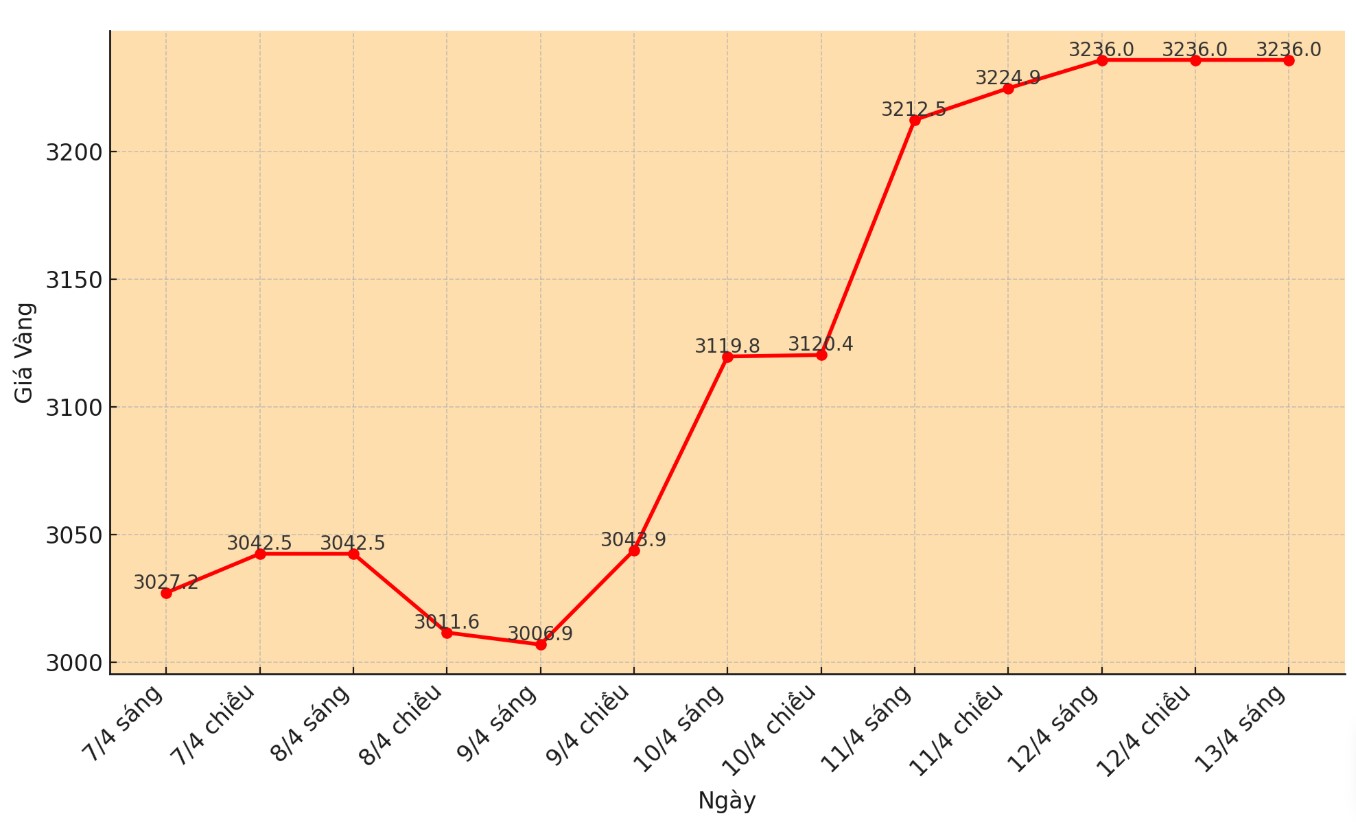

Currently, gold not only transacted 3,200 USD/ounce, but also increased by 6% compared to last Friday - the strongest week of week since March 2020. Gold price delivered to close the weekly trading session is at 3,236 USD/ounce.

Although gold price is soaring, experts say that it is difficult to predict the price that gold will pause and stabilize, because the dollar is decreasing while the bond yield increases.

David Morrison - a senior analyst at Trade Nation - said: “Normally, gold will need to accumulate at a new high price before more buying force. But at this time, investors are desperate to find a safe shelter, especially after the US Treasury bond - which is considered a traditional defensive asset become less safe.

Gold continues to attract cash flow amid weak USD and consecutive tariff news.

The USD index has fallen to 99 - the lowest in 3 years. Although the week can return to the 100th landmark, many experts believe that the damage has occurred.

Jonas Goltermann - an economist at Capital Economics - said: "The US dollar position is a global reserve currency that is suspected.

In addition to the weak USD, the 10 -year -old US bond yields also suddenly increased sharply, reaching 4.5% - the largest increase in the week. In theory, the increase in yields is disadvantage with gold (because gold does not produce interest), but this time the opposite. Investors sell off bonds.

Jesse Colombo - an independent analyst - said that gold still increased sharply because the USD has been highly valued for many years. "The yield of bonds increases now is beneficial for gold because it reflects the bond is no longer considered a safe asset. That is forced the US Federal Reserve (Fed) to stop the currency soon and return to the money pump - this is like 'rocket fuel' for gold and goods prices."

Sameer Samana - Head of Property Strategy at Wells Fargo - said: "The risk of recession is increasing as consumers are forced to burden the additional cost due to taxes.

Experts at TD Securities said: "The attractiveness of USD and US bonds is gradually disappearing when the US economy is no longer superior to the world. The US stock is weaker than the global common ground. We predict will continue to weaken in 2025."

In this context, many people think that gold price may rise even higher.

Lukman Otunuga, an analyst at FXMT, said: "The weak dollar, global growth decline and the expectation that the US interest rate will be a lever for gold price. Technically, gold is in a significant trend. When closing weeks over US $ 3,200/ounce, the price may be directed to 3,250 USD/ounce or even US $ 3,300/ounce."

Alex Kupsikevich - an expert at FXPro is even more optimistic: "This week's evolution shows that gold is in a separate trajectory. The price of gold closed at a record level opens the possibility of exceeding US $ 3,500/ounce.

The market will continue to follow every statement from the White House as well as the new developments of the trade war. Meanwhile, economic data only plays a secondary role in current price fluctuations.

In the near future, Fed President Jerome Powell will speak at the Chicago Economic Club on Wednesday, this will be the focus of monitoring.

In addition, the Canadian central bank will meet the policy in the middle of the week, which is expected to keep the interest rate. The European Central Bank (ECB) meets on Thursday and may continue to cut interest rates to support growth.