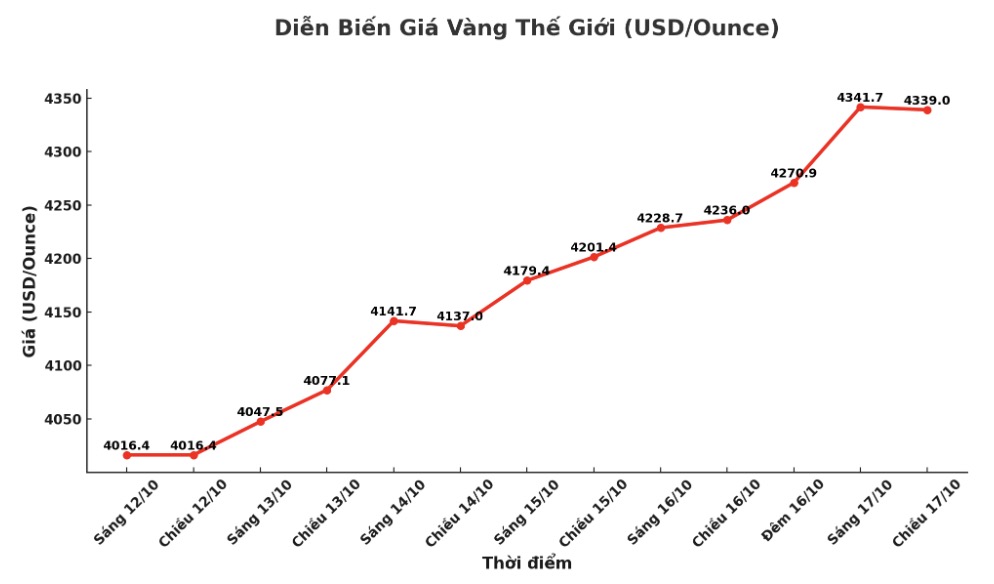

In today's trading session (October 17), gold prices exceeded the 4,300 USD/ounce mark for the first time. Recorded at 5:25 p.m. (Vietnam time), the world gold price was listed at 4,339 USD/ounce.

Meanwhile, the main US stock indexes simultaneously turned down at the end of the session, erasing the previous increase. Meanwhile, gold prices continue to hit new peaks as safe-haven demand increases.

Poor business results from Travelers (TRV.N) and Zions Bancorp (ZION.O)'s announcement of a loss of $50 million in the third quarter caused the (.SPXBK financial index) to plummet by 2.75%.

Mr. Chu Chu Carlson - CEO of Horizon Investment Services ( Indiana) - commented: "In the context of a lack of new economic data, banks are becoming an alternative source of information. We are seeing deep declines in some credit-sensitive banks, suggesting that credit quality may be weakening.

Carlson added: The US dollar is quite weak today, with cryptocurrencies also falling sharply. This is a trading session in which investors reduce their risk appetite".

Some cooling signals from the labor market also reinforce the possibility that the US Federal Reserve (FED) will cut interest rates by another 25 basis points at its policy meeting on October 29.

Based on all the available data, I believe the Fed should continue cutting policy rates by another 0.25%, said FED Governor Christopher Waller.

Global investors are closely monitoring new developments in trade relations between the US and China, after the two sides made moves related to controlling exports of some strategic items. These factors have increased concerns about the supply chain and continue to impact market sentiment.

According to Mr. Sam Stovall - Investment Strategy Director of CFRA Research in New York - "commercial instability is the main factor pushing gold prices to record highs. Many central banks in the world are increasing their gold purchases, supported by low interest rates and a weak USD. This is not a reaction to the fear of recession, but a consequence of political instability.

At the end of the session, the Dow Jones index decreased by 301.07 points (0.65%) to 45,952.24 points; the S&P 500 lost 41.98 points (0.63%) to 6,629.08 points; Nasdaq composite decreased by 107.54 points (0.47%) to 22,562.54 points. Meanwhile, European stocks increased as investors received positive business results and the French political situation became more stable after Prime Minister Sebastien Lecornu overcame a no-confidence vote. The CAC 40 index increased by 1.4%, STOXX 600 increased by 0.69%, while FTS Eurofirst 300 increased by 0.68%.

The US dollar fell slightly against the euro and the Japanese Yen as the market watched tariff negotiations and loose comments from Fed officials. USD Index decreased by 0.33% to 98.35 points; the euro increased by 0.36% to 1.1688 USD; the Yen increased in price when the USD lost 0.43%, to 150.39 Yen/USD.

US Treasury yields also fell sharply. 10-year yield fell 6.9 basis points to 3.976%; 30-year yield fell 5 points to 4.589%; 2-year yields often reflecting the Feds policy expectations fell 8.4 points to 3.422%.

Oil prices reversed and decreased after US President Donald Trump said Indian Prime Minister Narendra Modi pledged to stop oil imports from Russia - a move that has worried investors about falling consumption demand. US crude oil (WTI) decreased by 1.39% to 57.46 USD/barrel; Brent oil decreased by 1.37% to 61.06 USD/barrel.

See more news related to gold prices HERE...