Gold prices fell in the trading session on Wednesday, pressured by the rising USD, but new concerns about the independence of the US Federal Reserve (FED) after US President Donald Trump threatened to fire Governor Lisa Cook have somewhat supported the precious metal.

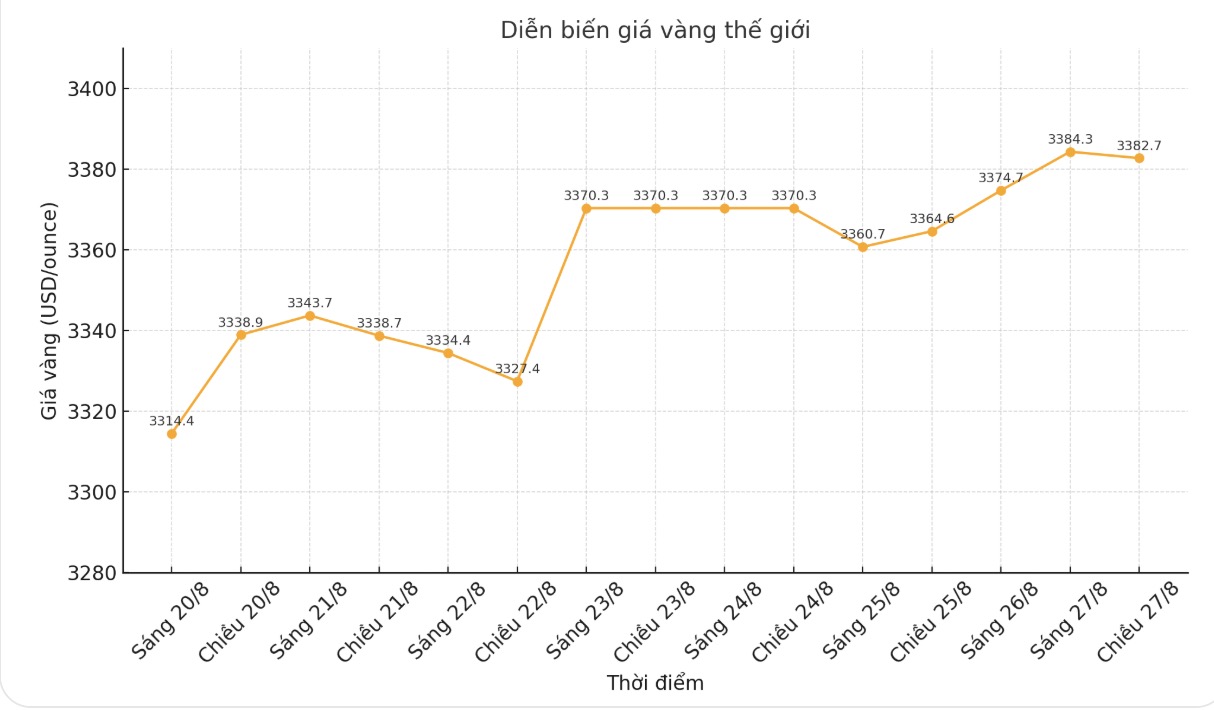

At 07:01 GMT, spot gold fell 0.5% to $3,376.99 an ounce, after hitting its highest level since August 11 in the previous session. US December gold futures fell 0.2% to $3,427.

USD Index increased by about 0.3% against major currencies, making gold less attractive to investors holding other currencies.

Mr. Kelvin Wong - Senior Analyst at OANDA commented: " short-term speculators are taking profits. However, gold is still receiving support, especially when the FED is clearly showing its policy easing stance. In the short term, gold could still face upward pressure to test the $3,400 threshold, if it breaks through, it will head towards $3,435/ounce.

President Donald Trump has announced that he will remove Ms. Cook from her position on charges related to mortgages, a move that could test the limits of presidential power over central banks. Ms. Cook replied that Mr. Donald Trump has no authority to fire her and she will not resign.

In that context, Mr. Donald Trump continued to pressure the Fed to lower interest rates and repeatedly criticized FED Chairman Jerome Powell for being too slow.

The market's attention is now on the personal consumption expenditure (PCE) price index - the FED's preferred inflation measure, due on Friday, to give more signals about the interest rate path after Mr. Powell's "pigeon" speech at the Jackson Hole conference last week.

According to the CME FedWatch tool, the market is betting on an 87% chance that the Fed will cut by 0.25 percentage points at the policy meeting on September 17. In a low interest rate environment, gold - a non-yielding asset - often benefits.

In other precious metals markets, spot silver fell 0.4% to $38.42 an ounce, platinum fell 0.4% to $1,343.95, while the price moved sideways at $1,093.57.

See more news related to gold prices HERE...