Adrian Day, chairman of Adrian Day Asset Management, said gold prices will rise this week: “The resilience of gold has been incredible. All sorts of reasons for different groups to buy. Lower interest rates in a sluggish economy and unchecked inflation are a combination that is driving gold prices up.”

Rich Checkan, president of Asset Strategies International, said gold prices will continue to rise this week. According to him, there are many variables that can trigger price fluctuations in either direction. Disappointing employment data could be enough to push the US Federal Reserve (FED) to cut another 25 basis points. Lower interest rates are good for gold.

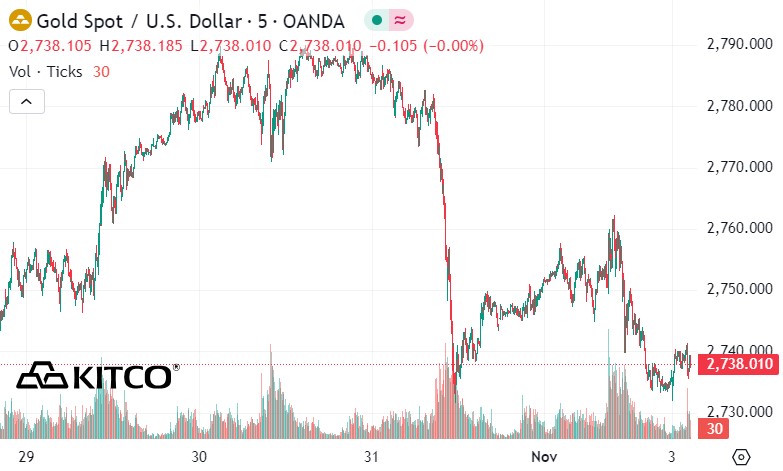

Rich Checkan believes that the profit-taking in recent days has been enough to push gold prices up to nearly $2,800 an ounce. In the long term, there is no doubt that gold prices will go higher.

James Stanley, senior market strategist at Forex.com, sees gold making fresh gains this week. “There have been a lot of potential downside moves over the past few months,” he said. “But now, there’s a lot of buying on the dip.”

“I am neutral on gold next week,” said Colin Cieszynski, chief market strategist at SIA Wealth Management. “It’s a little harder to predict the near-term direction with all the event risks in the coming days (Middle East geopolitical tensions, US elections, Fed rate hikes).

Gold appears to be starting a normal consolidation process, but the underlying long-term uptrend remains intact for now.”

Darin Newsom, senior market analyst at Barchart.com, sees gold prices falling this week:

“Gold prices could be volatile on Tuesday due to the US presidential election, followed by the Federal Open Market Committee (FOMC) meeting on Wednesday and Thursday.

The next announcement on interest rates will be made at the end of the meeting, many opinions say that the FED will have another 25 basis point cut" - this expert said.

Marc Chandler, managing director at Bannockburn Global Forex, said he was bearish: “Gold hit a record high last week but has stalled below $2,800 an ounce. It is worth noting that gold sold off sharply as US stocks fell on October 31.”

He noted that five G10 central banks are meeting this week: “The Fed and BOE are expected to cut by 25 basis points. Sweden will cut by 50 basis points; Norway and Australia will keep it the same.”

"After that, the US election will have a strong impact on gold prices," the expert added.

Adam Button, head of currency strategy at Forexlive.com, says the smart move for gold traders this week is to stay on the sidelines.

“It’s not wise to bet on gold so close to the US election. There will be a lot of trading after the dust settles. I see gold going down,” said Michael Moor, founder of Moor Analytics.

See more news related to gold prices HERE...