Opportunities from the US election event

The recent decline is considered an opportunity that many investors have been waiting for to return to the market after a year of witnessing continuous increases in gold prices.

Since the world gold price surpassed the 2,100/USD/ounce mark in March, many investors have been hesitant to participate in a market that has risen too high. However, the recent US presidential election has created an opportunity for them to return.

After Donald Trump won, the US financial market recorded a strong increase in the USD and government bond yields. Trump's "America First" policies created major obstacles for gold, leading to a sharp price correction.

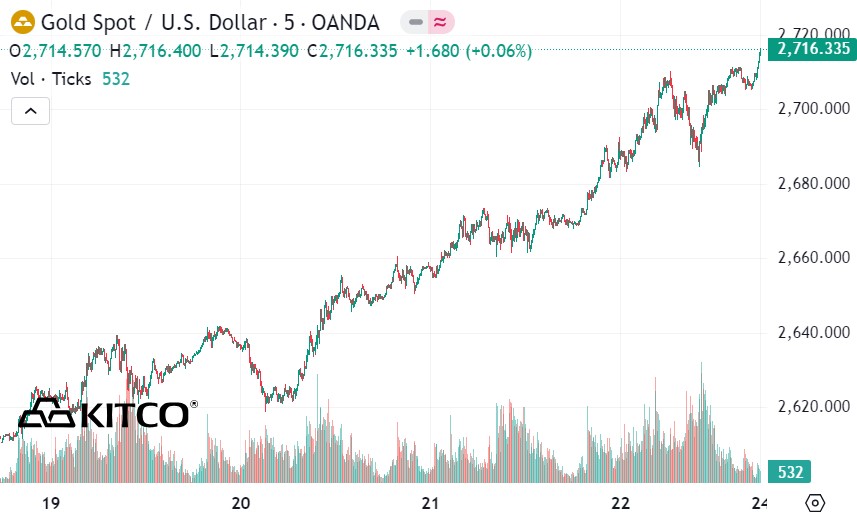

Gold prices have fallen more than 9% from a peak of 2,800 USD/ounce three weeks ago to a low last week. However, the correction appears to be over as gold prices rebound sharply, demonstrating its role beyond the U.S. market as an important global financial asset.

Gold price recovery momentum

Last week, the gold market recorded a 5% increase, thanks to increased demand for safe havens amid escalating tensions between Russia and Ukraine. In addition, geopolitical tensions in the Middle East remain high.

At the same time, slowing global economic growth has raised expectations that central banks around the world will continue to ease monetary policy. Falling real yields reduce the opportunity cost of gold, thereby increasing the appeal of this precious metal.

With the new momentum, gold price forecasts are once again being raised to record highs. Some analysts expect gold prices to hit 3,000 USD/ounce next year. Earlier this week, Goldman Sachs reaffirmed its forecast for gold prices to reach 3,000 USD/ounce by the end of 2025.

Despite the challenges facing the market, gold continues to be a hot investment. Last week, the world's largest gold-backed ETF, SPDR Gold Shares, celebrated its 20th anniversary.

According to a survey conducted by State Street Global Advisors on this occasion, 38% of US investors currently have gold in their portfolio, a significant increase from 20% in 2023. Of those, 56% said they intend to increase their investment ratio in gold in the next 6-12 months.

Despite short-term volatility, the gold market still holds strong long-term growth potential.

Lukman Otunuga - Managing Market Analyst at FXTM said that besides geopolitical tensions, gold is also supported by the dovish monetary policy stance from the US Federal Reserve (FED), with the possibility of a rate cut next month at 50/50.

“Gold is trading 4% below its record high and could retest this level if geopolitical tensions trigger a wave of risk aversion,” Otunuga said.

See more news related to gold prices HERE...