Mike McGlone - a high -class commodity strategist at Bloomberg Intelligence said that gold price exceeded the $ 3,200/ounce mark may be a start for a stronger increase, even towards $ 4,000/ounce. Mike McGlone said that we are witnessing "the beginning of the price market in the US" and a comprehensive change in the way of operating cash flow.

"We are building a fairly solid base area around US $ 3,000. Gold price will reach 4,000 USD, just a matter of time. What happens in the middle is for speculators, which I used to be a part of it," McGlone said.

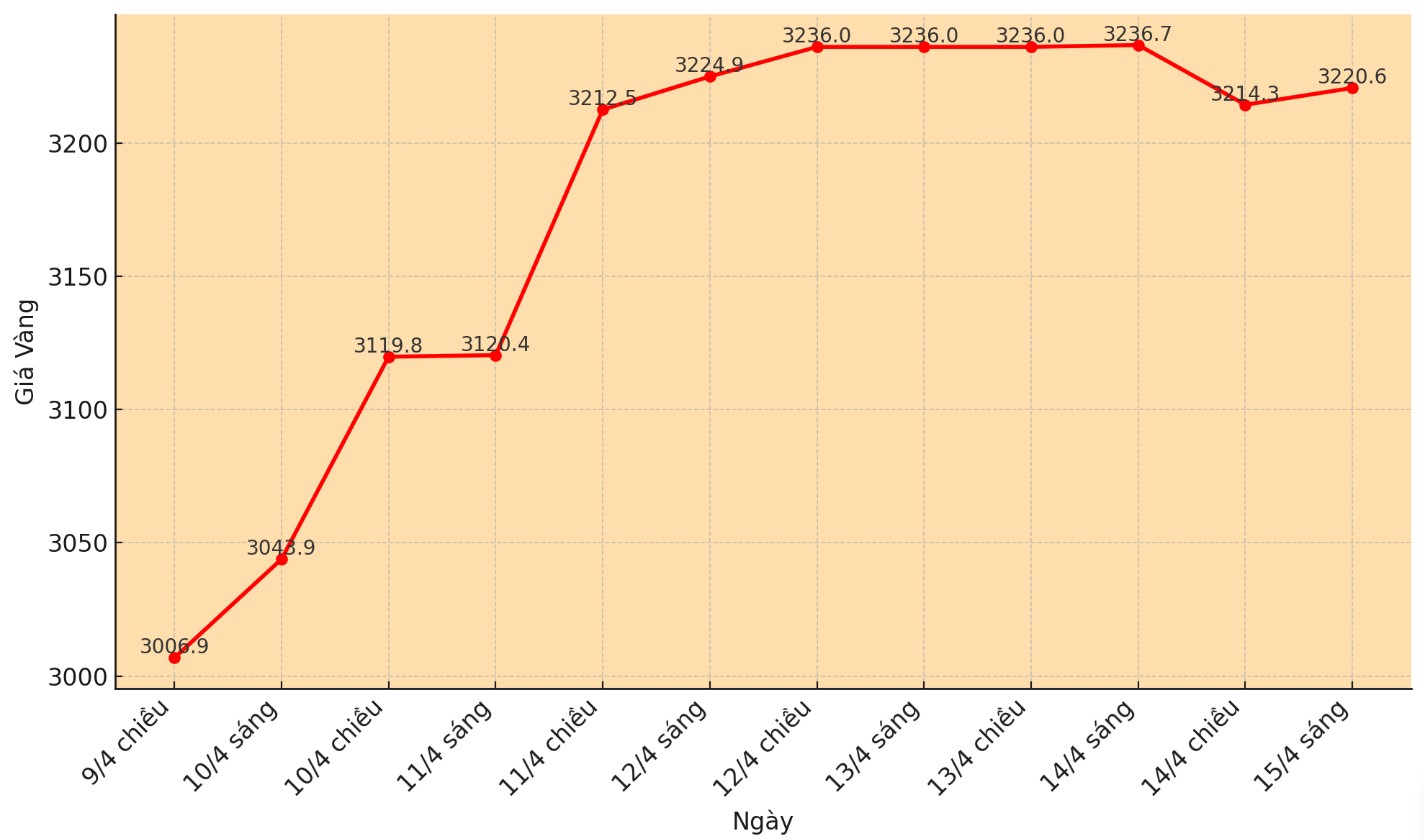

Since the beginning of the year, gold has increased by nearly 25%, supported by the demand from the central bank, the cash flow to the gold ETFs and macroeconomic instability. Goldman Sachs has just raised the forecast of gold at the end of the year to US $ 3,700 and said it could reach US $ 3,900 if the economy was in recession.

Theo McGlone, da tang cua vang phan anh su dich chuyen dong von khoi cac tai san dau co. "Gold is currently at the most expensive history compared to the long -term bond market. It is the result of over -increasing public debt and the trend of taxation causes inflation to increase" - he said

Trong khi do, Bitcoin va chung khoan My dang mat dan da. McGlone said the US stock market had lost $ 6,000 billion in market capitalization since the beginning of the year, equivalent to half of the increase in 2023. "Last year, the market was pumped by an additional $ 12,000 billion - the strongest increase ever. Now the majority of that money is being drawn."

Ve Bitcoin, ong cho rang tai san nay co the da dat dinh. "The gold/bitcoin ratio is currently around 26, but our model shows that it will continue to drop below the previous quarter of the fourth quarter. Bitcoin is still an extremely volatile speculative asset and may be starting to enter the downtrend."

Bloomberg Intelligence currently predicts that the S&P 500 can decrease to 4,000 points, equivalent to a decrease of nearly 25% if the US economy has decreased. McGlone noted: "The US stock market is currently unprecedented if compared to other countries and compared to the scale of the economy (GDP). Now there is a reason to adjust, and this process has just begun."

Expected inflation of American consumers is also deteriorating. Michigan's 1 -year inflation forecast has soared to 6.7% - the highest since 1981, while the US Federal Reserve (Fed) has not continued to raise interest rates. "We have created too many liquidity ... and the Fed reacted too slowly. They only started tightening from the first quarter of 2022, and then too strong again" - he said.

McGlone also warned that the "rich effect" is reversing: "The US market has evaporated US $ 6,000 billion this year - equivalent to 10% of GDP. Maybe this time will be different, but I don't think so."

He also pointed out the price of the US stock imbalance compared to GDP and the rest of the world. "Only two times in history that the stock market has doubled GDP: in 1929 in the US, 1989 in Japan. Now it was 2025, and we were in that milestone," McGlone said.

According to this expert, a global signal, especially from China and Germany, also began to appear. "China's 10 -year bond yield is only 1.66%, while the US is 4.4%. It is an abnormal point and will have to adjust. I think the US yield can decrease to 2%, just unknown, maybe right this year."

When asked where to pour capital if the stock and bonds are no longer attractive, McGlone answered definitely: "People are withdrawing from US stocks and switching to gold.

Regarding the stocks of gold mining companies - which are lagging behind gold prices, McGlone admits many investors feel disappointed, but he thinks that it will have the potential if gold continues to increase. "Gold is still the main motivation of the noble metal group. If the S&P 500 collapses, it is possible that the story will turn to bonds. But now it is not."

He thought that this could be a generation "re -established". "We are entering a new stage, with policies to tighten spending and increase taxes. This happens just when many assets are pushed up too high.