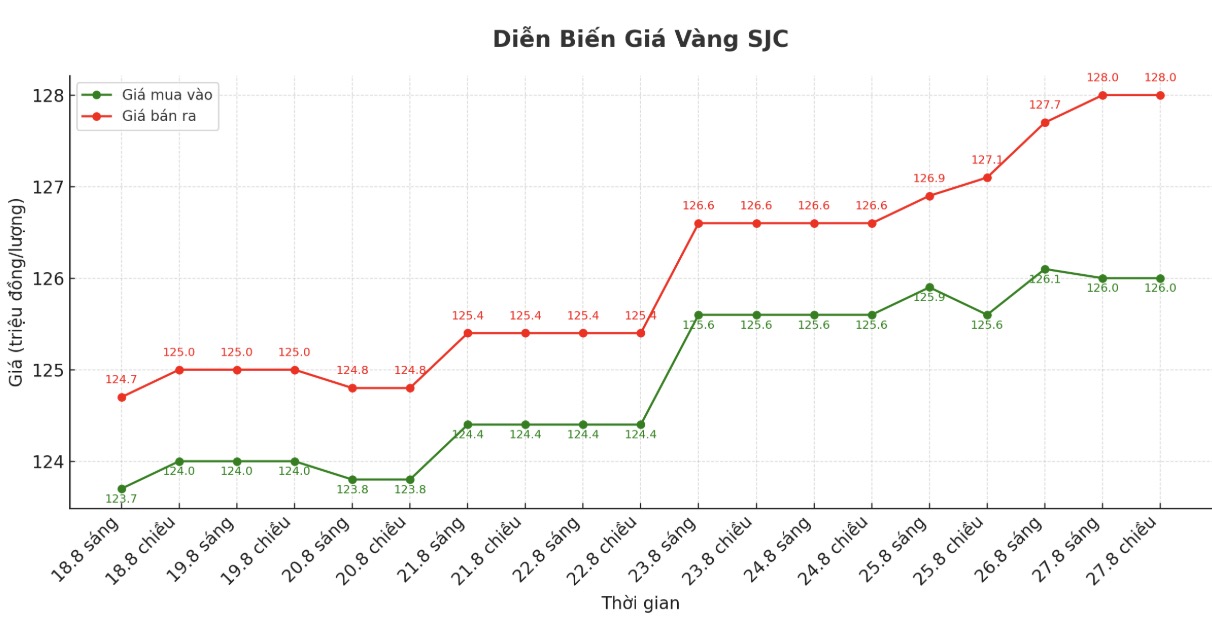

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 126-128 million VND/tael (buy - sell), down 100,000 VND/tael for buying and up 300,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 125.8-128 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 900,000 VND/tael for selling. The difference between buying and selling prices is at 2.2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 125.4-128 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 119.8-122.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 120-123 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 119.5-122.5 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

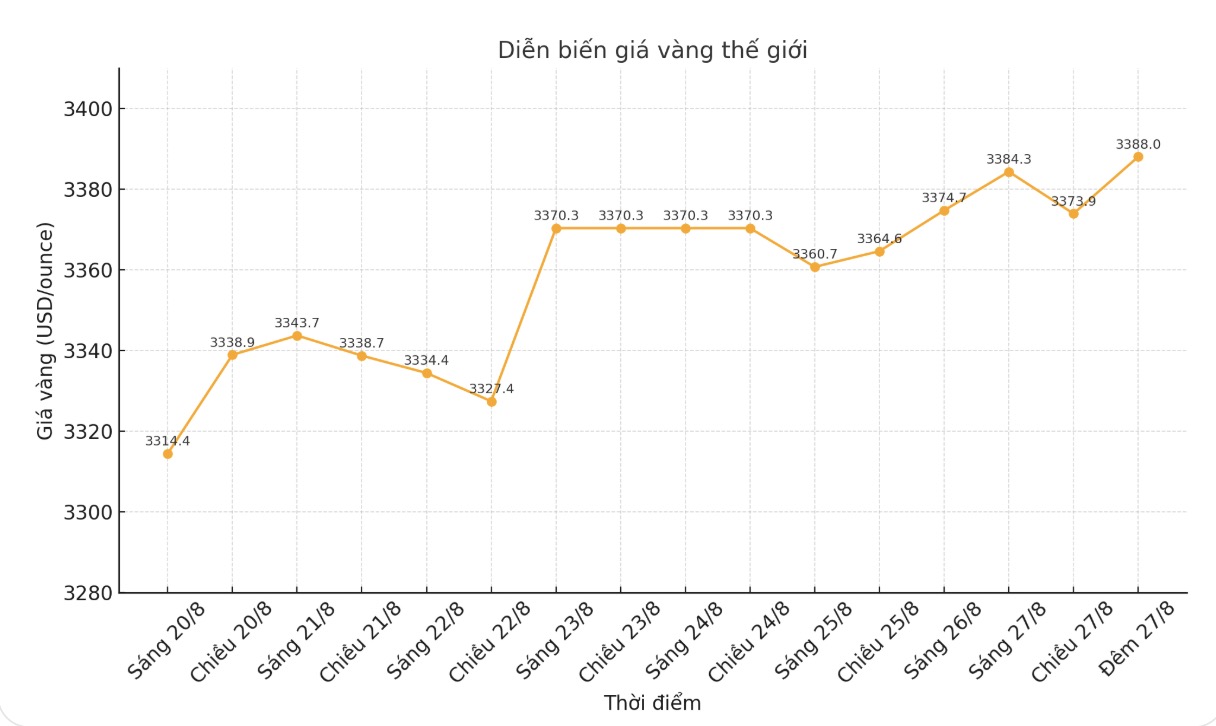

World gold price

The world gold price was listed at 22:20 on August 27 at 3,388 USD/ounce, down slightly by 2.1 USD.

Gold price forecast

World gold prices decreased slightly partly due to the increase in the USD index and profit-taking activities from short-term futures traders. December gold futures fell $9 to $3,424 an ounce.

The global stock market last night had mixed developments to weaken. US stock indexes are expected to open slightly when entering the New York session.

Veterans note that history shows that September and October are often a period of strong fluctuations in financial markets.

This week, there is an early warning signal from Hong Kong (China): financial liquidity here continues to tighten, with Hong Kong Interbank ( Hibor)'s one-month interest rate exceeding 3% - the highest level since May.

The US has imposed a 50% tariff on imports from India to punish the country's purchases of Russian oil, "destroying Washington's decades-long efforts to promote closer relations with New Delhi" - Bloomberg said. The new tax affects more than 55% of Indian exports to the US, especially causing damage to labor-intensive industries such as textiles and jewelry; while key products such as electronics and pharmaceuticals are exempt. The move threatens India's competitiveness and questions Prime Minister Narendra Modi's ambition to turn the country into a global manufacturing hub.

Meanwhile, the European Union (EU) will urgently pass a law this weekend to lift all tariffs on US industrial goods - as requested by President Donald Trump before the US cuts EU car import tariffs.

The European Commission will also apply preferential tax rates to some seafood and agricultural products. The EU acknowledges that the deal is beneficial to the US, but necessary to bring stability to European businesses. Chairwoman of the Ursula von der Leyen Committee called it a strong, if not perfect, deal.

In the commodity market, the USD index increased sharply, while crude oil prices decreased slightly, trading around 63 USD/barrel. US economic data released today includes a weekly MBA mortgage survey and a DOE energy reserve report.

Technically, December gold futures still hold a short-term advantage. The next upside target for buyers is to close above the resistance level of $3,500/ounce. On the contrary, the sellers want to push the price below the support level of 3,319-20 USD/ounce (July).

The first resistance was recorded at an overnight high of $3,444.3/ounce and then $3,450/ounce. First support was at $3,400/ounce, followed by $3,396.1/ounce (the lowest level this week).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...