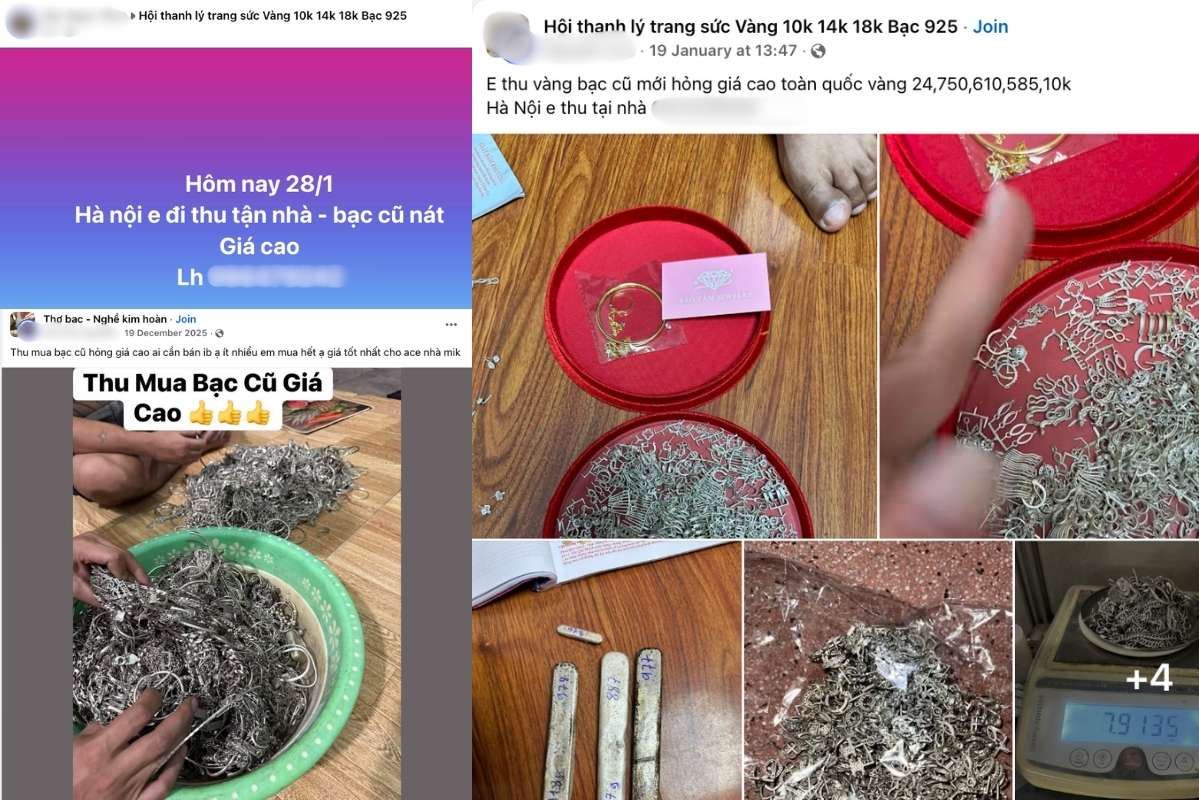

Old, damaged, broken silver becomes "selling well

In recent days, the "hunt" for silver products has always been bustling at precious metal business stores. Not inferior to traditional stores, on forums and groups, from old silver products, scrap silver to billiard silver, ingot silver are all offered from 200,000-320,000 VND/chi, 3.2-6.5 million VND/kg...

In the role of someone who needs to sell and take profits from products related to silver, reporters contacted purchasing accounts on groups and forums.

According to the account holder L.M.C (Hoang Mai, Hanoi), as long as it is silver, whether new or old, broken or broken, it is purchased at a "good price".

Buying according to the price is only 310,000 VND, according to taels is equivalent to about 8 million VND, and according to kg is 80 million VND" - account L.M.C said.

However, this person affirmed that they are not buying coins, old silver products will be crafted to return to the market.

Continuing to connect with account holder N.C (Cau Giay, Hanoi), the reporter received a less attractive price but was asked to take photos to prove the product and check it at home.

We collect according to chi and kg, while according to lang chi are products of ethnic minorities, many parties also buy but are often fraudulent. Products from rings that are not as expensive as necklaces, even old, broken, damaged, and broken ones can be purchased. Collecting according to chi if the product is a necklace or bracelet, the price will be more than 280,000-290,000-19,000 VND/chi" - account holder N.C offered.

Buying and selling according to the psychology of "fearing missing opportunities

From an economic and market perspective, Mr. Nguyen Quang Huy - CEO of the Faculty of Finance - Banking, Nguyen Trai University, said that the phenomenon of buying old silver, damaged silver, and scrap silver reflects important movements in both supply and demand as well as market expectations.

According to Mr. Huy, the increase in purchasing activities shows that the demand for silver, especially silver as a raw material, is trending upwards. As input demand increases, the market often expands to secondary sources of supply, in which recycling from old silver, damaged silver and scrap silver becomes an important complementary channel. This reflects a market seeking to proactively source raw materials, reduce costs and reduce dependence on primary supply sources.

However, Mr. Huy acknowledged that transactions on social networks are spontaneous and unstandardized. Most transactions are based on verbal agreements, without invoices, documents or unified inspection procedures. This entails some noteworthy risks.

First, the risk of silver quality and content. Old and scrap silver can be alloy, silver plated or have a lower percentage of pure silver than committed. Without specialized testing equipment and procedures, both buyers and sellers may suffer losses due to deviations in actual content.

Second, risks of disputes and liquidity. When transactions do not have receipts or clear quality standards, disagreements about volume, value or quality are inevitable.

Third, risks from price fluctuations and crowd psychology. The online market is often strongly influenced by rumors and spreading effects. This can lead to buying and selling based on the psychology of "fearing missing opportunities", causing some decisions to be made when prices have reflected almost all short-term expectations, thereby increasing the risk of reversal in the short cycle.

Representatives of Nguyen Trai University gave recommendations for participants to carefully consider risk management factors, including content verification, agreement standardization, document preservation and avoiding decisions based purely on rumors or crowd psychology.

In a vibrant but unstandardized market, opportunities and risks always go hand in hand, and systematic caution is the factor that helps limit unnecessary losses" - Mr. Huy noted.