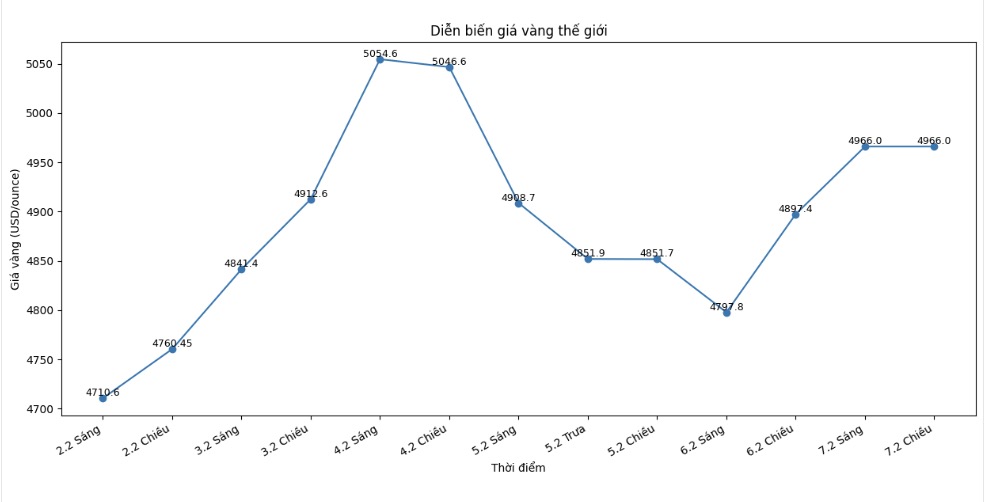

Mr. Aaron Hill - chief market analyst at FP Markets - said that when volatility subsides, gold prices may fluctuate in the range of 4,700 - 5,000 USD/ounce.

In the short term, the risk of a slight decrease in price is slightly higher because much positive information has been reflected in the price after the strong increase last week. For gold to return to a clear upward trend, perhaps a new boost is needed such as weaker economic data, clearer interest rate cut signals, or increased geopolitical tensions," he said.

Meanwhile, Mr. Nick Cawley - market analyst at Solomon Global, said that the current volatility is only "noise" in the short term.

I expect the 5,000 USD mark to be soon conquered again in the next few weeks, and the price may retest the decade-long peak around 5,600 USD in Q2/2026. "Removing" waves are necessary after strong gains, and technical prospects are still positive.

Supporting factors are still there. Although the USD is currently quite solid, in the coming months, interest rate cuts will weaken the greenback, or at least block further gains" - Mr. Nick Cawley said.

Ms. Rania Gule - senior market analyst at XS. com, said that the volatility of gold and silver reflects the deep level of uncertainty of investors, stemming from concerns about inflation and recession, changing expectations about monetary policy, as well as escalating geopolitical risks.

According to her, although gold prices may still remain below the 5,000 USD/ounce mark in the short term, there is still a roadmap to reach 6,000 USD/ounce by the end of the year.

The market has not exhausted its upward momentum. However, investors have become more selective and cautious, making the next waves of increase more likely to be less impulsive, interspersed with adjustment phases and more fundamental, instead of just relying on momentum or speculation.

The precious metals market is currently in a repositioning phase, not reversing the trend. The current accumulation reflects a cautious sentiment after a sharp increase, and also affirms that the price base of gold and silver is still solid," she analyzed.

Notable economic calendar for next week

Elections in Japan.

US Retail Sales.

US non-farm payroll.

US Weekly Unemployment Benefit Application; Current House Sales in the US.

US Consumer Price Index (CPI).