Domestic silver prices

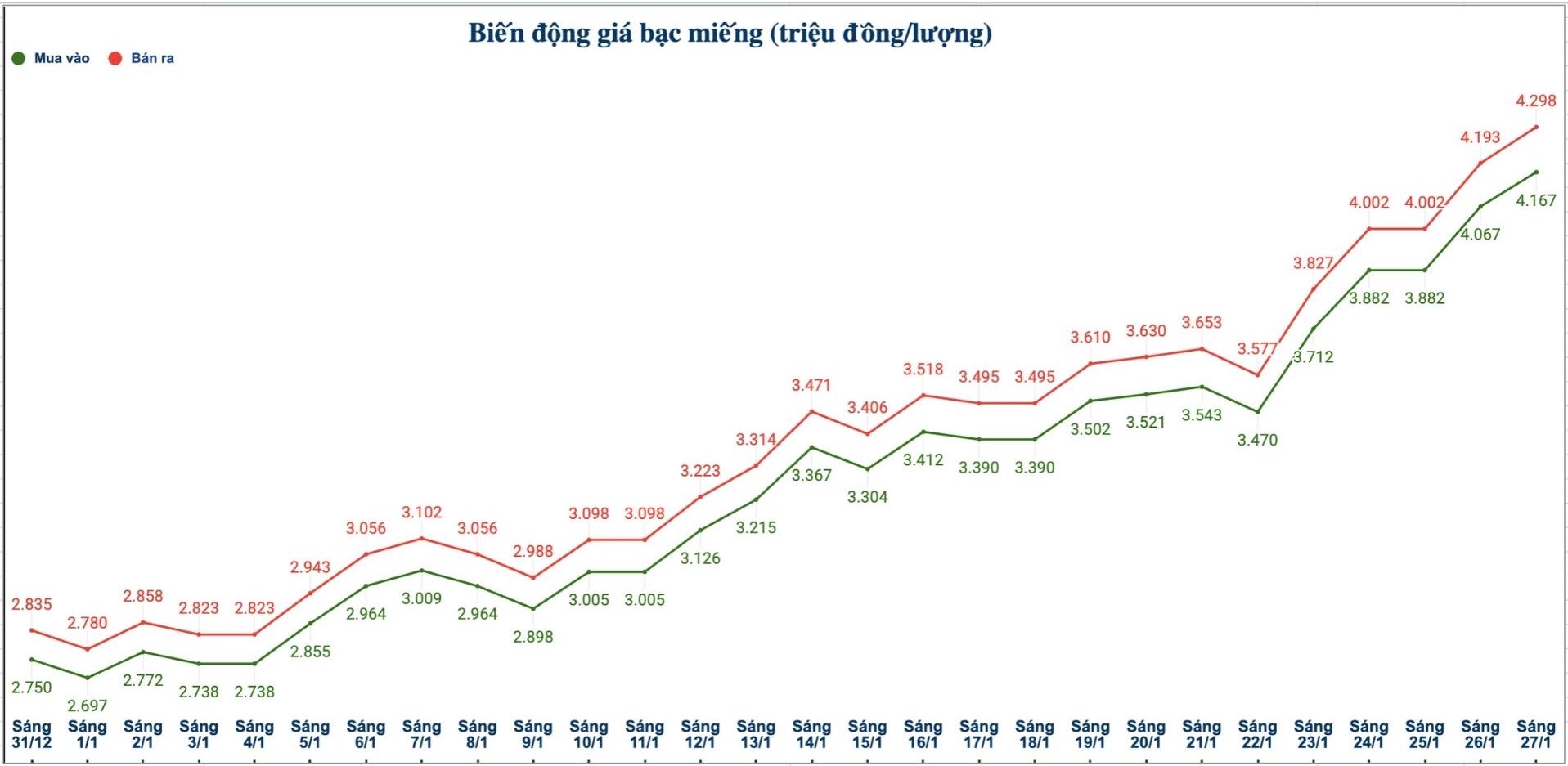

As of 10:50 am on January 27, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company was listed at the threshold of 4.166 - 4.268 million VND/tael (buying - selling); an increase of 94,000 VND/tael on the buying side and an increase of 96,000 VND/tael on the selling side compared to yesterday morning.

The price of 2025 Ancarat 999 (1kg) in Ancarat Jewelry Company is listed at 109.974 - 113.314 million VND/kg (buying - selling); an increase of 2.49 million VND/kg on the buying side and an increase of 2.56 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) is listed at the threshold of 4,194 - 4.299 million VND/tael (buying - selling); an increase of 87,000 VND/tael on the buying side and an increase of 90,000 VND/tael on the selling side compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 4.169 - 4.298 million VND/tael (buying - selling); an increase of 102,000 VND/tael on the buying side and an increase of 105,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 111.173 - 114.163 million VND/kg (buying - selling); an increase of 2.72 million VND/kg on the buying side and an increase of 2.35 million VND/kg on the selling side compared to yesterday morning.

World silver prices

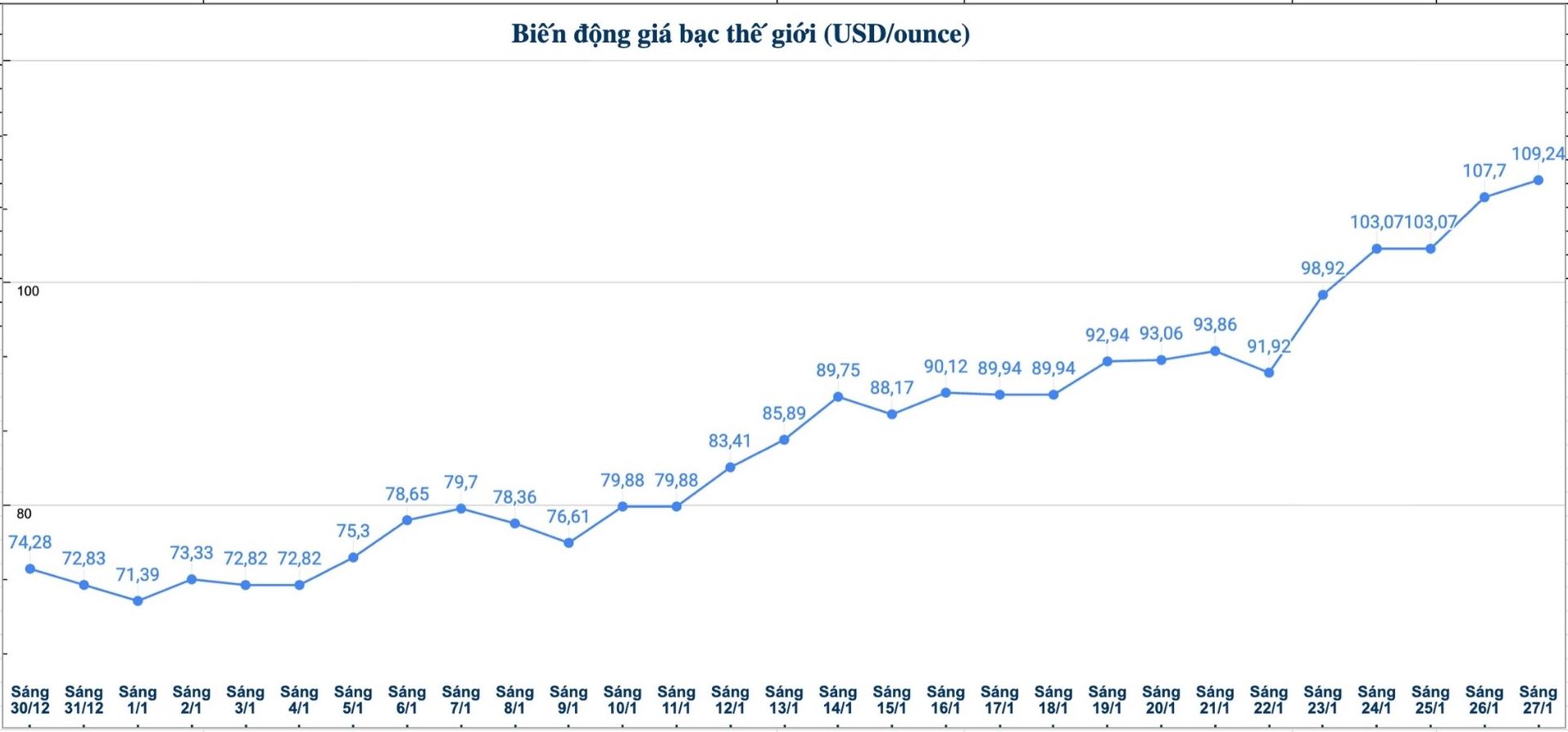

On the world market, as of 10:50 am on January 27 (Vietnam time), the world silver price was listed at 109.24 USD/ounce; up 1.54 USD compared to yesterday morning.

Causes and forecasts

Silver prices continued to increase sharply in the first trading session of the week, at times exceeding the 110 USD/ounce mark, reflecting a clear upward trend but also containing many risks for investors.

According to market developments, precious metal analyst Christopher Lewis at FX Empire said that the increase in silver is being significantly driven by the fear of missed opportunities (FOMO), when cash flow pours in strongly in a short time.

However, this is a market with very high volatility, where chasing prices can cause great losses for investment accounts, especially individual investors" - he noted.

In the current context, he believes that price adjustments are seen as buying opportunities, but it should be noted that silver is an asset with a high leverage level.

Just a price drop of about $20, many small investors may lose almost all of their capital if they use high leverage and do not control risks well. Therefore, although silver prices are still in an upward trend, participating in this market still poses great risks and needs to be very cautious" - Christopher Lewis emphasized.

The expert also believes that silver is unlikely to become a suitable asset for short selling in this period. Instead, this precious metal is likely to form a new higher price level after the market adjusts. However, the new floor price is still an unknown and very difficult to accurately predict.

Some scenarios show that even if there is a strong correction, silver prices may not return to previous low prices, such as below 50 USD/ounce. The most recent correction of silver also took place at a relatively high price compared to previous cycles" - Christopher Lewis said.

See more news related to silver prices HERE...