Mr. Jeetendra Khadan - Senior Economist and Ms. Kaltrina Temaj, Analyst of the World Bank's Prospects Group, commented: "The price of precious metals has skyrocketed to a record high in the first half of 2025, after an increase of 20% in 2024.

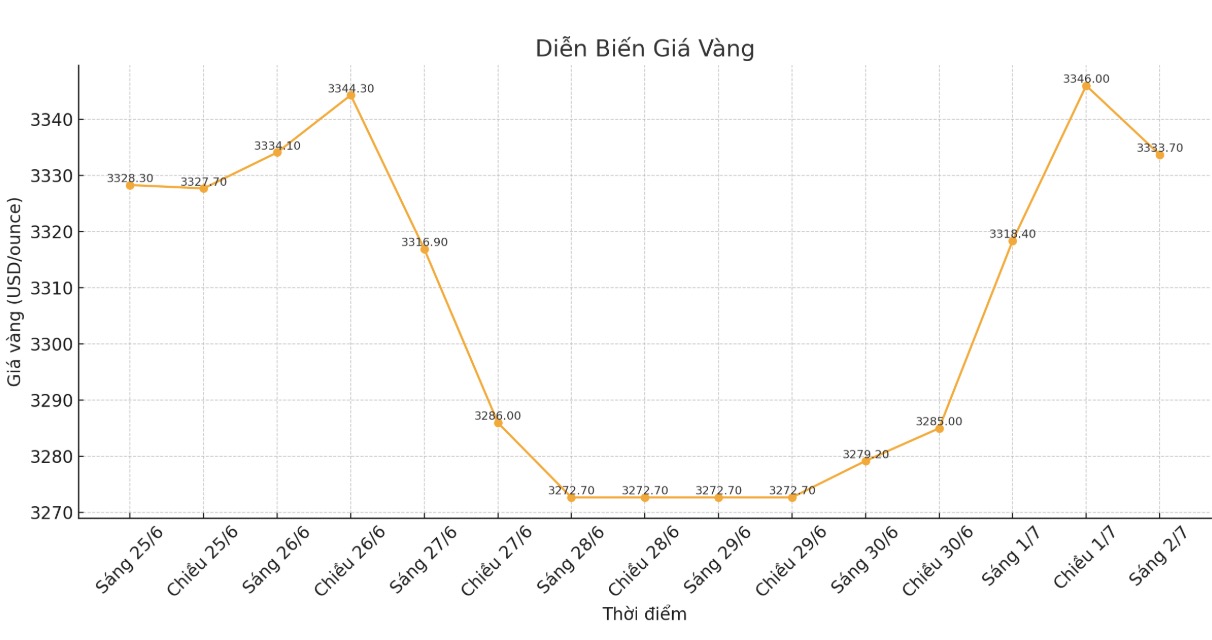

The price increase was led by gold, as gold prices approached a historical peak in mid-June amid escalating geopolitical tensions and increased economic instability. Silver and platinum also recorded strong increases, with prices expected to remain high throughout 2025 and 2026".

Experts added that in the first six months of 2025, gold prices have increased by nearly 25%. Recent price increases have been driven largely by strong demand amid prolonged policy uncertainty and rising geopolitical tensions. The amount of capital poured into gold ETFs has recovered strongly in the first quarter of 2025, pushing investment demand to the highest level since 2022. Gold purchases by central banks continue to support prices, reflecting the foreign exchange reserve management strategy.

Notably, this large demand is expected to continue in the short term, thanks to global instability and high geopolitical risks. Gold prices are expected to increase by about 35% in 2025 (compared to the same period last year), before cooling down slightly in 2026 when part of the instability gradually eases.

However, gold prices are still expected to remain at a very high level compared to before, estimated at about 150% higher than the average in the period from 2015 to 2019, and lasting in both 2025 and 2026. World Bank experts said the risk of further price increases is still high, as geopolitical tensions will continue to be a major factor of instability.

Silver also maintained a strong momentum from 2024, up nearly 20% in the first half of 2025. Although silver prices have increased sharply, the gold- silver price ratio continues to surpass the 10-year average in early 2025, maintaining a steady upward trend. This partly reflects a greater demand for gold as a safe haven asset amid uncertainty and escalating tensions, they said.

Looking ahead, the World Bank forecasts that silver demand will continue to be stable, thanks to its dual role as both industrial raw materials and safe-haven assets.

Analysts say increased economic and geopolitical instability could further strengthen silver's appeal to investors. In terms of supply, global output is expected to increase steadily in 2025 thanks to expanded mining output.

Recycling, which accounts for about 20% of global supply, is expected to remain unchanged after a 6% increase in 2024. Overall, solid demand is expected to increase silver prices by 17% in 2025, and increase by another 3% in 2026.

platinum is the latest precious metal to participate in the rally, with a gain of nearly 30% in the first half of 2025, reaching a peak of more than a decade.

This price increase is mainly due to tight supply, as mining output is expected to fall to a 5-year low this year. The modest increase from recycling only partially offsets the shortage, while inventory on the ground is expected to decrease sharply, they wrote.

However, platinum demand is expected to decline significantly from both the automotive and industrial sectors, two of which account for nearly 2/3 of global platinum demand.

Although overall demand is weak, supply constraints are expected to remain high, with prices increasing by 10% in 2025 and an additional 2% in 2026, analysts said.

Looking ahead, the World Bank believes gold prices are on track to set a historical high annual average. Silver prices are expected to continue to increase thanks to persistent demand, while limited supply conditions will support platinum prices.

However, if global tensions escalate further, gold prices could well exceed current forecasts, while weaker industrial activity could curb demand and push silver and platinum prices below forecasts, the analysts concluded.