According to Axel Rudolph - market analyst at IG Markets, the world gold price will break the threshold of 2,900 USD/ounce by the end of this year. This expert commented that the gold price will trade between 3,000 and 3,113 USD/ounce in the first quarter of 2025.

In a recent analysis, Rudolph noted that gold has been on a strong rally over the past two years, with last week's record price of $2,790 an ounce just shy of the key $2,800 an ounce level.

“Even if there is a significant pullback, gold prices will remain in a long-term uptrend. Any potential pullback would be a buying opportunity, provided gold does not lose its late April low of $2,278 an ounce,” Rudolph said.

“Support can be seen on the weekly chart around the September high of $2,685/oz and the early October low of $2,605/oz,” he added.

Rudolph said that in addition to the psychological level of $2,800 - $2,900 / ounce, it is expected to be reached by the end of 2024. He believes that the level of $3,000 / ounce will appear in the early months of next year.

Rudolph believes that gold prices will likely trade around $3,000/ounce for several months as gold will act as a strong magnet for investors:

“Physical gold purchases by some central banks, especially China, are likely to continue until this threshold is met.

If these bullion purchases continue, pushing gold prices above the technical level of $3,000/ounce, the precious metal could also reach $3,113/ounce.”

He added that if gold breaks above these technical levels in 2025, “the next psychological level of $4,000/oz could also be seen as a viable upside target.”

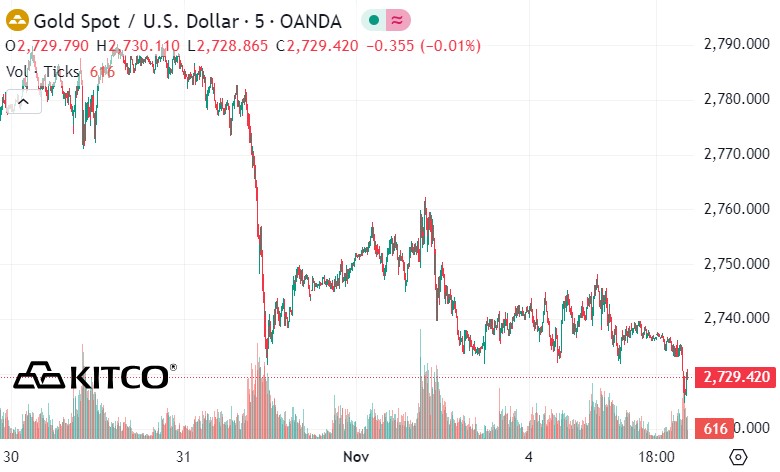

Rudolph said the sudden drop to $2,731.64 an ounce after last week's record high of $2,790.17 an ounce "is a buying opportunity for investors ahead of the US election".

“As long as the October 23 low of $2,731.60/ounce holds, the medium-term uptrend will remain intact.

After falling below $2,732 an ounce, spot gold is seeing moderate buying momentum on Monday morning (November 4). However, global gold prices are still moving sideways as investors are more cautious as they await news from the US presidential election.

Kitco senior analyst Jim Wyckoff said that this week also includes the Federal Reserve's FOMC meeting. The meeting begins on Tuesday morning and ends on Wednesday afternoon with the FOMC statement and a press conference from Fed Chairman Jerome Powell.

Most people believe that the Fed will cut its key interest rate by 0.25%, especially after the weaker US jobs report released last Friday.

Major overseas markets saw Nymex crude futures rise sharply and trade around $71.50 a barrel. The Organization of the Petroleum Exporting Countries (OPEC) extended its production cuts. The yield on the 10-year US Treasury note reached 4.307%.

See more news related to gold prices HERE...