Central exchange rate of VND/USD

This morning (October 20), the State Bank of Vietnam announced that the central exchange rate remained unchanged, currently at VND 25,101/USD.

With an margin of plus/ minus 5%, commercial banks today are allowed to trade USD in the range of VND 23,896 - VND 26,306/USD.

At the State Bank of Vietnam Transaction Office, the reference exchange rate today is as follows:

Buy in: VND 23,896/USD.

Selling: VND 26,306/USD.

Domestic bank USD prices fluctuate, black market USD increases prices

At commercial banks, the USD price today remains unchanged in both buying and selling directions. On the contrary, the black market USD price is moving in a bearish trend, fluctuating between 27,240 - 27,340 VND/USD (buy - sell), stable compared to the closing price of last weekend.

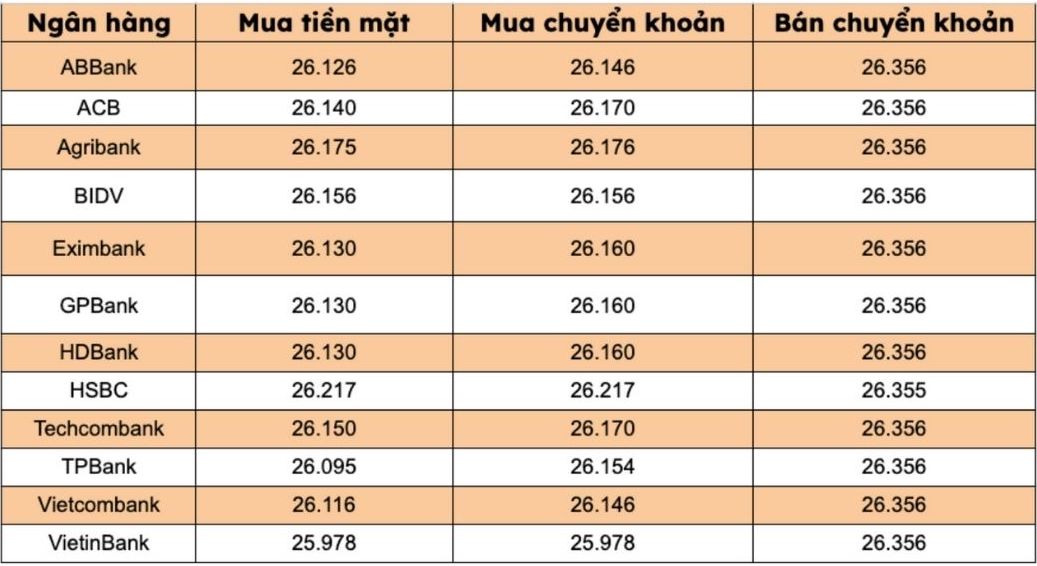

Banks simultaneously listed USD selling prices at VND 26,356/USD.

Bank with the highest cash and transfer price: HSBC (26,217 VND/USD).

The difference between buying and selling prices at banks ranges from 139-261 VND/USD.

Yen exchange rate against USD

At the time of the survey, the Yen exchange rate against the USD was currently trading at 150.64 USD/JPY, although this was still low, the recovery signal was clearer when maintaining a slight increase of 0.14%. Meanwhile, in the free market, this pair of exchanges is trading between 177.50 - 178.70 USD/JPY (buy - sell).

Assessment and forecast

The USD weakened as political risks in Japan and France eased, while US-China trade tensions still created waves in the market. Complex factors are also impacting the US dollar, making it difficult to predict the bottom of the sell-off, according to analysts from ING.

According to experts, the increased review of US regional banks is affecting stocks and the USD. At the same time, the impact of the Fed's loose expectations, hopes for a peaceful dialogue with Ukraine, lower oil prices and US-China trade tensions are also influencing factors.

US President Donald Trump has admitted that high tariffs threatening China are "unsustainable". US Treasury Secretary Scott Bessent said he will hold a phone call with Chinese Deputy Prime Minister He Lap Quang to discuss the trade negotiation situation.

Defense funds buying USD against Yen and Euro at the beginning of the month have stopped losing money, while institutional investors are mostly on the sidelines.

The market recorded a selling-oriented sentiment in the short term even though positions were still leaning towards the USD to increase strongly at the end of the year. At the same time, the USD-Yen pair options trading index is at its highest warning level for the possibility of short-term selling since August.

"The search for signals of weakening the USD continues," Bank of America warned. Inadequate US economic data due to government shutdowns, creating a potential information void, as the release of economic data inundatedly could increase volatility in the foreign exchange market.