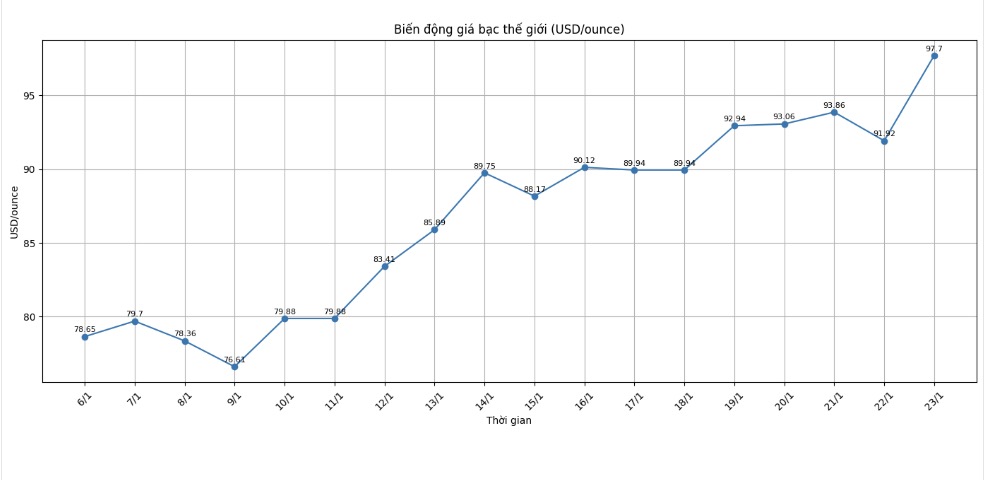

Silver prices continued the upward momentum considered "unstoppable", setting a new record high above 95 USD/ounce. However, more and more analysts are showing more caution with this precious metal.

Ms. Roukaya Ibrahim - chief strategist at BCA Research - said that although the silver market still has a good long-term support base, she does not recommend investors chasing prices in the current zone, because the risk of strong correction has increased.

In just the first month of the new year, silver prices increased by 31%, following a nearly 150% increase in 2025. This precious metal benefited from the "perfect storm", when investment demand increased sharply along with solid industrial consumption in the context of increasingly scarce material supply.

However, according to Ms. Ibrahim, the "fever" speculative wave is becoming the main driving force driving silver prices up and this may not be sustainable.

We still believe that the macroeconomic and geopolitical context is creating a foundation to support silver prices in the medium and long term. Notably, BCA Research has maintained an optimistic view of silver in its commodity matrix over the past year" - Ms. Ibrahim said - "However, the recent strong increase is very difficult to explain by fundamental factors. Gold and the entire group of precious metals are showing clear signs of buying activity due to fear of missed opportunities (FOMO)".

Since the second half of 2025, the entire precious metal market has witnessed large investment flows. Experts believe that this demand stems from the trend of seeking hard assets to hedge against currency devaluation risks, as well as against prolonged economic and geopolitical instability.

Although this environment is predicted not to change soon, Ms. Ibrahim said that most positive information has been reflected in the price. She also said that inflationary pressure, although still high, has not escalated further, while the USD shows signs of stabilizing again, although at a lower level.

According to Ms. Ibrahim, concerns that China's control of silver exports exacerbates the global supply shortage are unfounded.

In essence, China's silver export policy has not changed. Requiring businesses to apply for licenses when exporting this metal is just an extension of regulations that have been applied since previous years," she said.

Meanwhile, the US not immediately imposing tariffs on imported silver is expected to help improve global market conditions. However, Ms. Ibrahim believes that there are still many uncertainties surrounding US trade policy.

The US government is still leaving open the possibility of imposing taxes in the future if ‘satisfactory agreements are not reached within a reasonable time’. Prolonged tariff instability is likely to make the current deformities in the silver market unlikely to be completely resolved soon," she said.

The biggest risk to silver prices comes from industrial demand, as high prices force manufacturers to find ways to cut costs, such as reducing the amount of silver used or switching to cheaper alternatives.

From an investment perspective, Ms. Ibrahim said that BCA Research's analysis models show that silver prices are currently in a clear overbought state.

“Based on the actual price, the level of deviation of the silver price compared to the 200-day moving average line is approaching the levels that appeared before the strong adjustments in the past” - she said.

Although more cautious about silver, BCA Research still maintains an optimistic view of gold. Ms. Ibrahim predicts that the gold/silver price ratio will soon increase again after falling to the lowest level in many years.

Gold currently has the most attractive risk-benefit ratio in the precious metal group" - she emphasized - "Silver prices will continue to benefit from the need for safe haven, and are also the only asset directly benefiting from the efforts to diversify foreign exchange reserves of central banks in emerging economies. Therefore, we prioritize gold over other precious metals.