In a recent interview with Kitco News, Michele Schneider, chief market strategist at Marketgauge, said that the market is forming a technical bull run. She said that if resistance is broken, gold could easily return to $2,800 an ounce:

"A solid close above $2,760 an ounce would take gold back to $2,800 an ounce. Gold would then head toward $3,000 an ounce," Schneider said, adding that sustained high inflation would support gold. Geopolitical uncertainty and rising production risks due to climate change would also weigh on gold.

“Even a small disruption in the global food supply chain could push food prices and inflation higher by 2025.

Uncertainty about the health of the global economy and inflation are just two factors supporting gold. The precious metal is holding up well even as the dollar remains relatively strong and U.S. bond yields hover near three-month highs above 4.2%.

If yields are rising because the economy is doing so well, why is gold still being bought? Would you believe in US Treasuries or gold? Personally, I would believe in gold. If commodities like sugar continue to rise, we are not out of inflation. I think we are just seeing a short-term pause in inflation before it rises again," the expert said.

The growing debt problem in the US is one reason Schneider sees “gold as a better reflection of the health of the economy than Treasury bonds.” She noted that major investors such as Stanley Druckenmiller and Paul Tudor Jones have recently expressed bearish views on bonds, which should support higher yields.

Schneider said consumer demand will be the main factor determining the direction of the U.S. economy. On the other hand, Schneider said that while the recession initially had a negative impact on gold, weak growth could prompt the U.S. Federal Reserve to cut interest rates aggressively, even if inflation remains high.

“This will be an ideal environment for gold,” she said.

As uncertainty continues to dominate the market, Schneider said she feels comfortable holding 15% to 20% of her portfolio in gold. She added that she also holds some silver because the precious metal still has significant value.

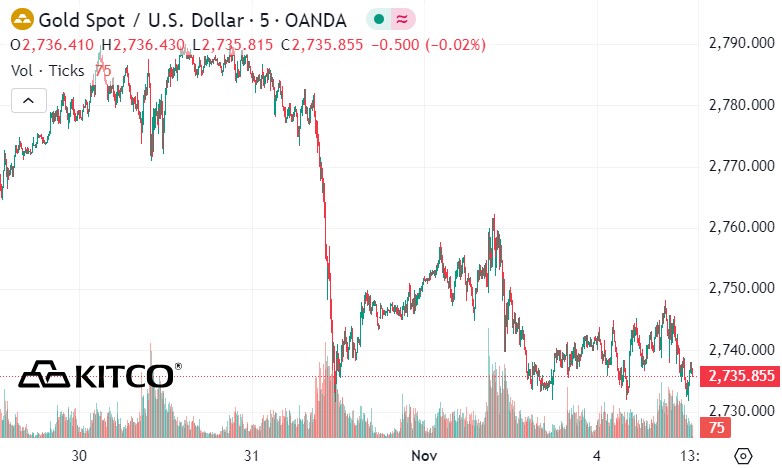

Experts and investors are waiting for the purchasing managers index (PMI) of the US Institute for Supply Management (ISM) and the results of the US election taking place today, November 5, to have more comments on the direction of gold prices.

On Thursday and Friday this week, some of the information that affects gold prices will be released, including the Bank of England's monetary policy decision, the US weekly jobless claims number, the US Federal Reserve's monetary policy decision and the University of Michigan's preliminary consumer sentiment.

Rich Checkan, president of Asset Strategies International, said he still sees gold prices rising this week. There are many variables that could trigger price movements in either direction, he said. Disappointing jobs data could be enough to prompt the Fed to cut another 25 basis points. Lower interest rates are good for gold.

See more news related to gold prices HERE...