In its latest report, JP Morgan (popular name of JPMorgan Chase & Co., one of the world's largest financial and banking groups, headquartered in the US) said that central banks' gold buying demand along with investors' cash flow will continue to be the main driving force pushing up the price of this precious metal.

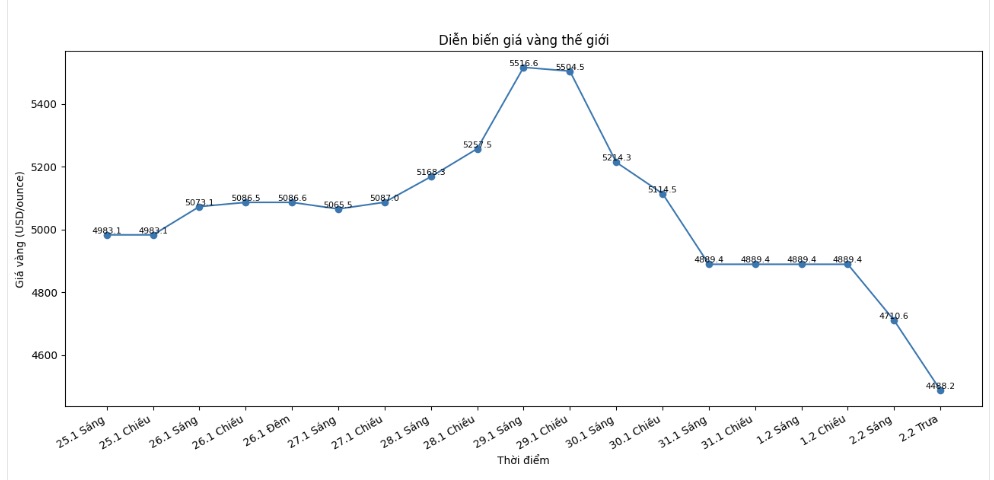

However, gold prices extended their decline in the trading session on Monday, falling to 4,488.2 USD/ounce at 1:25 PM on February 2nd (Vietnam time). Previously, gold lost more than 5% at one point and fell to its lowest level in more than two weeks. Gold once set a historical peak at 5,594.82 USD/ounce on Thursday last week.

We remain strongly optimistic about gold in the medium term, based on a structurally, clear and ongoing diversification trend, in the context that real assets continue to outperform paper assets," JP Morgan stated in the report.

The bank currently forecasts that central banks' gold purchases could reach about 800 tons by 2026, saying that the trend of diversifying reserves is still ongoing and shows no signs of ending.

Meanwhile, for silver, JP Morgan is more cautious, saying that the factors driving the price increase in recent times are increasingly difficult to identify and difficult to measure. Silver prices have been maintained around 73.85 USD/ounce since the end of December.

Last week, this metal once hit a record high of 121.64 USD/ounce on Thursday, then quickly retreated to a nearly a month low on Friday.

JP Morgan also noted that, unlike gold, silver does not have structural support from central banks as a buying force when prices fall. Therefore, the market still faces the risk that the gold-to-silver ratio may increase again in the coming weeks.

However, JP Morgan believes that silver prices are unlikely to completely lose what they have achieved. The bank assesses that the new price level of silver is currently higher than previously predicted, around 75–80 USD/ounce, and believes that although it has increased sharply in the process of "catching up" with the upward momentum of gold, silver is likely to still maintain most of the gains achieved.

See more news related to gold prices HERE...