Driving force from geopolitical tensions

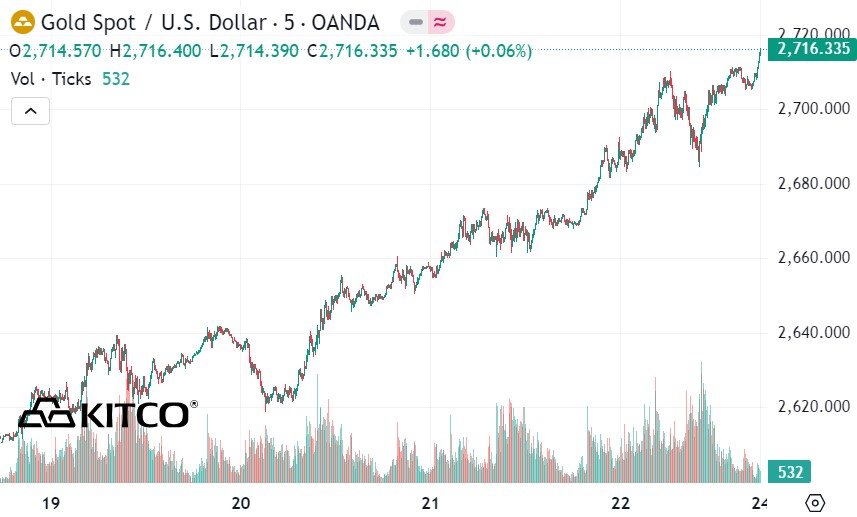

After a long period of decline, gold prices officially regained the $2,700/ounce mark on Friday. Gold prices gradually recovered after a decline when Republican candidate Donald Trump was elected President of the United States.

Many analysts believe that the main reason driving up gold prices is increased demand for safe havens after the Russia-Ukraine conflict escalated.

Russia warned on November 19 that it would retaliate after Ukraine fired a US-made long-range missile into its territory. This was the first time the US had allowed Ukraine to fire long-range missiles into Russian territory in the nearly three-year conflict, adding new tensions to the protracted war in the region.

A senior Ukrainian official told AFP that the attack on Russia's Bryansk region on November 19 "was carried out with ATACMS missiles" provided by the US.

“Gold has been quick to recover despite pressure from a stronger US dollar. Gold’s outperformance against silver suggests that this is a safe-haven rally, leading to a wave of buying from investors waiting for an opportunity,” said Ole Hansen, head of commodity strategy at Saxo Bank.

However, Hansen warned that the geopolitical rally may not last. “Unless there is further development in Eastern Europe, the upside is likely to be limited until there is clarity on the new actions of Donald Trump and the US Federal Reserve,” he said.

Forecast of short-term correction

Mr. Naeem Aslam - Investment Director at Zaye Capital Market said that next week the gold market may witness an adjustment when gold prices increase at the same time as the USD and the stock market.

“It is unusual for risk assets and safe havens to rally together. This is largely due to investors reacting to geopolitical tensions while remaining optimistic that things will not get out of hand,” Aslam said.

Lukman Otunuga, chief market analyst at FXTM, believes that gold prices still have room to rise in the current environment. He believes that in addition to geopolitical tensions, gold is also supported by the dovish monetary policy stance from the Fed, with the possibility of a rate cut next month at 50/50.

“Gold is trading 4% below its record high and could retest this level if geopolitical tensions trigger a wave of risk aversion,” Otunuga said.

Economic factors and short-term outlook

Next week, the market will focus on the Thanksgiving holiday and important economic reports from the US. Data such as consumer confidence, third-quarter GDP growth, and personal consumption expenditure (PCE) index can have a big impact on gold prices.

According to economists, any signs of weakness in US economic data could strengthen expectations of a Fed rate cut, thereby supporting further gains in gold prices.

Some analysts also pointed out that gold's performance against the euro is opening up new upside prospects. Gold ended the week above 2,600 euros/ounce, up 7%.

Gold could hit a new record high against the US dollar and other major currencies, according to independent analyst Jesse Colombo.

“We need to remember that, despite the Trump administration’s economic stimulus, this does not mean that the national debt will decrease. Instead, the pressure of low interest rates and increased spending can create a positive short-term economic picture but fraught with long-term risks,” said Jesse Colombo.

Although gold prices are rising sharply, analysts still advise investors to be cautious of unexpected fluctuations from geopolitical and global economic factors. In the short term, if gold maintains a price above $2,700/ounce, the next targets are $2,750 and $2,790.