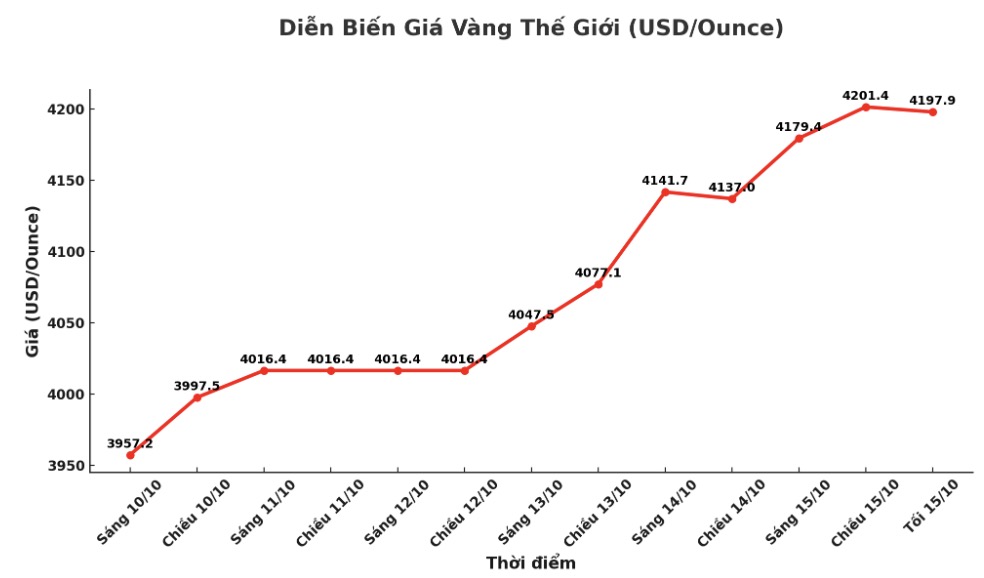

Gold prices increased sharply, the December gold contract hit a new record of 4,235.8 USD/ounce. Silver prices broke out as safe-haven demand and technical purchasing power were the highlights of the midweek.

December gold price is currently up 53.6 USD to 4,217 USD/ounce. December delivery silver price increased by 0.893 USD to 51.53 USD/ounce.

Both metals recorded safe-haven demand amid rising US-China trade tensions and US government shutdowns.

The silver market is witnessing a phenomenon of "short squeeze" due to the serious shortage of silver supply in London, causing prices here to be significantly higher than in New York.

When asked about owning gold, JPMorgan CEO Jamie Dimon said: Im not a gold buyer owning it costs about 4% of the cost a year, he said at Fortunes Most Powerful Women conference in Washington on Tuesday.

However, in the current environment, prices can easily reach $5,000/ounce, or even $10,000/ounce. This is one of the few times in my life that I have found holding a little gold in my portfolio quite reasonable, he added, according to Bloomberg.

Federal Reserve Chairman Jerome Powell also signaled on Tuesday a softer monetary policy which is in the favor of gold prices.

In a speech to an economic group, he said the Fed is expected to make another 0.25 percentage point interest rate cut later this month.

Powell stressed the low recruitment rate and the possibility of a further weakening in the labor market, while noting that the decline in the number of recruitment positions may be reflected in the unemployment rate.

Due to the US government's shutdown, the Fed is having to look to alternative data sources to assess the economic situation. The upcoming Fed policy meeting is scheduled to take place on October 28-29.

The global stock market last night fluctuated in different directions to increase slightly. US stock indexes are expected to open up as the trading session in New York begins.

In China, according to data released by the National Statistics Office on Tuesday, the consumer price index (CPI) in September 2025 decreased by 0.3% compared to the same period last year, stronger than the forecast to decrease by 0.1% but lower than the decrease of 0.4% in August.

Food prices fell (-4.4% more deeply than -4.3% in August), recording the sharpest decrease since January 2024, due to abundant supply before the National Day holiday, low production costs and weak demand. Basic inflation (excluding food and energy) rose 1.0% year-on-year - the highest in 19 months, after an increase of 0.9% in August.

On a monthly basis, the country's CPI increased by 0.1%, lower than the forecast of 0.2%, after moving sideways in August. Signs that the Chinese economy is under a lot of pressure could give the US more advantage in current trade negotiations.

In outside markets, the USD index weakened. Crude oil prices are almost flat around 58.75 USD/barrel. The yield on the 10-year US government bond is currently at 4.011%.

Technically, December gold futures are still in a strong uptrend and maintain a clear technical advantage in the short term, but the increase may be close to the limit. The next target for buyers is to close above the solid resistance level of 4,300 USD/ounce. Meanwhile, the target for the sellers is to push the price below the important technical support level of 4,000 USD/ounce.

The first resistance level was at an overnight record peak of $4,235.8/ounce, followed by $4,250/ounce. First support was at the bottom of the night at $4,157.30/ounce, then $4,100/ounce.

See more news related to gold prices HERE...