Bitcoin price: Continuously fluctuating

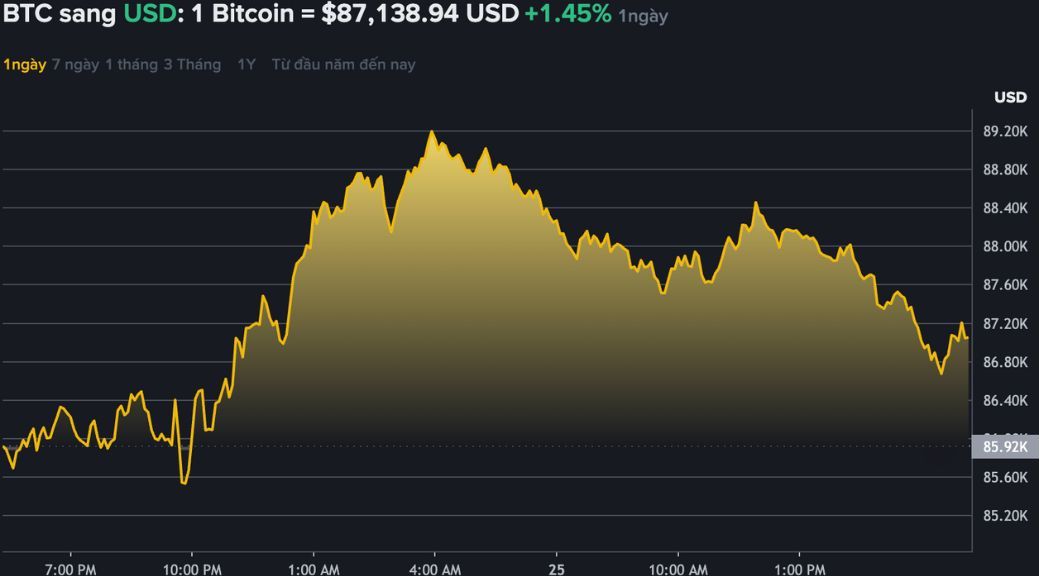

As of 5:12 p.m. today Vietnam time, Bitcoin (BTC) - the world's largest cryptocurrency in terms of constantly fluctuating market value, is currently up 1.45%, reaching 87,138.94 USD.

This new price contributes to bringing market capitalization to 1,738 billion USD, up 19 billion USD. On the other hand, trading volume in the 24 hours increased slightly by 0.44 billion USD, reaching 69.77 billion USD.

Assessment and forecast

Bitcoin has endured a disastrous week in the cryptocurrency market when it nearly lost the support level of 80,000 USD. Several alternative currencies, hyperliquid and Zcash, also suffered heavy losses with double-digit losses within seven days. However, during the weekend, a rather unusual event occurred: A sudden price increase.

Bitcoin has risen back to around $87,000, leading to a recovery for smaller cryptocurrencies.

However, weekend rallies are often unsustainable. Due to liquidity in the cryptocurrency market falling sharply at the end of the week when ETFs monitoring Bitcoin prices on Wall Street closed and investors took a break, Bitcoin prices were vulnerable to strong fluctuations on low trading volumes.

Research has shown that trading volume on weekends typically decreases by 20%-25% compared to normal days, creating a "thinner" market environment where dynamic transactions can have a greater impact on prices.

Another factor is that Bitcoin futures traded on the Chicago Commodity Exchange (CME) closed at the weekend. Bitcoin was listed at around $85,100 at closing time, while the actual market price increased by 3% to $87,000 at the end of the week, creating a gap in CME futures contracts, which will often return to fill, causing many people to doubt the sustainability of the price increase at the end of the week.

In addition, there are separate factors supporting the recent recovery: peace talks to end the war in Ukraine with the controversial 28-point peace plan proposed by Donald Trump, and active negotiations between US and Ukrainian representatives in Switzerland.

The prospect of ending the conflict helps increase investors' interest in risky assets such as Bitcoin. In addition, the possibility of the US Federal Reserve (Fed) cutting interest rates further next month also contributes to improving market sentiment.

In the short term, Bitcoin still faces the challenge of returning above $90,000, especially during the Thanksgiving week in the US when Wall Street closes or only trades for half a day, causing market liquidity to weaken. However, Bitcoin has just had its first week of closing in the bull market after four consecutive weeks of decline, but with a quarterly loss of about 23%, the currency is still on track for its worst year since 2018.

The weekend rally will help create a temporary recovery momentum for Bitcoin and other cryptocurrencies, but investors should be cautious because of the low liquidity at the end of the week, needing more clarity on geopolitical issues as well as macro policies to create a more solid foundation for sustainable growth.

In Vietnam, the cryptocurrency asset market has been piloted since September 9, with a pilot implementation period of 5 years.

However, organizations and individuals participating in the cryptocurrency asset market must comply with relevant legal regulations on prevention and control of money laundering, terrorist financing, sponsorship of the dissemination of weapons of mass destruction, electronic transactions, network information security, network security, data protection to ensure security and safety in the cryptocurrency asset market and other relevant specialized laws.