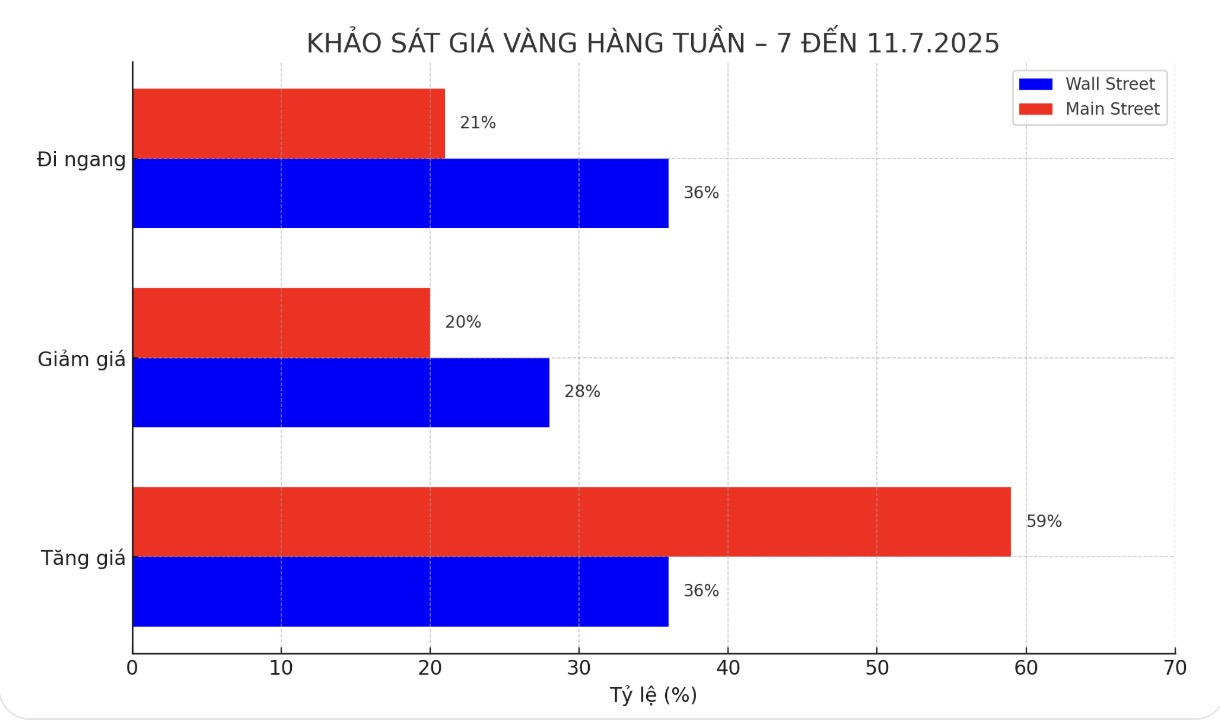

Gold price forecast for next week

This week, 14 Wall Street experts participated in the survey. After a fairly stable trading week, Wall Street maintained a relatively neutral view. There are 5 experts (36%) predicting gold prices to increase next week, 4 people (28%) predict prices will decrease, while the remaining 5 people (36%) predict gold will go sideways.

Meanwhile, 243 people participated in the online survey. Private investors increased their support for the upward trend that had dominated slightly last week. 143 investors (59%) expect gold prices to rise next week, 49 (20%) expect prices to fall, and the remaining 51 (21%) expect prices to continue moving sideways to accumulate.

Notable US economic data next week

After a week of dominating the employment index, the market will have a bit of "rest" in economic data when entering the new week.

The Reserve Bank of Australia will announce its monetary policy decision on Tuesday. On Wednesday, the market will analyze the minutes of the US Federal Reserve's June FOMC meeting. Data on the number of weekly jobless claims will be released on Thursday morning.

See more news related to gold prices HERE...