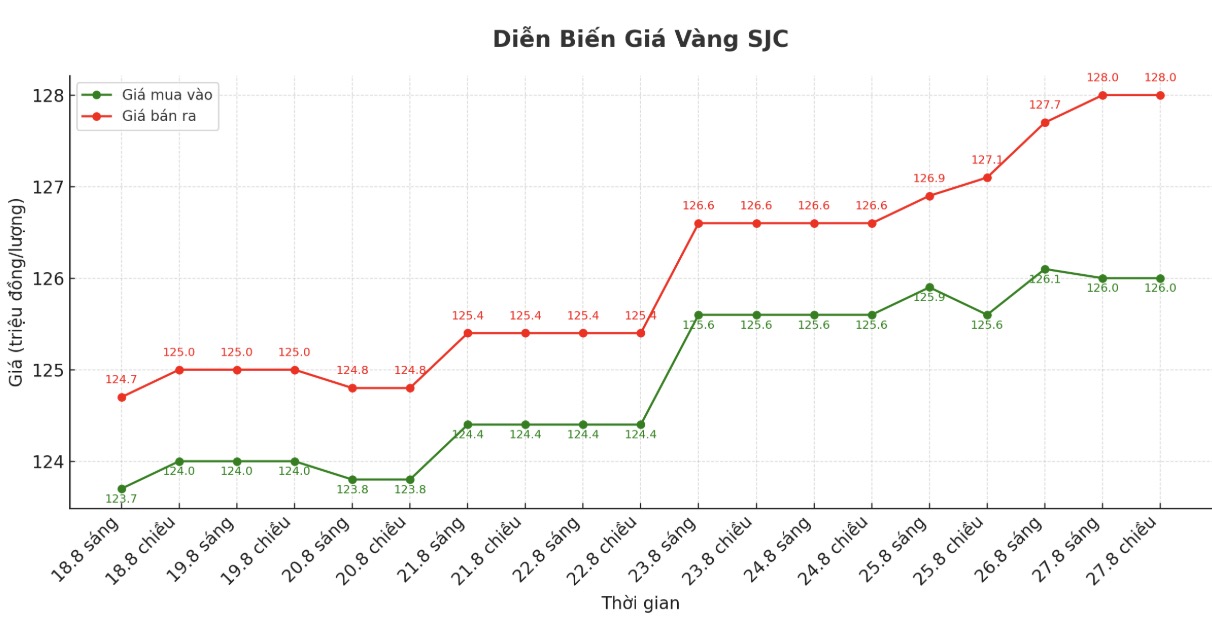

SJC gold bar price

As of 5:50 p.m., DOJI Group listed the price of SJC gold bars at 126-128 million VND/tael (buy - sell), down 100,000 VND/tael for buying and up 300,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 125.8-128 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 900,000 VND/tael for selling. The difference between buying and selling prices is at 2.2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 125.4-128 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

9999 gold ring price

As of 5:50 p.m., DOJI Group listed the price of gold rings at VND 119.8-122.8 million/tael (buy in - sell out), an increase of VND 500,000/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 120-123 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 119.5-122.5 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

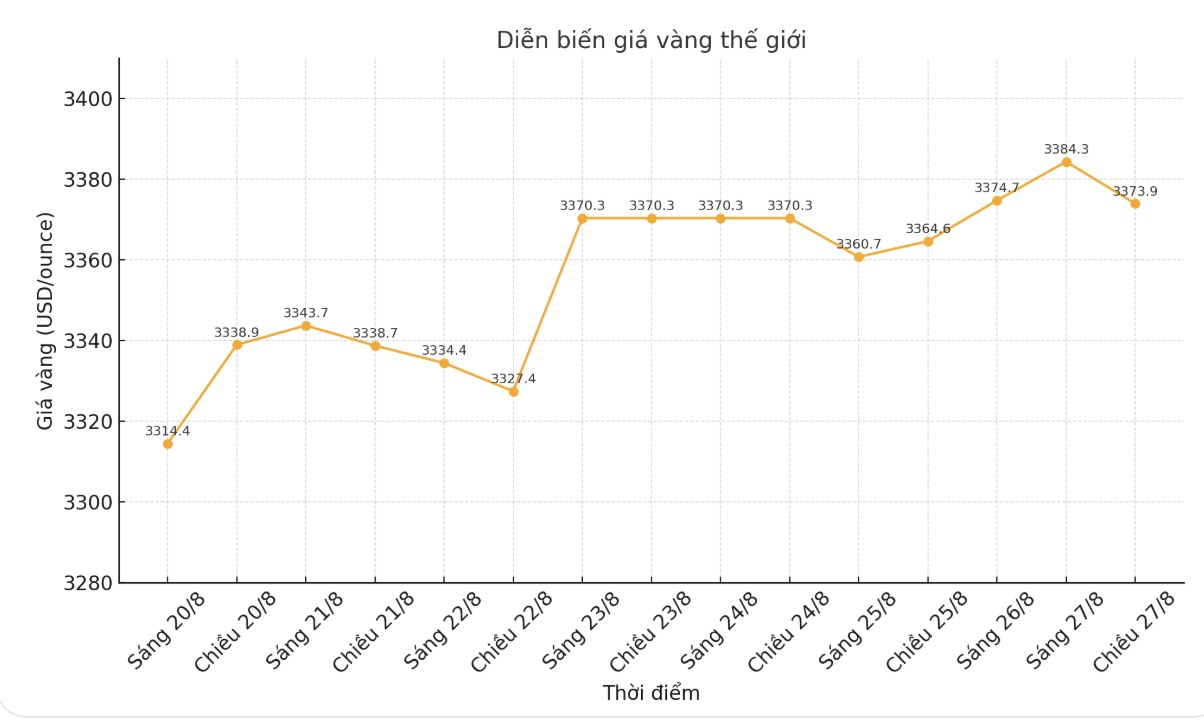

World gold price

The world gold price was listed at 5:50 p.m. at 3,373.9 USD/ounce.

Gold price forecast

Gold prices fell in the trading session on Wednesday, pressured by the rising USD, but new concerns about the independence of the US Federal Reserve (FED) after US President Donald Trump threatened to fire Governor Lisa Cook have somewhat supported the precious metal.

On Monday evening ( EDT), US President Donald Trump announced that he would fire US Federal Reserve Governor Lisa Cook, a move considered the most serious attack on central bank independence, while also stirring up the market and politics and pushing gold prices up sharply.

Mr. Trump posted a " dismissal letter" on the Truth Social platform, accusing Ms. Cook of giving false information in two mortgage loan applications in 2021, before she was appointed to the Fed.

If successful, Mr. Trump could nominate a replacement, thereby reshaping the Fed Board of Governorsorsors (14 years term). The council now has six members, one seat vacant after Ms. Adriana Kugler resigned on August 8.

Mr. Trump nominated Stephen Miran - Chairman of the Economic Advisory Council, to this position.

Mr. Kelvin Wong - Senior Analyst at OANDA commented: " short-term speculators are taking profits. However, gold is still receiving support, especially when the FED is clearly showing its policy easing stance. In the short term, gold could still face upward pressure to test the $3,400 threshold, if it breaks through, it will head towards $3,435/ounce.

The market's attention is now on the personal consumption expenditure (PCE) price index - the FED's preferred inflation measure, due on Friday, to give more signals about the interest rate path after Mr. Powell's "pigeon" speech at the Jackson Hole conference last week.

According to the CME FedWatch tool, the market is betting on an 87% chance that the Fed will cut by 0.25 percentage points at the policy meeting on September 17. In a low interest rate environment, gold - a non-yielding asset - often benefits.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...