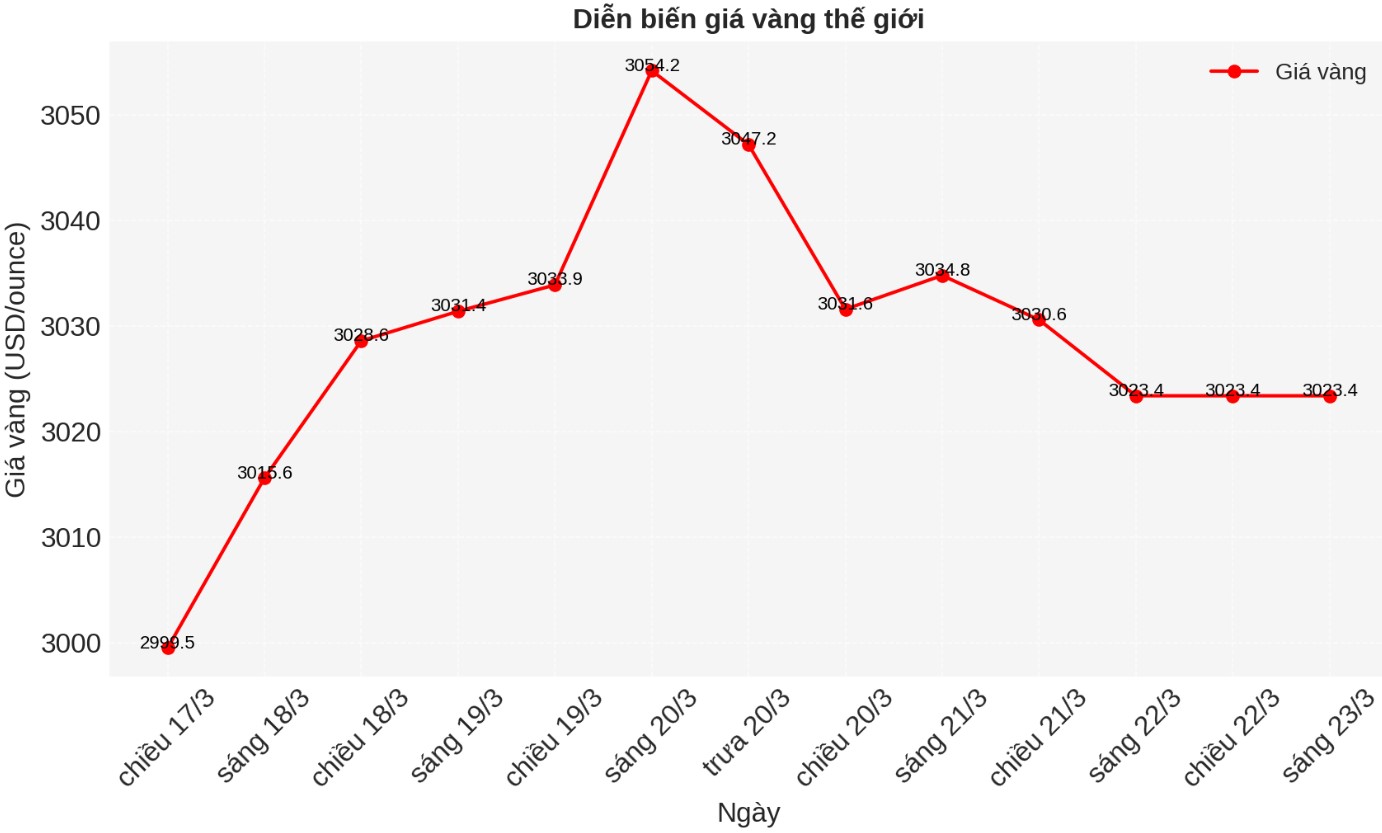

George Milling-Stanley, chief strategist at State Street Global Advisors, said he could see gold prices hover around $3,000 an ounce in the coming months as investors get used to the breakout.

We will be more confident in maintaining prices above $3,000 an ounce if it takes some time this year to get over it, he said.

While Milling-Stanley is not expecting new record highs in the near term, he also does not see any major factors that could have a strong impact on gold prices.

Ole Hansen - head of commodity strategy at Saxo Bank - said that gold prices could easily fall by $100 without greatly affecting the current uptrend.

If you are an asset manager looking to move from stocks to gold because of concerns about stagflation (inflation accompanied by recession), you can welcome a $100 decline, he said.

Hansen said the first significant support he is monitoring is $2,955 an ounce, a high from last month before gold prices broke out last week.

David Morrison, senior market analyst at Trade Nation, said he will monitor whether gold holds $3,000.

Gold has fallen from a high level but not too much. The daily MacD index is still high, but not overbought. However, gold could benefit from an additional correction to bring prices to levels where another rally could begin.

Gold could definitely continue to rise from current levels. However, testing $3,000 to see if it can maintain a supportive role is not ruled out, he said.

In a note on Friday, Thu Lan Nguyen - head of research at Commerzbank, said that concerns about inflation could be a factor holding back gold prices. On Wednesday, after keeping interest rates unchanged, the US Federal Reserve (FED) updated its inflation forecast and currently forecasts consumer prices to increase by 2.8% this year, higher than the December forecast of 2.5%.

Although Fed Chairman Jerome Powell has mitigated the inflationary threat, the expert said investors are still very cautious.

The Federal Reserve has also initially assessed the 2021 and 2022 inflation shocks as temporary, but in the end, it had to take very drastic countermeasures due to strong price increases. If a similar scenario occurs, it will be bad news for gold," she said.

The head of research at Commerzbank also said that any correction in gold is still considered a buying opportunity.

Although gold's technical momentum has pushed gold above $3,000 an ounce, some analysts believe that the precious metal may be sensitive to economic data, especially high inflation and weak economic activity, which would suggest the risk of rising stagflation.

Important data to watch next week are the core personal consumption expenditure index, eliminating energy and food prices, and the US Federal Reserve's favorite inflation index. Markets will also be interested in how US consumers react amid rising economic uncertainty.

Economic data to watch next week

Monday: US manufacturing and services PMI (S&P Global).

Tuesday: American consumer confidence, new home sales in the US.

Wednesday: Orders for durable US goods.

Thursday: Waiting for home sales, US Q4 GDP.

Friday: US core PCE, US personal income and expenses.