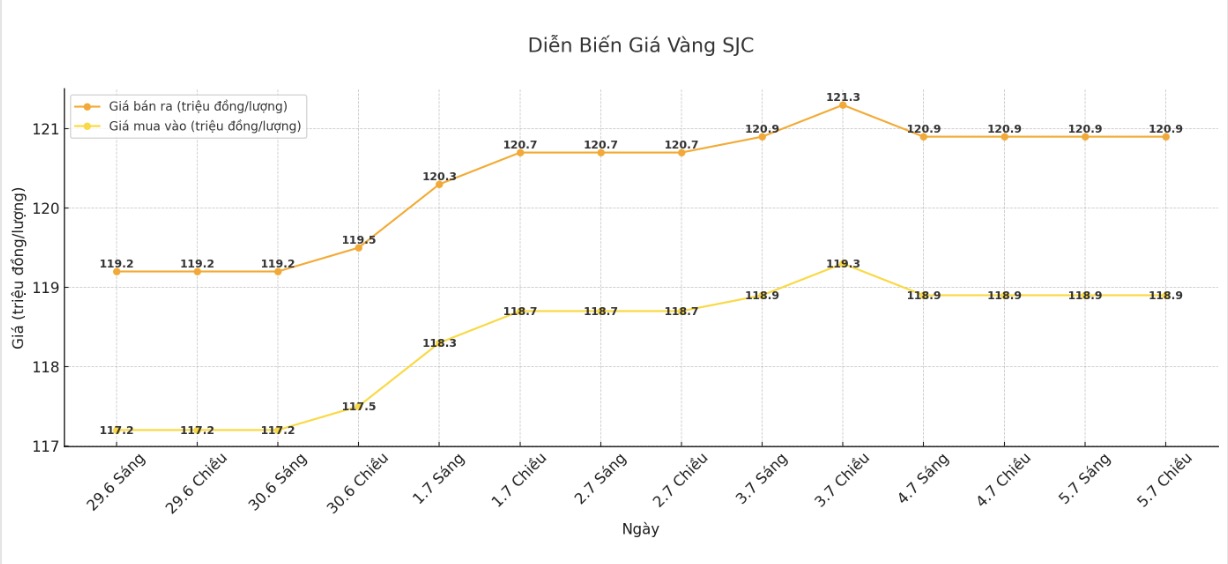

SJC gold bar price

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.9-120.9 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.9-120.9 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.9-120.9 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 118.2-120.9 million/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2.7 million VND/tael.

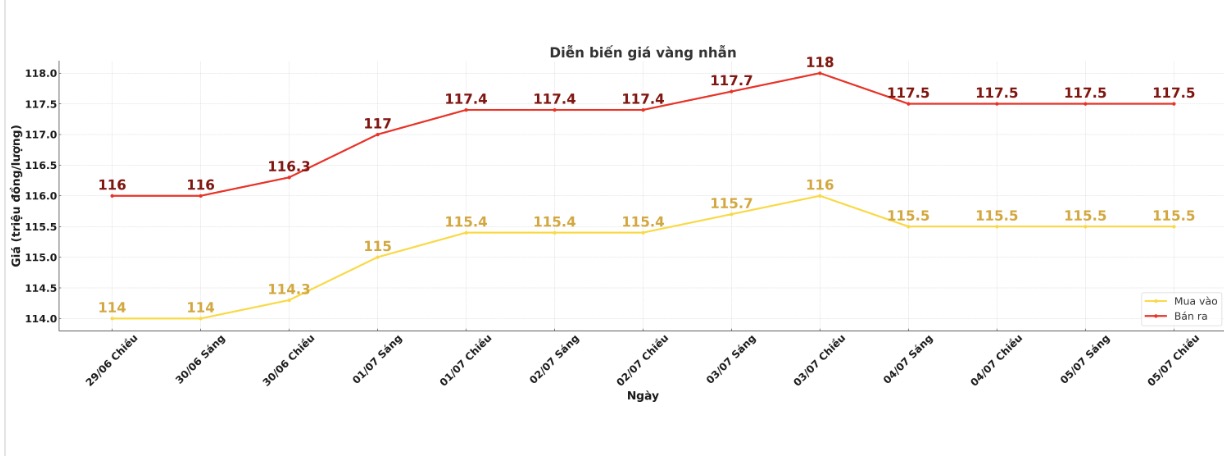

9999 gold ring price

As of 7:20 p.m., DOJI Group listed the price of gold rings at 115.5-117.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.3-117.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

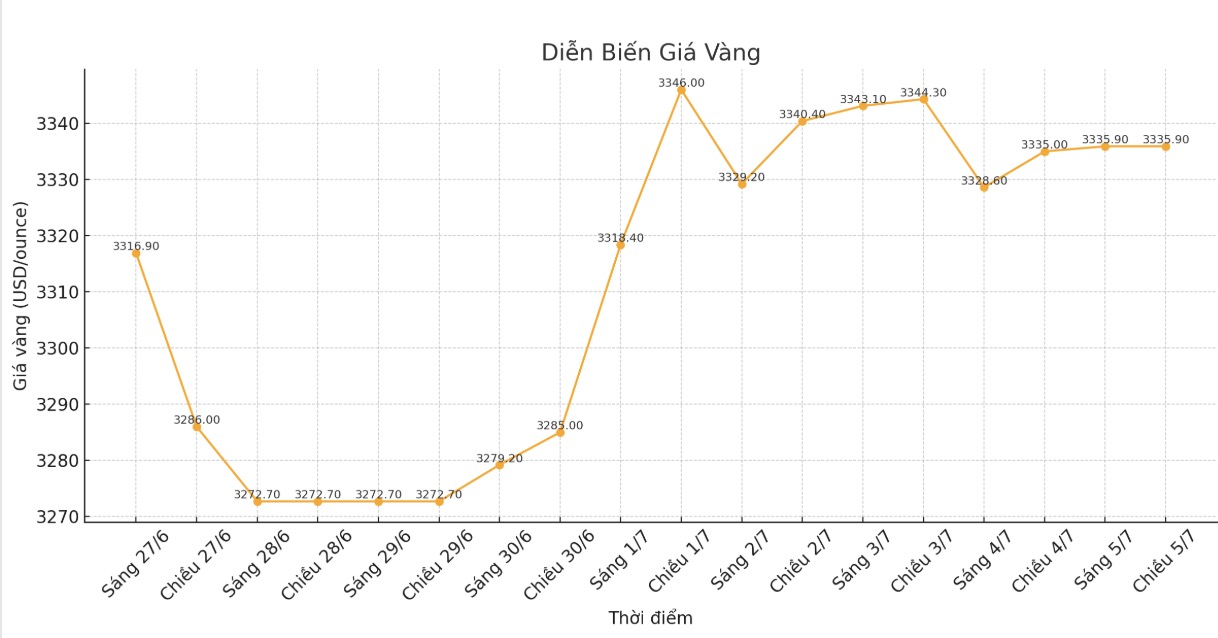

World gold price

The world gold price listed at 7:20 p.m. was at 3,335.9 USD/ounce, without much change.

Gold price forecast

Wall Street experts are still concerned about gold's short-term outlook, while retail traders are consolidating their upward trend.

More advanced, said Adam Button, director of currency strategy at Forexlive.com. The US dollar initially rose thanks to non-farm payrolls data, then quickly reversed. That highlights the relentless dollar selling trend that dominated the first half of the year. As that trend continues and continues, gold will benefit, Adam Button stressed.

Reduced, Adrian Day - chairman of Adrian Day Asset Management said. It is likely that a convergence of negative factors, including a number of tariff agreements and increased speculation about the US Federal Reserve (FED) cutting interest rates in July will take place at the same time, in the context of slowing down in central bank buying and gold hoarding in China. Any withdrawal is likely to be short-term, Adrian Day said.

Meanwhile, Rich Checkan - chairman and CEO of Asset Strategies International believes that gold prices may increase in the short term: "The world is waking up to the problems of over spending and debt, and the main solution is gold" - he added.

Economic data to watch next week

Tuesday: Reserve Bank of Australia monetary policy meeting.

Wednesday: Minutes of the Fed's June FOMC meeting.

Thursday: US weekly jobless claims.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...