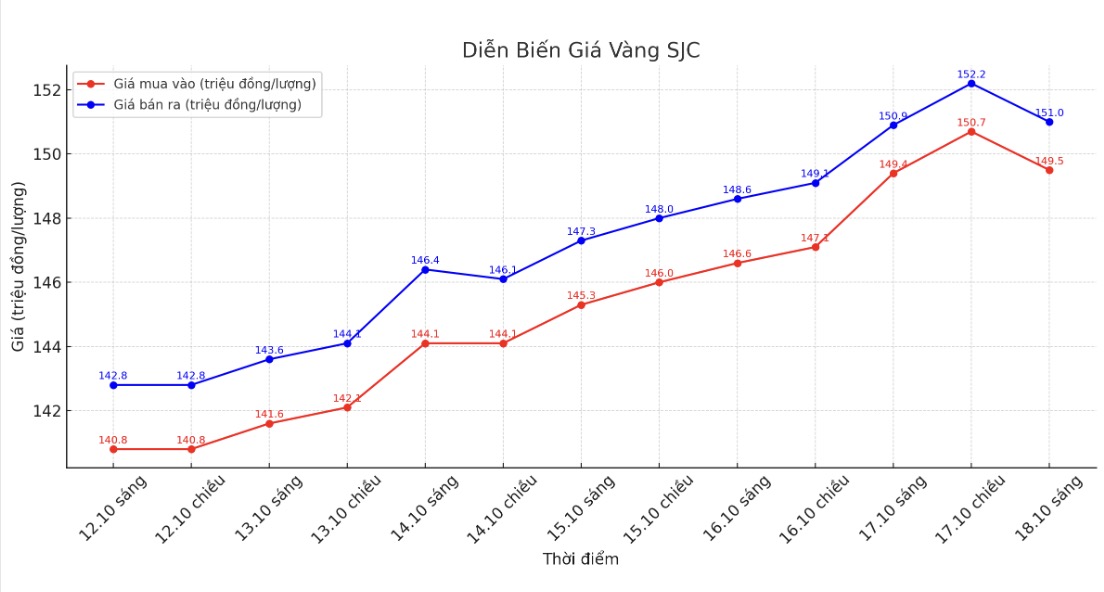

Updated SJC gold price

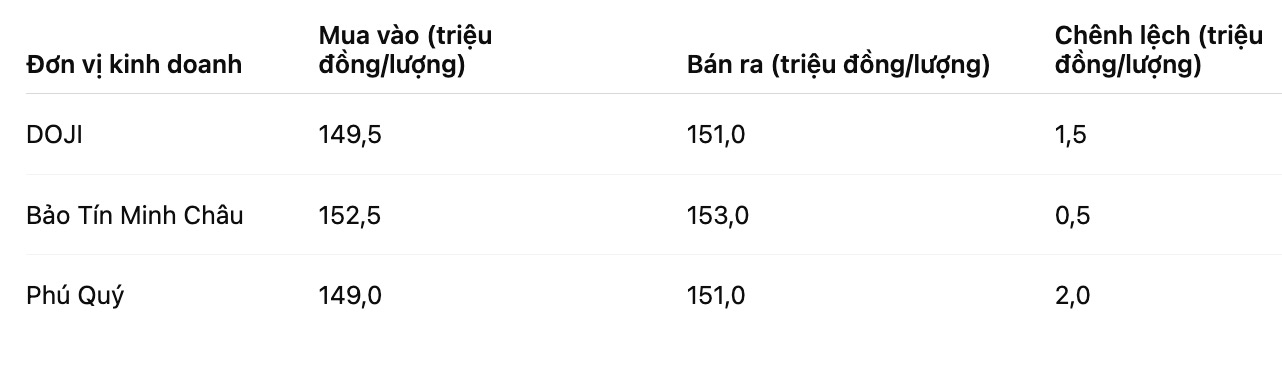

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 149.5-151 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.5-153 million VND/tael (buy - sell), an increase of 3.1 million VND/tael for buying and an increase of 2.1 million VND/tael for selling. The difference between buying and selling prices is at 500,000 VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 149-151 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

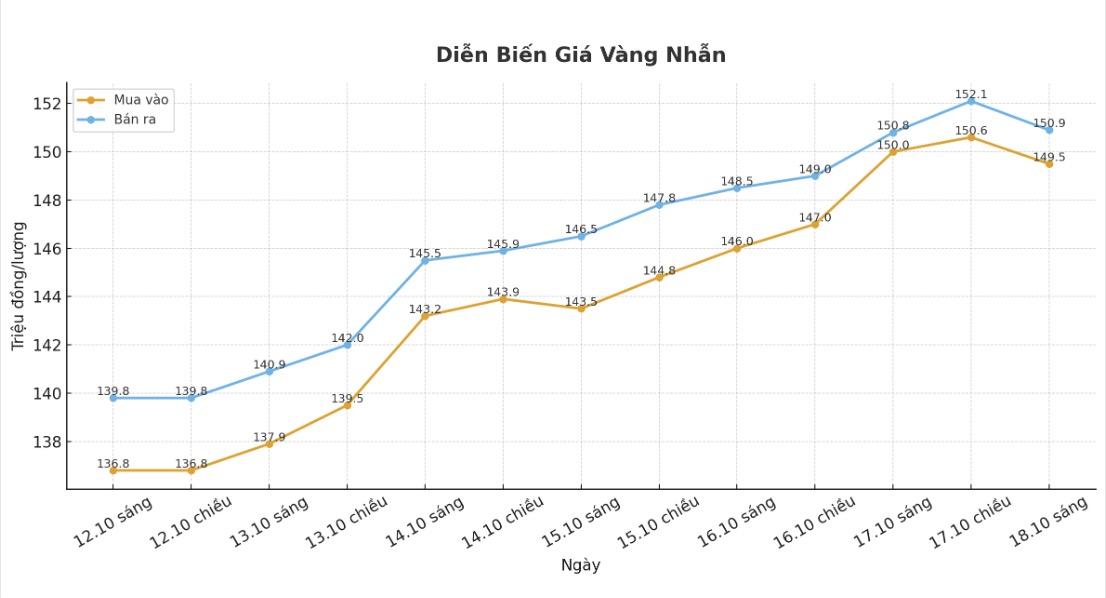

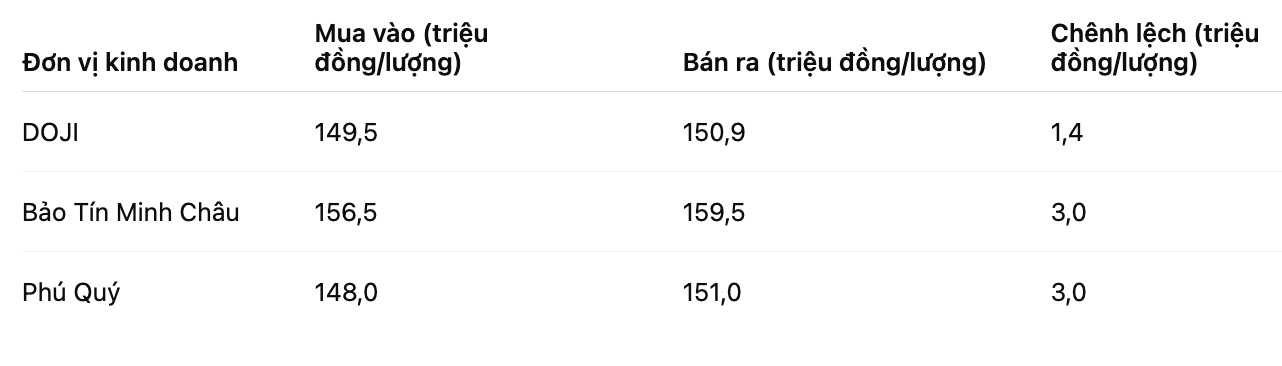

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 149.5-150.9 million VND/tael (buy - sell), down 500,000 VND/tael for buying and up 100,000 VND/tael for selling. The difference between buying and selling is 1.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 156.5-159.5 million VND/tael (buy - sell), an increase of 2.9 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 148-151 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is showing signs of decreasing, but is still basically too high. increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

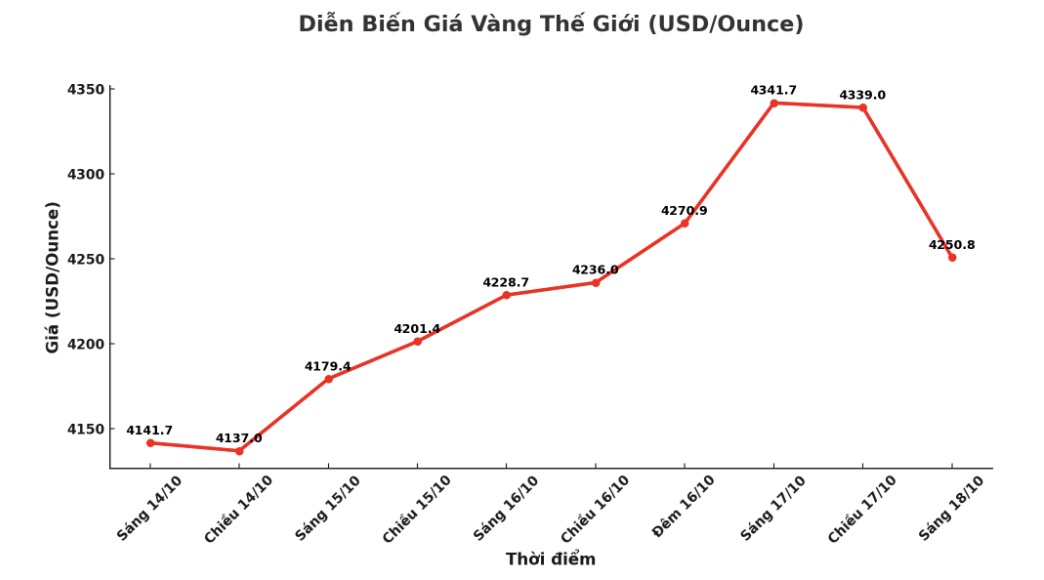

World gold price

At 9:07 a.m., the world gold price was listed around 4,250.8 USD/ounce, down 90.9 USD.

Gold price forecast

Gold prices fell sharply after hitting a record high of over $4,300/ounce, due to the rising USD and US President Donald Trump's comments that imposing a "comprehensive" tax on China is not feasible.

This past week, market risk concerns have increased, further strengthening safe-haven demand for gold. Meanwhile, the global stock market fell overnight. US stock indexes are expected to open sharply down when the trading session in New York begins.

Concerns about banks and credit have rocked the global financial market. Investors ended the trading week worried about the quality of loans at two US regional banks, raising doubts about credit risks in the economy and emphasizing the fragility of the US stock market's $28 trillion increase.

US bank stocks continued to plummet in overnight trading, after a strong sell-off on Thursday spread to both Asian and European markets.

Investors are concerned about not fully identifying the potential risks, although some experts believe that this sell-off is only short-term, and regional banks still have enough provisions for potential losses.

Technically, December gold futures are still having a strong near-term technical advantage. The next upside target for buyers is to close above the solid resistance level of 4,500 USD/ounce. On the contrary, the target for the sellers is to push the price below the strong support zone of 4,000 USD/ounce.

The most recent resistance level was a peak of 4,392 USD/ounce and then 4,400 USD/ounce; the most recent support was 4,291.3 USD/ounce and then 4,250 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...