The precious metals analysis team led by Michael Widmer said that if certain conditions are met, gold is completely likely to surge to this level.

Investing in gold needs to increase by 18% compared to the same period last year and demand for jewelry must be stable. The BofA stressed: It sounds high, but this increase has happened in 2016 and 2020.

Previously in March, Widmer's team only predicted that gold prices would reach 3,500 USD/ounce by 2027, but this mark was broken in less than a month.

Factors supporting the new increase in gold, according to BofA, are geopolitical instability due to global trade and concerns about the US fiscal situation. They believe that the USD is weakening in this context and gold could become a less risky asset than US government bonds.

Regarding Mr. Donald Trump's tariff policy, the BofA said that although the goal is to reduce public debt, in reality, import taxes do not create a stable source of income but also cause economic instability, pushing up prices and making it difficult for the US Federal Reserve (FED) to regulate interest rates. Real interest rates may remain low, which is beneficial for gold.

In the short term, BofA believes that gold prices will still remain stable above $3,000/ounce, but to surpass the $3,500 mark, more momentum is needed.

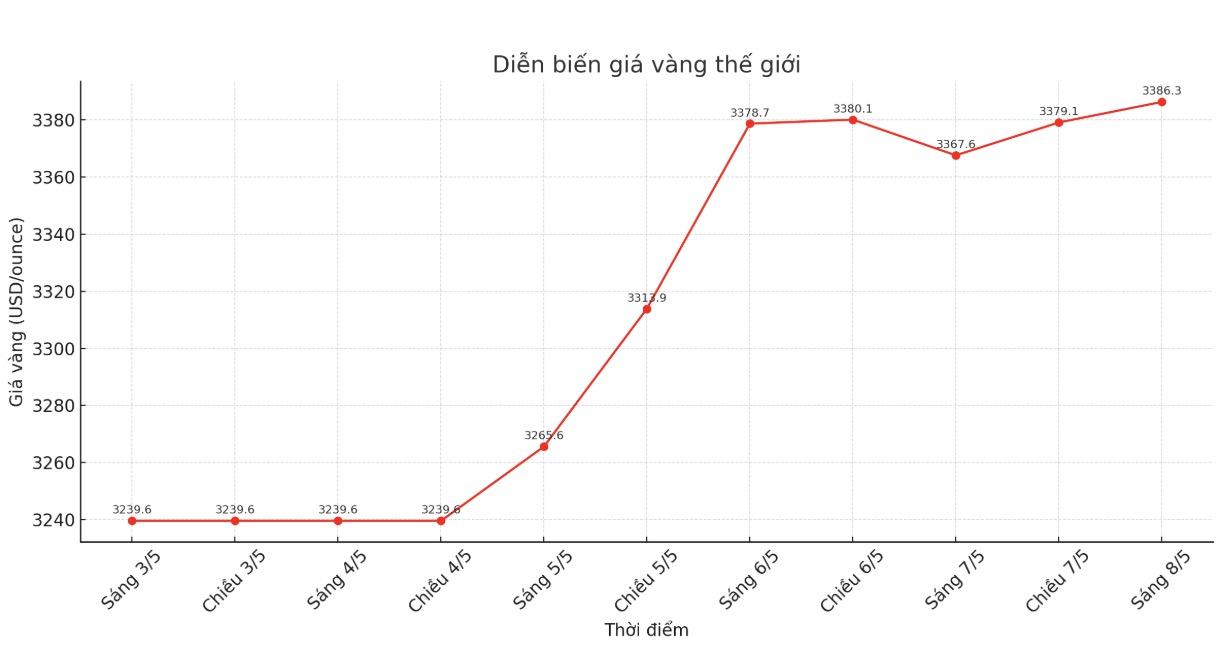

Currently, the spot gold price is around 3,386 USD/ounce, the market is still showing quite good resistance around 3,200 USD/ounce.