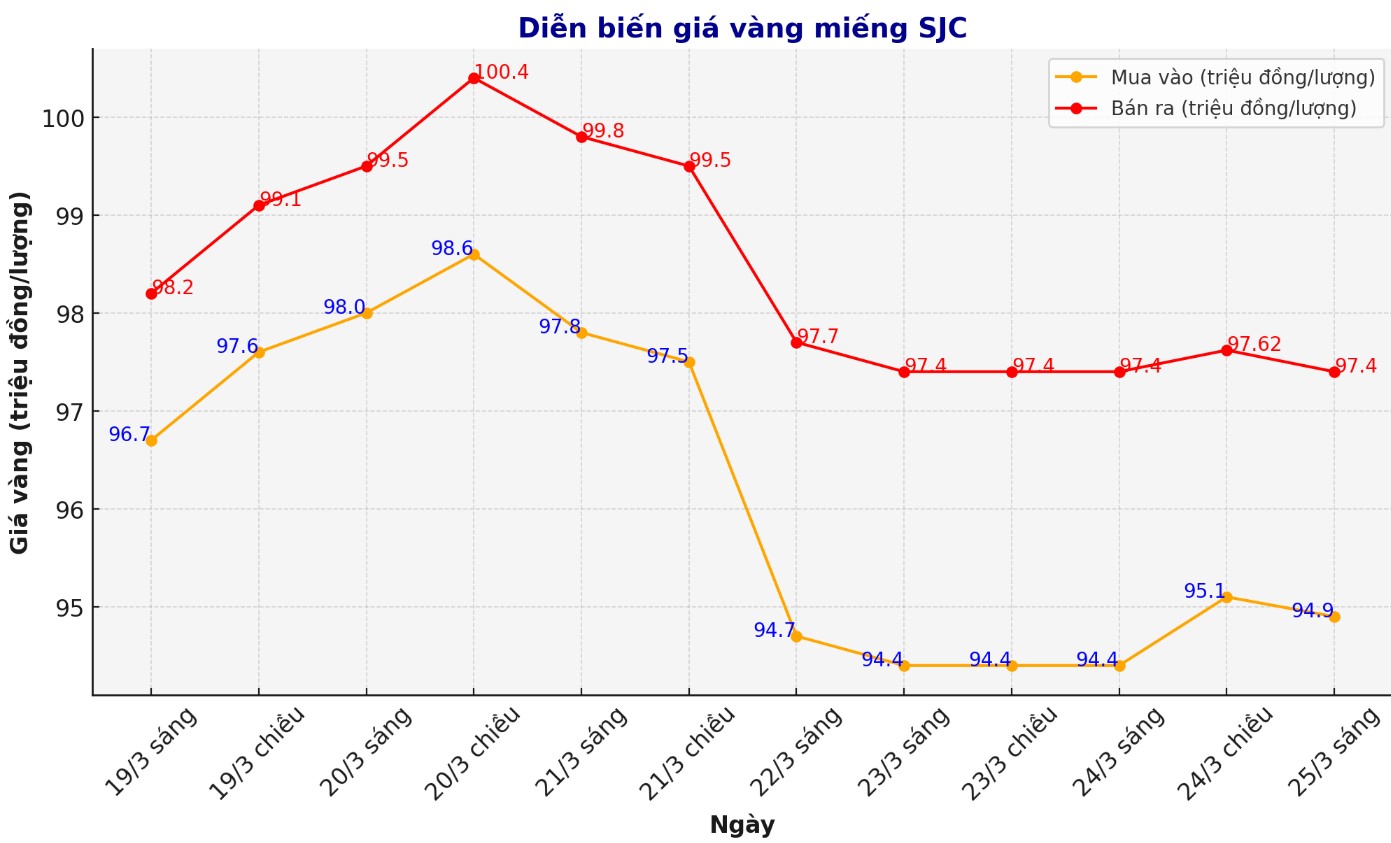

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at VND94.9-97.4 million/tael (buy - sell), an increase of VND500,000/tael for buying and unchanged for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND94.9-97.4 million/tael (buy - sell), an increase of VND500,000/tael for buying and unchanged for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND95.3-97.6 million/tael (buy - sell), an increase of VND500,000/tael for buying and an increase of VND200,000/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

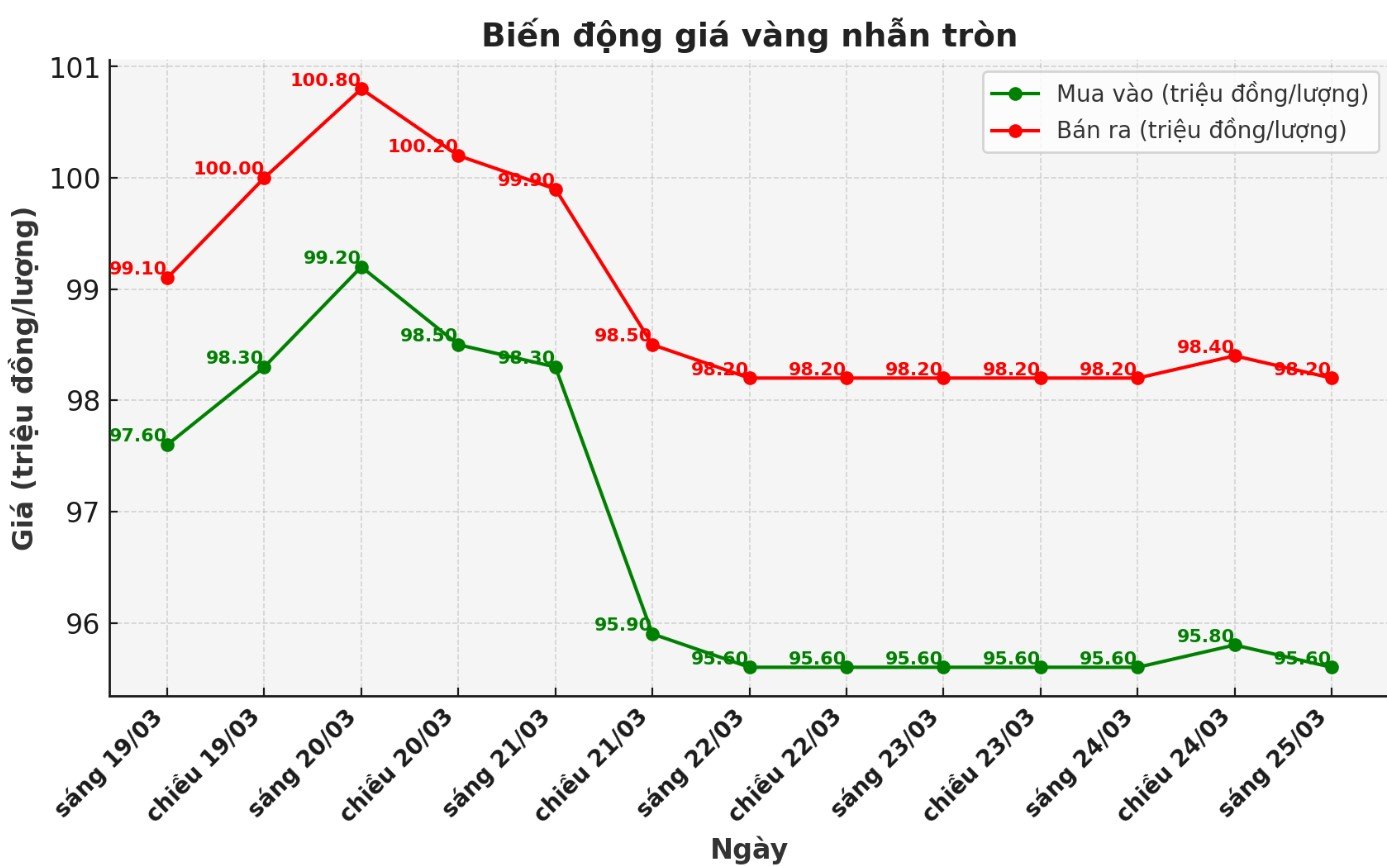

9999 round gold ring price

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI is listed at VND95.6-98.2 million/tael (buy in - sell out), unchanged. The difference between buying and selling is listed at 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 96-98.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 100,000 VND/tael for selling. The difference between buying and selling is 2.6 million VND/tael.

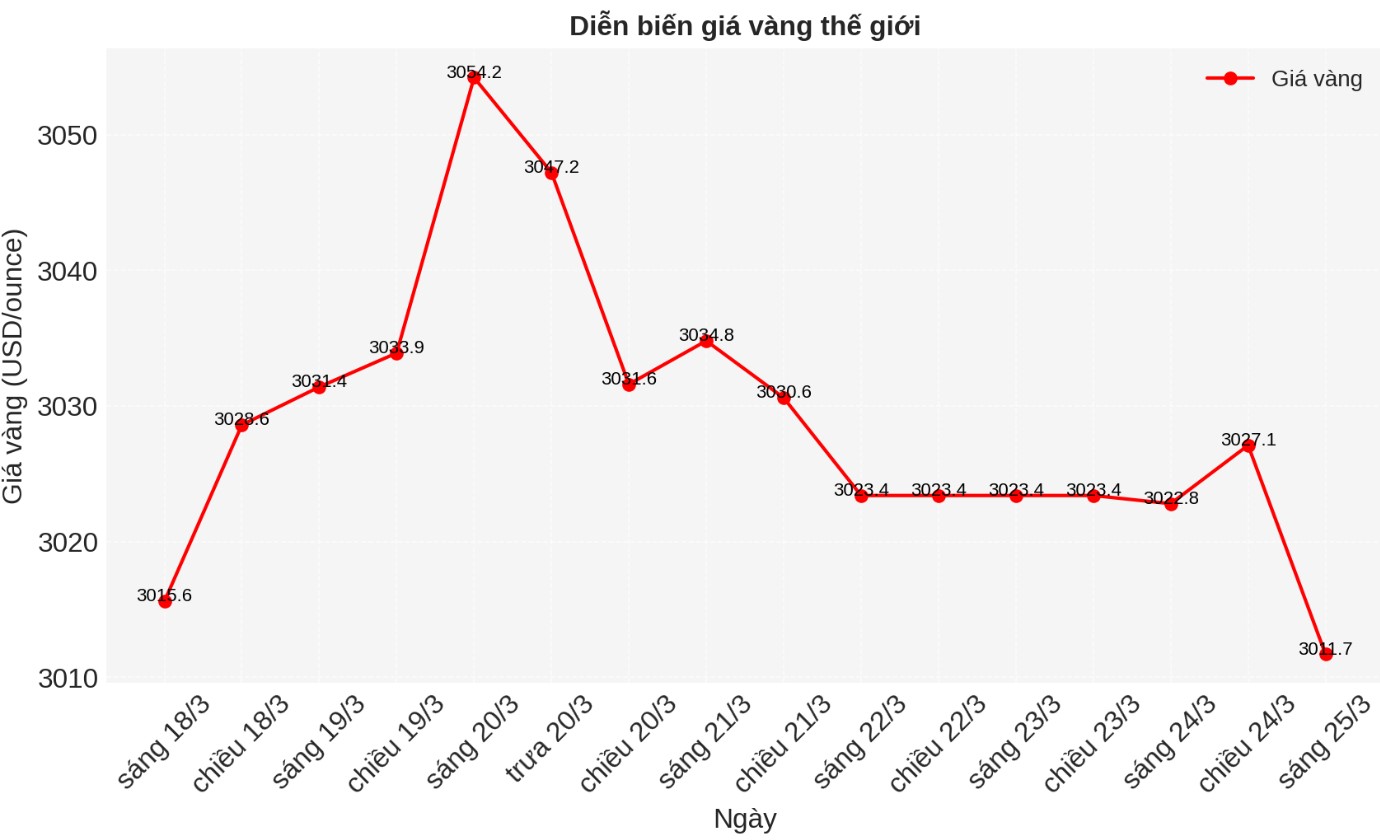

World gold price

At 9:00 a.m. on March 25, the world gold price listed on Kitco was around 3,022.8 USD/ounce, down 0.6 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold price forecast

World gold prices fell in the context of the USD's recovery trend. Recorded at 9:30 a.m. on March 25, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.990 points (up 0.05%).

The long-term upward trend of gold remains, but macro instability can cause unexpected fluctuations. The risk of a short-term gold price decline still exists.

According to James Hyerczyk from FX Empire, gold traders are paying attention to $3,150/ounce. Gold prices are currently fluctuating within a certain range after a recent sharp decline. Traders are focusing on US PCE inflation data and new tariff information to decide the next direction for the gold market.

Gold prices were steady at the beginning of the week, suspended after a sharp decline of two days last week, Hyerczyk wrote.

Monday trading is still within Fridays range, showing hesitation as traders await new stimulants. The precious metal remains in a general uptrend, but the risk of a short-term correction still exists, especially as important macro data and tariff headlines are approaching.

The US dollar is supporting gold prices at current levels, as the US dollar index fell 0.1% on Monday, combined with a 3.4% decline in March. A weaker US dollar typically supports gold prices by making gold more accessible to international investors. The weakness of the US dollar has helped stabilize gold prices after the recent decline, providing short-term support around $3,000/ounce, he noted.

Meanwhile, Jim Wyckoff - senior analyst of Kitco commented that gold prices decreased slightly due to some short-term futures traders taking profits and when US stock indexes increased sharply at the beginning of the week. A stronger USD index is also a slight peripheral factor that has a negative impact on gold. Gold futures for April fell $6 to $3.015.6 an ounce.

"US stock indexes rose sharply and hit a three-week high at noon on the back of a recent sell-off," the expert said.

According to data from the World Gold Council, the ETF gold fund saw capital flow into about 31 tons last week, worth 3 billion USD. This is the eighth consecutive week that capital has flowed in and North American funds have accounted for the majority of the increase. Gold investment funds have significantly increased in volume in recent weeks. The world's largest gold-backed exchange-traded fund, SPDR, has increased by 3.75 billion USD, while the GLDM fund has increased by 1.25 billion USD, so the two have increased by 5.5 billion USD in total.

See more news related to gold prices HERE...