Although gold maintains its position, an analyst warned that the potential for price increase is limited.

Rhona OConnell - Head of EMEA & Asia Market Analysis at StoneX has just raised the annual gold price forecast to $3,115/ounce, up 1% from the previous estimate of $3,078/ounce.

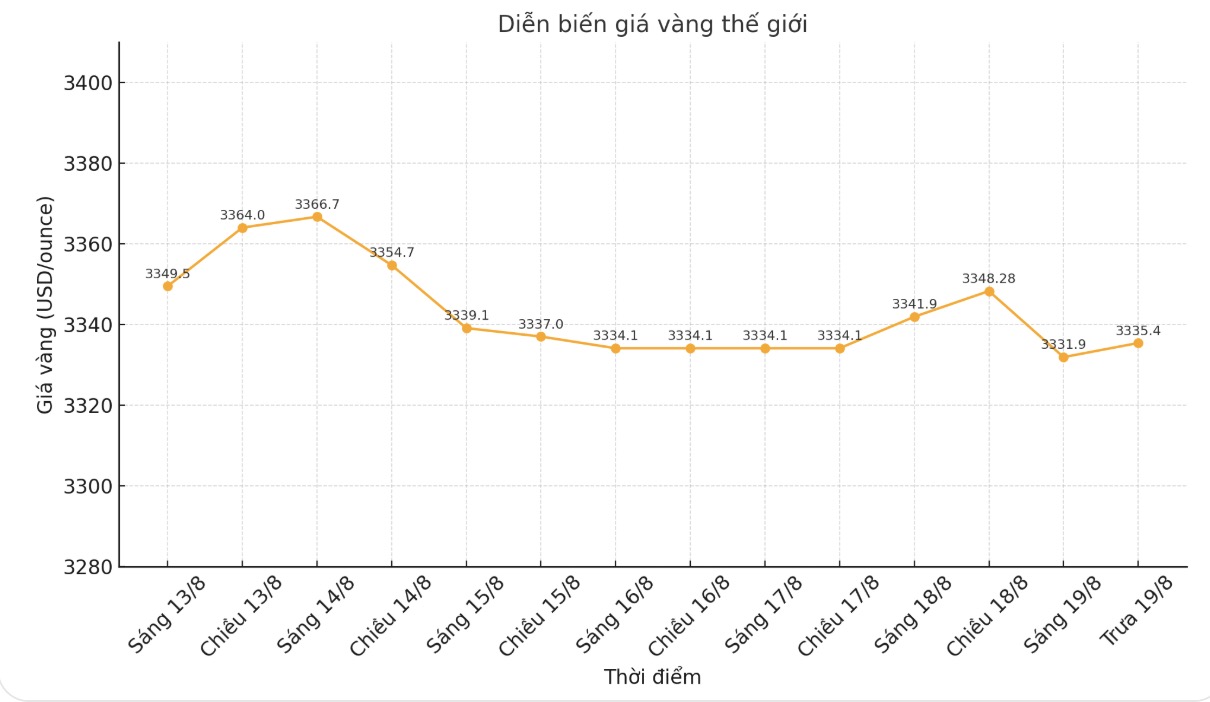

OConnell noted that gold prices have only fluctuated within a 2% range over the past week and around 8% over the past three months.

In the third quarter, she forecasts gold will average around $3,320/ounce. However, in the last three months of the year, the average could be around $3,000/ounce.

Ms. O'Connell said that gold prices are unlikely to hit a new peak. She explained: unless there is a serious surprise event (such as "Black Rift" or a humanitarian crisis), the highest price ever reached 3,500.1 USD/ounce on the morning of April 22 in London is at its peak.

She added the reason: the level of gold price's reaction to the FED's decisions is getting weaker, which shows that the market is saturated and unlikely to have a strong breakthrough.

Gold has yet to hold above $3,400/ounce, although the market expects the Fed to cut interest rates in September, with the possibility of another two cuts before the end of the year.

Although gold is unlikely to reach a new peak, O'Connell does not expect prices to collapse sharply. She pointed out that central bank demand has slowed in the past few months but has remained stable.

The volume, in my opinion, is not as important as the fact that they are still buying. Net buying signals investors that risks still exist. Moreover, the stock market is still too hot, although the US economy continues to exceed expectations.

Any initial crash could take gold down as investors take profits, but then spike demand for gold as a hedge, the expert said.

While gold is stuck, investors can look for opportunities in other precious metals. O'Connell has raised its silver price forecast, expecting an average of $34.21/ounce for the year, up 7% from the previous outlook.

However, she predicts that silver will also have a similar pattern, averaging about 37.30 USD/ounce in this quarter and nearly 34 USD in the last three months of the year.

Currently, spot silver is struggling to overcome the resistance of $38/ounce, most recently trading at $17.97, up 0.12% on the day.

Meanwhile, platinum prices continued to weaken after testing resistance at nearly $1,500/ounce nearly a month ago. The most recent spot platinum was at 1,333 USD, down 0.22% on the day.

Looking ahead, O'Connell forecasts that the average platinum price this year is around 1,160 USD/ounce, up 15% compared to the initial estimate.

See more news related to gold prices HERE...