Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND100.10.6 million/tael (buy - sell); an increase of VND900,000/tael for buying and an increase of VND1.7 million/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 100.6-103.6 million VND/tael (buy - sell); an increase of 900,000 VND/tael for buying and an increase of 1.7 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 100.6-103.6 million VND/tael (buy - sell); an increase of 800,000 VND/tael for buying and an increase of 1.7 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

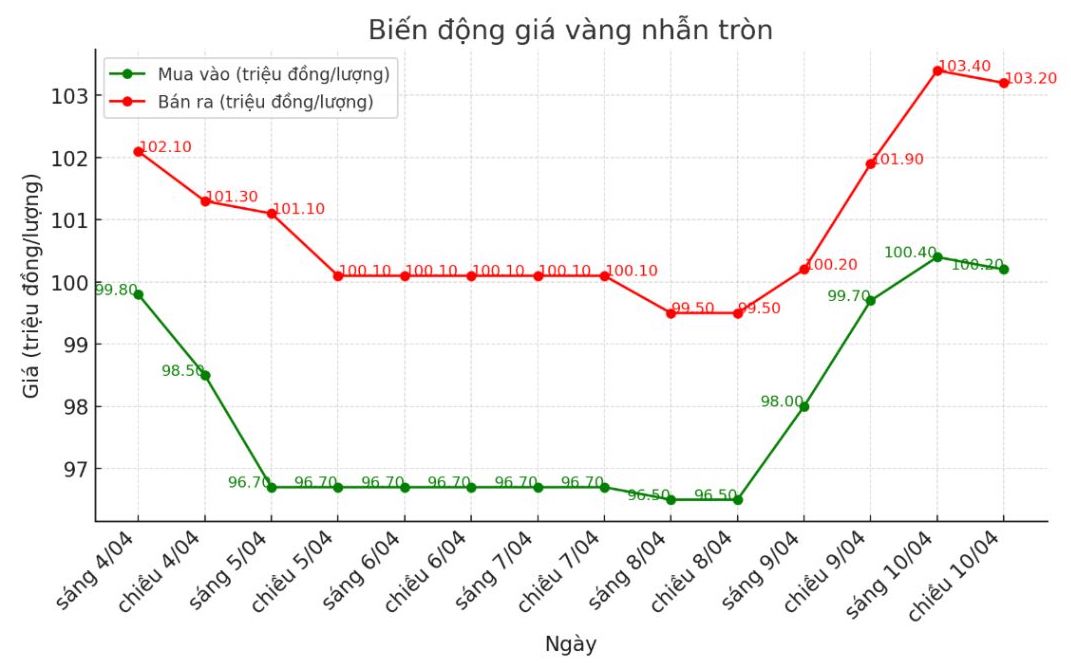

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 100.2-103.2 million VND/tael (buy - sell); an increase of 500,000 VND/tael for buying and an increase of 1.3 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 100.7-103.7 million VND/tael (buy - sell); an increase of 800,000 VND/tael for buying and an increase of 1.7 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

As world gold prices fluctuate strongly, the gap between domestic and domestic prices is widening, showing very clear risks. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

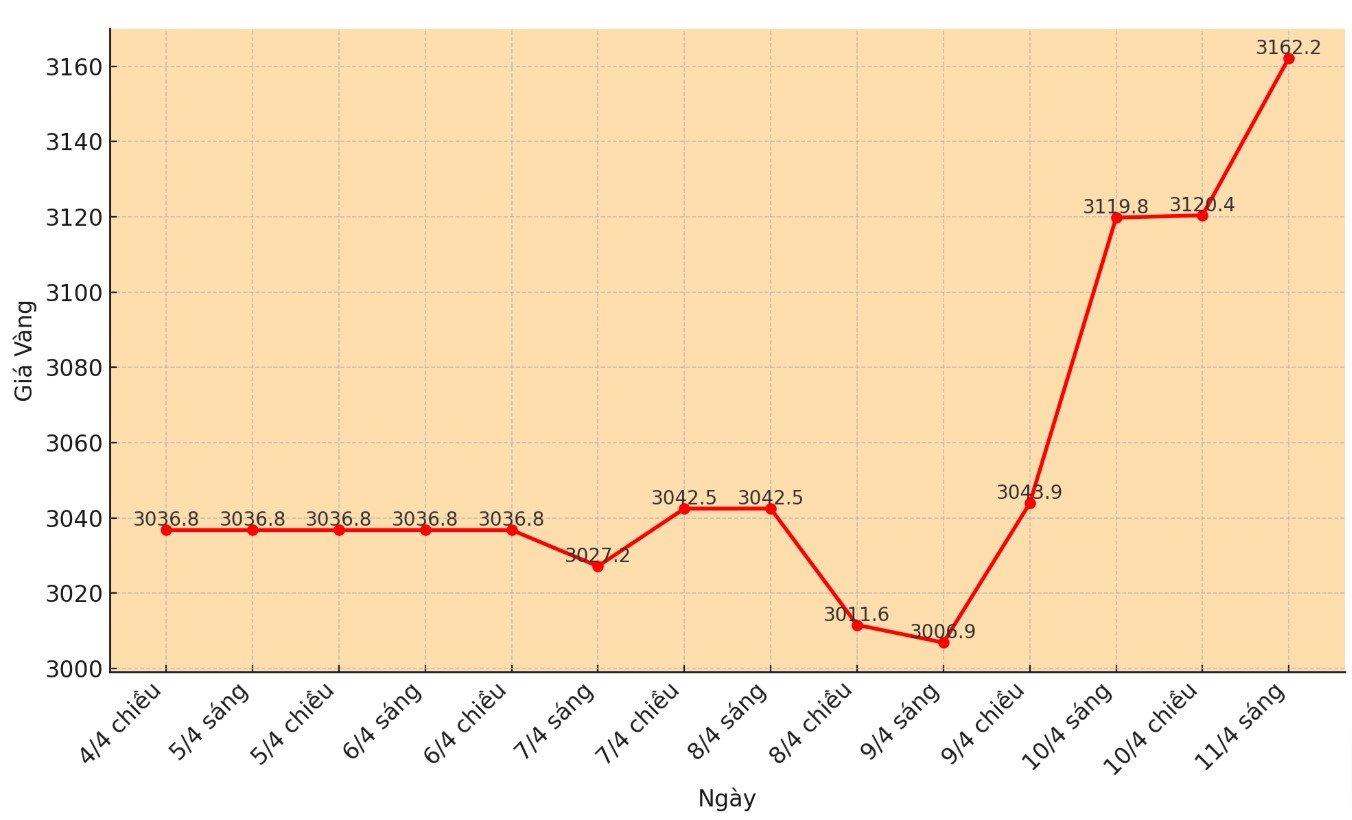

World gold price

As of 0:15 on April 11, the world gold price was listed at 3,162.2 USD/ounce, up more than 112 USD compared to early this morning.

Gold price forecast

According to Kitco, gold prices are rising sharply due to strong safe-haven demand. The US stock market is fluctuating, concerns about the US-China trade war, as well as the US inflation report cooling down, are prompting precious metals traders this weekend.

There are also concerns about the stability of the US bond market. Gold prices in June increased by 100.6 USD, to 3,180.5 USD/ounce. silver prices in May increased by 0.37 USD, to 30.775 USD/ounce.

The US consumer price index (CPI) in March recorded a 2.4% increase over the same period last year, lower than the forecast of 2.6% and an increase of 2.8% in the February report.

The "basic" CPI, which excludes food and energy, rose 2.8%, also below the forecast of 3.0% and 3.1% in February. This data reinforces experts' views on loose monetary policy, boosting expectations of early rate cuts.

The US stock index fell sharply in mid-April 10 after increasing sharply on Wednesday. The S&P 500 rose 9.5% on Wednesday, recording its strongest increase since October 2008.

The midday news of the US reducing most of the tariffs, but increasing them for China, boosted the US stock market.

However, China is the world's second largest economy and US-China trade tensions could still have serious consequences for the global economy in the coming months.

This view is clearly spreading to stock traders. If there were any doubts before, the real target of President Donald Trumps tariffs is now clear, said David Morrison of Trade Nation. The Trump administration does not consider China a friendly trade partner."

Some believe that President Trump has made a concession in the global trade war because the US bond market has become unstable. A title from Barron's today reads: "Trump cannot defeat the bond market".

The US bond market has stabilized somewhat but does not seem to have completely overcome the difficulties, due to only a slight price recovery (interest rate cut) after Mr. Trump's announcement of trade tariffs in the middle of Wednesday. Barron's said bond risks are still "potential."

Key outside markets today saw the USD index fall sharply and hit a 6.5-month low. Nymex crude oil prices fell sharply, trading around 5:99.25 USD/barrel. The yield on the benchmark 10-year US government bond is currently at 4.368%.

See more news related to gold prices HERE...