After a year, the price of SJC gold bars has increased sharply, helping investors who bought last year earn a significant profit.

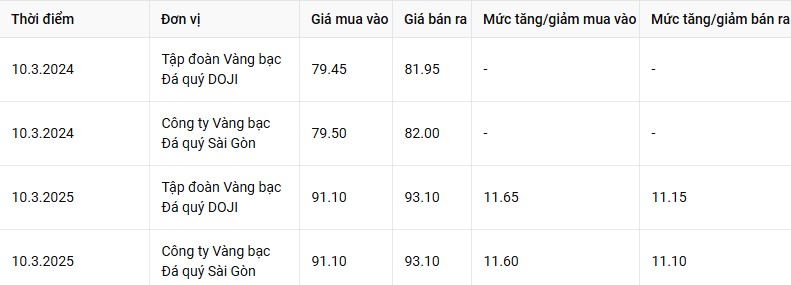

A year ago (March 10, 2024), the price of SJC gold bars at DOJI Group was listed at VND 79.45 million/tael (buy) and VND 81.95 million/tael (sell). At Saigon Jewelry Company SJC, the purchase price is 79.5 million VND/tael, the selling price is 82 million VND/tael.

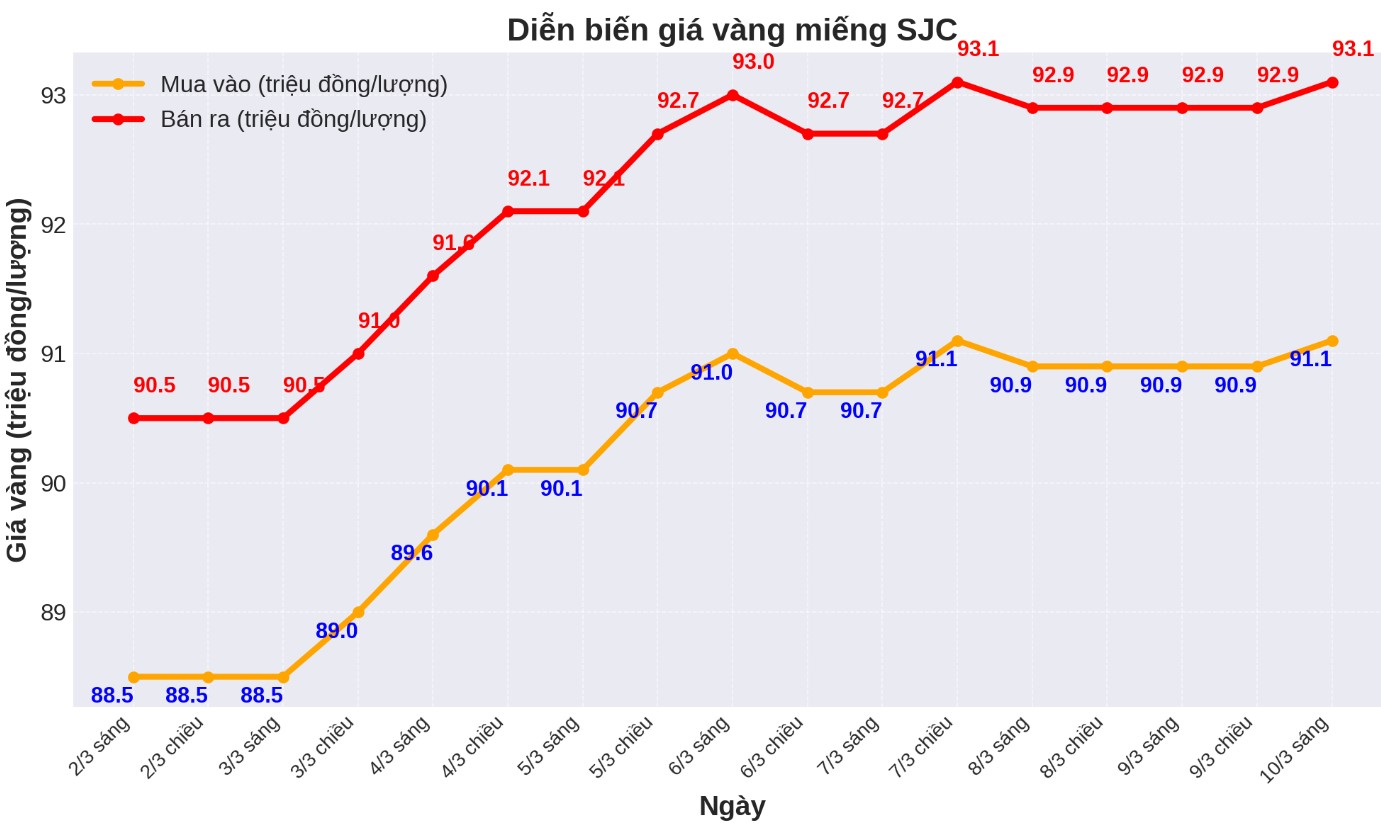

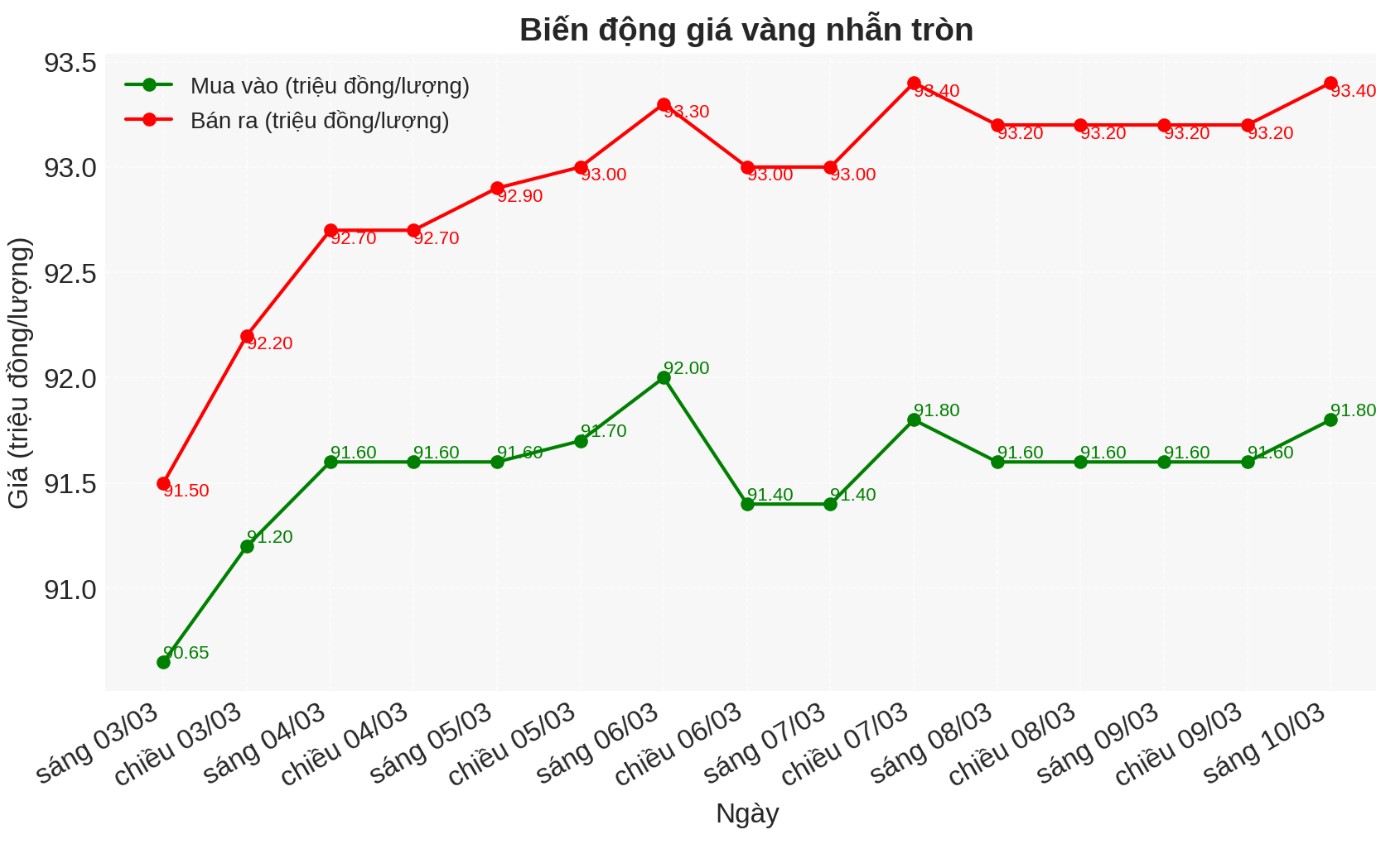

As of today (March 10, 2025), SJC gold prices at both large enterprises have recorded a strong increase. DOJI Group currently lists the purchase price at 91.1 million VND/tael and the selling price at 93.1 million VND/tael. Saigon Jewelry Company SJC also listed a similar price.

Compared to a year ago, the price of SJC gold at both DOJI and SJC increased by 11.6 million VND/tael for buying and increased by 11.1 million VND/tael for selling.

Gold buyers on March 10, 2024 and selling today will make a profit of about VND 9.15 million/tael if trading at DOJI and VND 9.1 million/tael if buying at SJC.

In addition, the gap between the buying and selling prices of SJC gold at business units has also narrowed. Last year, the difference was 2.5 million VND/tael, now reduced to 2 million VND/tael. This helps gold traders make more profits when buying and selling in the market.

With the strong increase in gold prices over the past year, the precious metals market continues to attract the attention of investors, in the context of economic instability and global monetary policy still being the main factors affecting the gold price trend.

Although SJC gold bars have had a strong increase of more than 11 million VND/tael over the past year, in reality, buyers last year only made a profit of about 9.1 - 9.15 million VND/tael. This stems from the difference between buying and selling prices, causing actual interest rates to always be lower than the overall price increase of the market.

A noteworthy point is that the larger the difference between buying and selling prices, the higher the risk. If buying gold at a time when there was a large margin difference like 2.5 million VND/tael last year, investors will need prices to increase more strongly to be able to make a significant profit. When the price range narrows to 2 million VND/tael as at present, the risk is reduced, but it is still necessary to carefully consider market developments before buying.

The increase in gold prices does not mean that all buyers are profitable, especially when prices fluctuate strongly and the buy-sell gap is high. If buying gold at a price level that is pushed up too high but the buy-sell gap is large, when the price is adjusted down slightly, investors may suffer heavy losses. At some points, gold prices may increase rapidly but also decrease sharply, posing a great risk for buyers at the peak price range.

To limit risks, investors need to monitor the difference between buying and selling prices, and should only buy when this range is not too high to avoid losing profit when prices are adjusted. Following the crowd psychology can cause many people to buy gold at unreasonable prices, leading to risks when the market fluctuates.

If deciding to invest in gold to preserve assets instead of short-term surfing, buyers need to have a clear plan, choose the right time to optimize profits and limit unexpected price shocks.

See more news related to gold prices HERE...