Update SJC gold price

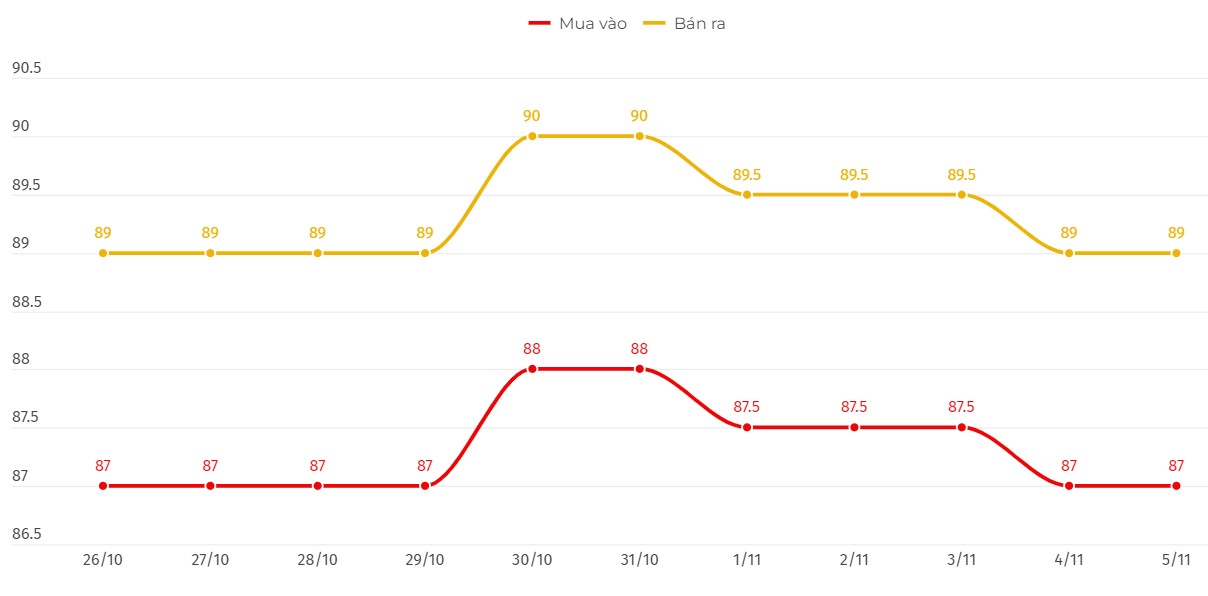

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 87-89 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 87-89 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 87-89 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at Bao Tin Minh Chau remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

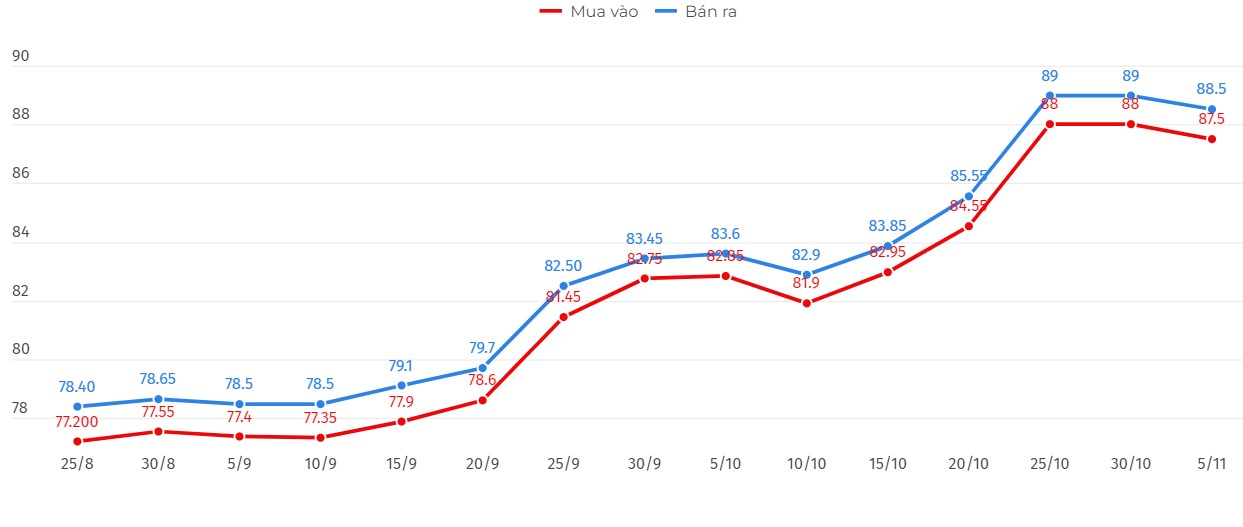

Price of round gold ring 9999

As of 9am today, the price of 9999 Hung Thinh Vuong round gold ring at DOJI is listed at 87.5-88.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions.

Bao Tin Minh Chau listed the price of gold rings at 87.48-88.48 million VND/tael (buy - sell); down 300,000 VND/tael in both directions.

World gold price

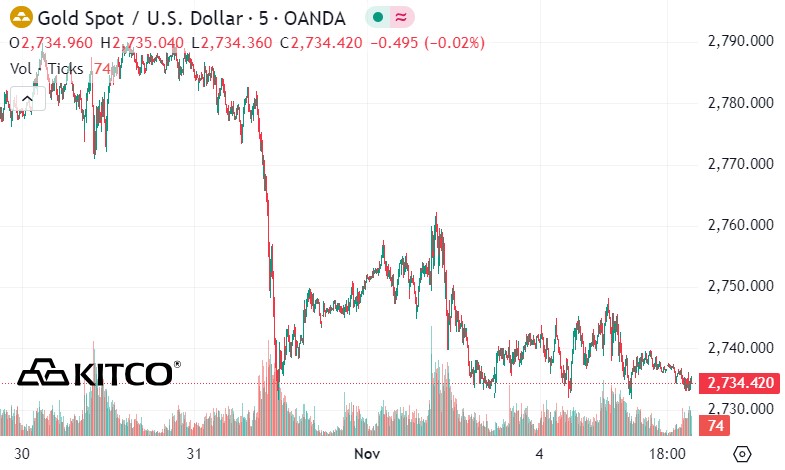

As of 9:15 a.m., the world gold price listed on Kitco was at 2,734.4 USD/ounce, down 4.8 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell as the USD index held high. Recorded at 9:15 a.m. on November 5, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 103.799 points.

Investors are expressing caution ahead of the US presidential election and the upcoming decision by the US Federal Reserve (FED) on interest rates.

Today (November 5), the US presidential election will take place. Polls show that Democratic candidate Kamala Harris and Republican candidate Donald Trump are neck and neck in the race for the White House.

“The driver for gold this week will be the US presidential election,” said UBS analyst Giovanni Staunovo. “A Trump victory would see gold move closer to its target of $2,900 an ounce. Gold could fall if Kamala Harris wins.”

Meanwhile, the Fed's interest rate decision is unlikely to create much volatility, as the bank may signal further cuts in line with market expectations."

Bart Melek, head of commodity strategy at TD Securities, agrees that if Trump wins, gold prices will rise. According to this expert, with what Trump is saying, inflation concerns will increase.

In a recent interview with Kitco News, Michele Schneider – Chief Strategist at Marketgauge – said that the market is forming a technical bullish trend.

If resistance is broken, gold could easily return to $2,800 an ounce, she said: "A solid close above $2,760 an ounce would take gold back to $2,800 an ounce. Then gold could head towards $3,000 an ounce."

Economic data to watch in the coming time

Thursday: Bank of England monetary policy decision, US weekly jobless claims, Fed monetary policy decision.

Friday: University of Michigan Consumer Psychology Preliminary.

See more news related to gold prices HERE...