Gold challenges important threshold

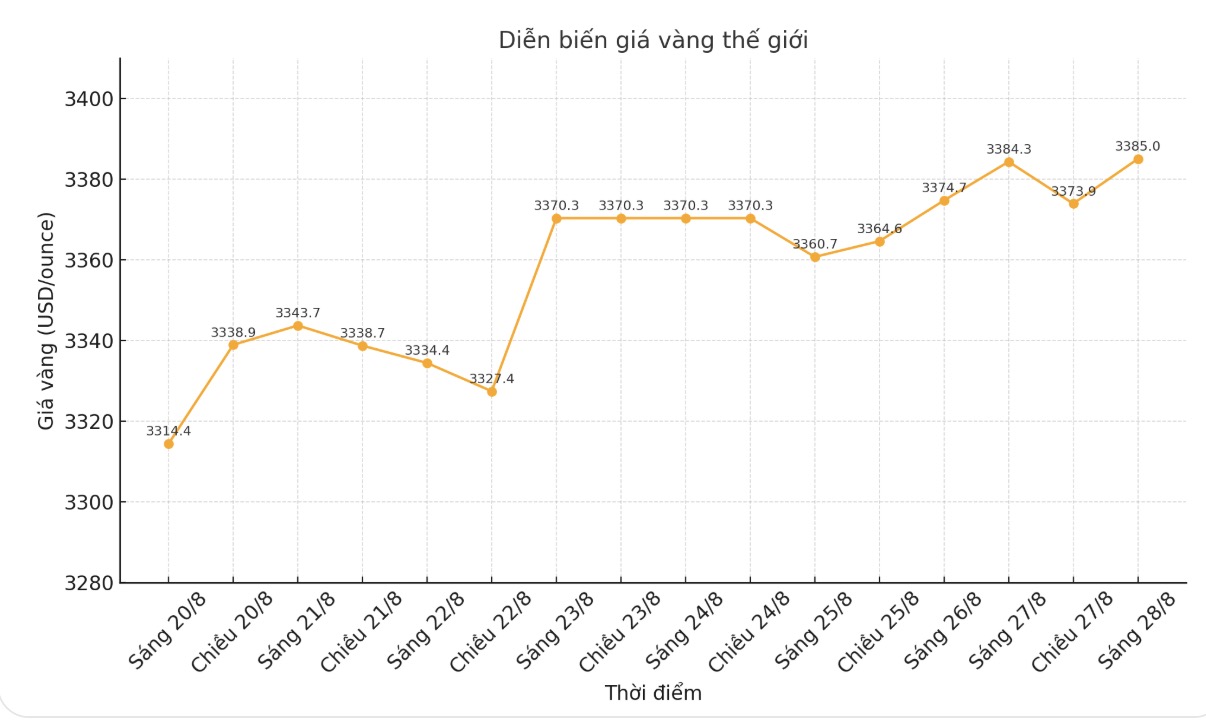

Gold prices are approaching a key resistance level below $3,400/ounce. According to Schroders (a global asset management corporation headquartered in London - UK), this increase could continue due to inflationary pressures and pessimism towards the USD.

We continue to view gold positively, seeing it as a tool for diversification in the context of volatile policies, fragile budgets and declining confidence in US government bonds as well as the US dollar, Schroders experts said. Golds portfolio insurance role remains intact.

Schroders also noted that the global stock market is underrated for risks, especially in terms of growth and inflation. This makes the investment environment susceptible to "shock" in the coming months.

Investing in gold still has room to increase

Mr. Jim Luke - Gold fund manager at Schroders - emphasized that gold's holding around 3,300 USD/ounce in the second quarter was quite impressive, despite much pressure from tight immigration policies and disappointing US employment data.

The big question now is how much bad news has been reflected in prices, as gold has gained nearly 30% since the start of the year, he said. Although investment demand in the first half of the year increased the most since 2020, Schroders believes that there is still room for the second half of the year.

We expect investment demand to increase significantly compared to previous cycles, Luke said, adding that demand from North America and Europe will gradually catch up with record levels in Asia.

The East-West gap is still very clear: Gold ETFs in the US and Europe are quite quiet, while most of the cash flow this year is from China, especially in April.

We have not seen a real global wave of gold buying something we believe will happen, Luke stressed.

See more news related to gold prices HERE...