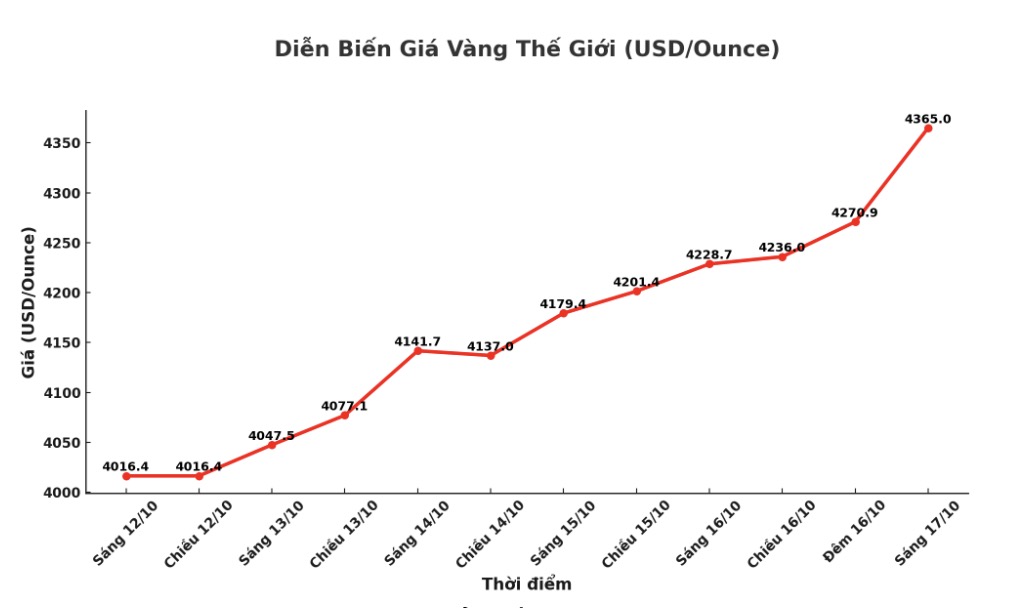

Recorded at 7:50 (Vietnam time), the world gold price was listed at 4,365 USD/ounce. Compared to early this morning, this precious metal recorded an increase of 169.4 USD.

World gold prices increased in the context of US stocks falling sharply in the session of October 17, when financial stocks fell sharply and trade tensions between the US and China escalated, causing investor sentiment to stagnate.

All three of Wall Street's key indicators turned down after increasing at the beginning of the session, in the context of cash flow looking for safe-haven assets, causing gold prices to set new records.

Financial stocks led the decline as Travelers announced disappointing business results, while Zions Bancorp said it would suffer a loss of 50 million USD in the third quarter, causing the S&P (.SPXBK financial index) to decrease by 2.75%.

In the context of a lack of macroeconomic data, results from banks are becoming an alternative source of information, said Mr. Chu Chu Chu Carlson, CEO of Horizon Investment Services ( indiana). Some credit-sensitive banks and financial institutions are falling sharply, which could be a sign of deteriorating credit quality.

In addition, the weakening USD is supporting the precious metal. Mr. Carlson added: The USD is quite weak today, and cryptocurrency is also plummeting. This is a clear "risk-off" day.

In addition, signals from the US labor market are reinforcing expectations that the US Federal Reserve (FED) will continue to cut interest rates, this information is beneficial for gold. Fed Governor Christopher Waller said: Based on all the available data, I think the Fed should cut another 25 basis points at its monetary policy meeting on October 29.

Despite record high gold prices, according to Marcella Chow - Market Strategist at JP Morgan Asset Management, the current supply-demand factors are still very favorable, showing that there is still room for price increase for this precious metal, but investors need to clearly understand why they hold gold.

In an interview with CNBC on Thursday, when asked if gold is still worth buying when the price has surpassed 4,200 USD/ounce, Ms. Chow firmly affirmed: " Yes".

She explained: "If we consider the supply-demand dynamics, we see that the basic factors from the demand side are very positive. The interest rate cutting cycle continues, the weaker USD is the medium- and long-term trend. In addition, continued demand from central banks and consumers in emerging markets, especially China and India. Therefore, on the demand side, fundamental factors are supporting gold prices.

According to Ms. Chow, limited supply is also a factor that helps gold prices continue to increase: "S supply is quite limited due to bottlenecks in mining. We do not see mining output increasing as rapidly as the supply of money or government debt. Therefore, in terms of supply correlation, demand and gold still have room to increase.

However, she warned that the gold market has some risks that investors need to pay attention to: Gold does not generate income, and in terms of volatility, it is higher than the bond market which should be in the portfolio to increase stability. Many investors consider gold a protective tool, but in fact, the negative correlation between gold and stocks is unclear.

We think adding gold to our portfolio is reasonable, mainly to diversify, as the fundamentals are still very positive, but we should not consider gold as a hedge against market fluctuations, Ms. Chow added.

Previously, on October 14, Jamie Dimon - CEO of JP Morgan - said that currently, accepting the "chance cost" of holding gold is reasonable, because this precious metal can easily double the value compared to the current peak.

Mr Dimon is not a gold supporter, so admitting that there is a reasonable reason to own gold despite a sharp increase in prices is a remarkable change of perspective.

Im not a gold buyer the cost of holding about 4%, he said at Fortunes Most Powerful Women conference in Washington on Tuesday. But in the current context, gold could well reach $5,000 or $10,000 an ounce. This is one of the rare times in my life where it makes sense to keep gold."

He also noted that property prices are generally at a high level, as value is increasing on almost all types of assets.

According to Mr. Sam Stovall - Investment Strategy Director of CFRA Research (New York), trade instability is one of the factors pushing gold prices to historical peaks.

"Due to trade tensions, many central banks around the world are actively buying gold. This trend is supported by low interest rates and a weak USD. This is not necessarily a reaction to recession concerns, but a reaction to political instability, he said.