Central exchange rate of VND/USD

This morning (October 19), the State Bank of Vietnam announced that the central exchange rate remained unchanged, currently at 25,01 VND/USD.

With an margin of plus/ minus 5%, commercial banks today are allowed to trade USD in the range of VND 23,896 - VND 26,306/USD.

At the State Bank of Vietnam Transaction Office, the reference exchange rate today is as follows:

Buy in: VND 23,896/USD.

Selling: VND 26,306/USD.

Domestic bank USD prices fluctuate, black market USD increases prices

At commercial banks, the USD price today remains unchanged in both buying and selling directions. On the contrary, the black market USD price moved in a bearish trend, fluctuating between 27,240 - 27,340 VND/USD (buy - sell), down 20 VND/USD in the sell-off direction.

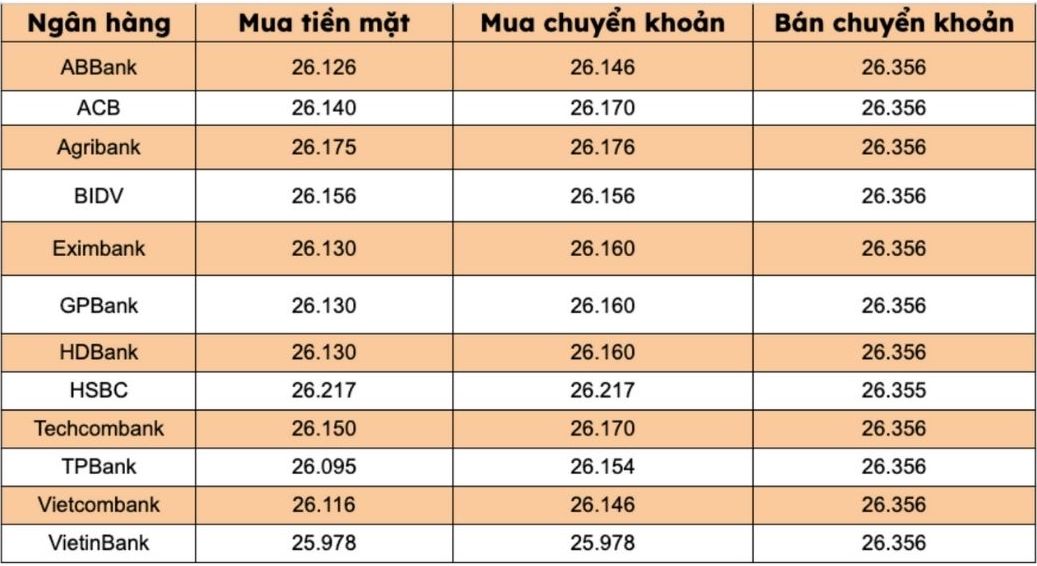

Banks simultaneously listed USD selling prices at VND 26,356/USD.

Bank with the highest cash and transfer price: HSBC (26,217 VND/USD).

The difference between buying and selling prices at banks ranges from 139-261 VND/USD.

Yen exchange rate against USD

At the time of the survey, the Yen exchange rate against the USD was currently trading at 150.64 USD/JPY, although this was still low, the recovery signal was clearer when it increased slightly by 0.14%. Meanwhile, in the free market, this pair of exchanges is trading between 177.50 - 178.70 USD/JPY (buy - sell), down from the previous session's close.

Assessment and forecast

The cooling of US-China trade tensions is supporting market sentiment and the US dollar, after President Donald Trump declared that high tariffs on Chinese goods were "unsustainable".

US Treasury yields rose on Friday to help strengthen the favorable interest rate differential for the USD. However, the greenback's gains were limited by the dovish statement of Alberto Musalem - Chairman of Fed St. Petersburg. Louis approved another rate cut to support the slowing labor market.

Mr.usalem said that the current Fed's policy is "between a bit tight and neutral" and he is willing to support another interest rate cut to support the labor market.

The Yen fluctuated from a 1.5-week high against the USD after the greenback recovered. Safe-haven demand for the Japanese Yen has eased as US-China trade tensions eased after Trump's statement that high tariffs on Chinese goods cannot last long.

In addition, the recovery of US Treasury yields also weakened the Yen.

The Japanese Yen increased after a statement from the Governor of the Bank of Japan (BOJ) - Kazuo Ueda, when he said that the possibility of raising interest rates at the meeting on October 29-30 was still left open. The Yen also benefits temporarily thanks to concerns about the credit quality of US regional banks, causing investors to seek safe havens.

However, in the context of domestic political instability, the Yen is still under pressure. Japan's ruling coalition collapsed after failed talks between Sanae Takaichi, LDP leader, and Natsuo Saito, Komeito leader, made it difficult to approve the budget and policies, which could lead to early elections.