Domestic silver prices

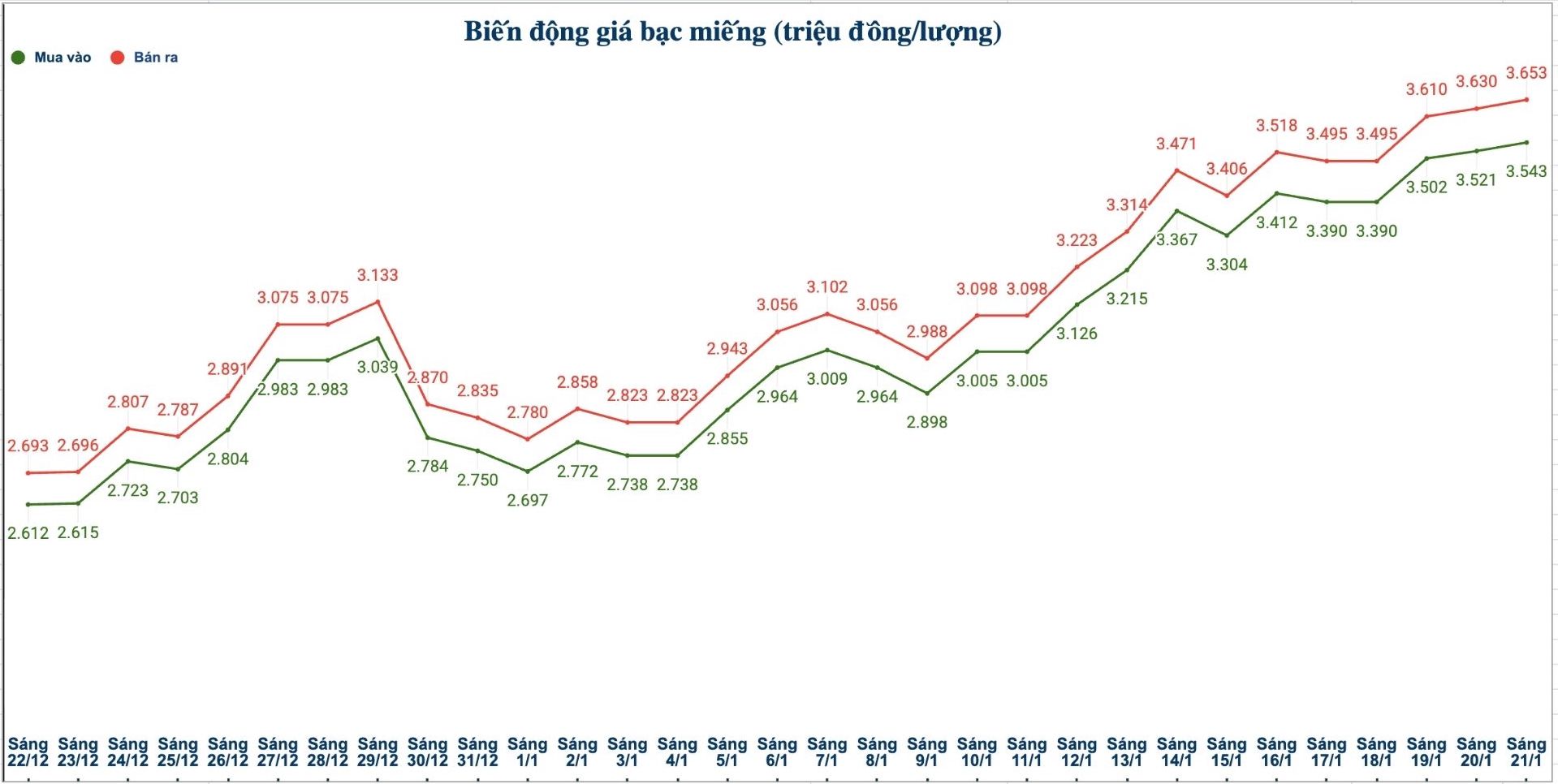

As of 10:40 am on January 21, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company was listed at the threshold of 3.545 - 3.632 million VND/tael (buying - selling); an increase of 23,000 VND/tael in both directions compared to yesterday morning.

The price of 2025 Ancarat 999 (1kg) in Ancarat Jewelry Company is listed at 93.514 - 96.354 million VND/kg (buying - selling); an increase of 594,000 VND/kg on the buying side and an increase of 614,000 VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) is listed at the threshold of 3.567 - 3.657 million VND/tael (buying - selling); an increase of 30,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at 3.543 - 3.653 million VND/tael (buying - selling); an increase of 22,000 VND/tael on the buying side and an increase of 23,000 VND/tael on the selling side compared to yesterday morning.

It's a bit of a bit of a bit of a bit of a bit of a bit.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 94.479 - 97.413 million VND/kg (buying - selling); an increase of 586,000 VND/kg on the buying side and an increase of 614,000 VND/kg on the selling side compared to yesterday morning.

World silver prices

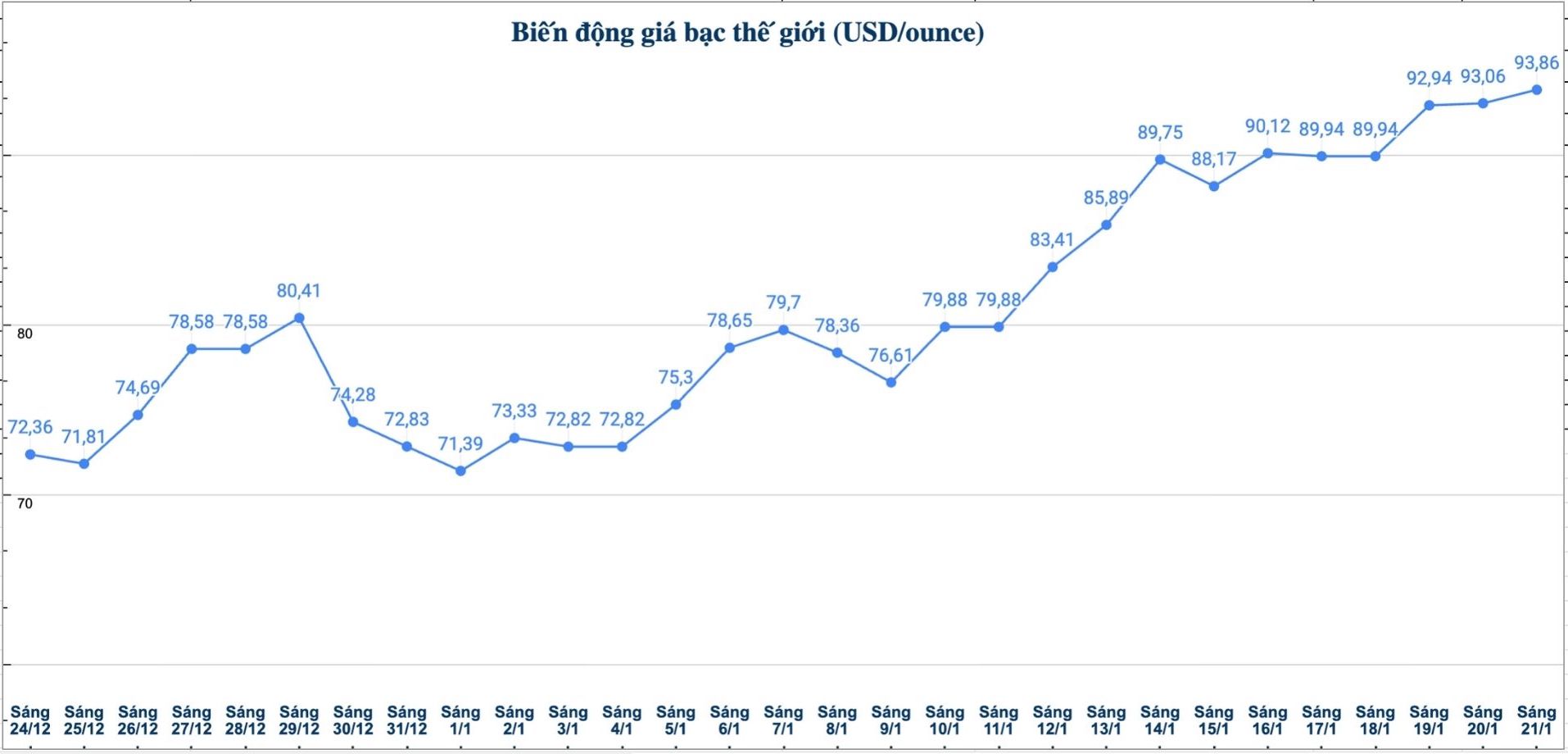

On the world market, as of 10:55 am on January 21 (Vietnam time), the world silver price was listed at 93.86 USD/ounce; up 0.8 USD compared to yesterday morning.

Causes and forecasts

Silver prices continued to rise sharply after the US dollar weakened. According to precious metals analyst Christopher Lewis at FX Empire, this development helps silver get closer to the 95 USD/ounce mark, and is likely to test the 100 USD/ounce mark in the near future.

He said that short-term corrections are still opening up buying opportunities, especially in the context that silver prices have just gone through a period of strong exponential increases. However, this very rapid increase is also posing many risks for investors.

Market history shows that any hot increase can end with a strong reversal. At that time, the fear of missing opportunities (FOMO) often causes many investors to rush into the high-price market" - Christopher Lewis added.

Currently, the biggest risk to the silver market comes from the supply problem and the fact that many investors use too high leverage. According to expert Christopher Lewis, the market will sooner or later experience a strong "break", followed by a deep price drop.

However, in the long term, silver prices still have the potential to form a new higher price level, but this process will not be smooth and may fluctuate strongly" - he assessed.

In the short term, Christopher Lewis said, the common strategy is still to buy when prices adjust. "However, investors need to be especially cautious about using high leverage, because just a sharp drop can make many accounts unable to react in time" - Christopher Lewis recommended.

See more news related to silver prices HERE...