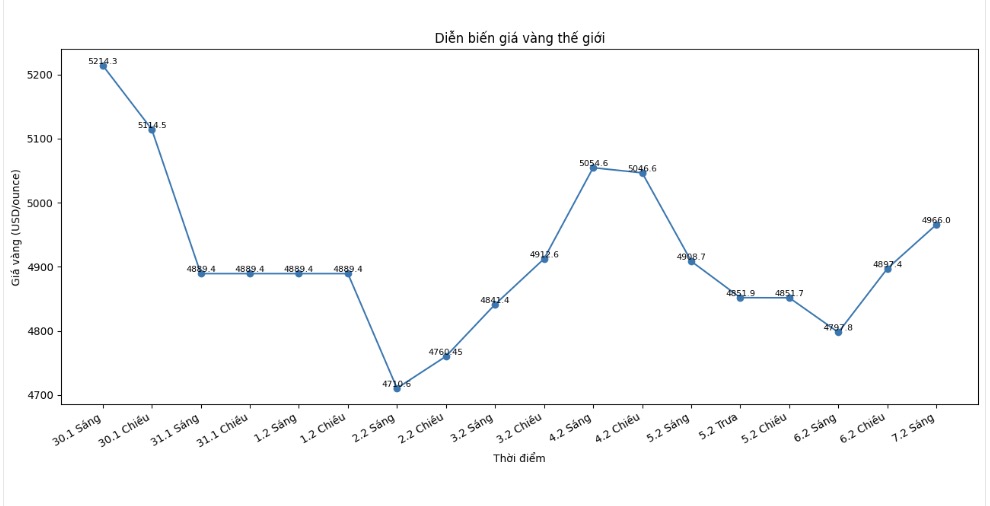

World gold price movements last week

After "suffering" from previous week's plunge, gold prices entered this week with a more stable state, trading in the true nature of a "mature" precious metal. By the closing session at the end of the week, gold even showed signs of being ready for a long-term stable life - like "building a family and borrowing to buy a house".

Gold prices started the week at 4,737.79 USD/ounce, but immediately afterwards opened sharply down, causing market momentum to lean towards price decreases. After a rapid increase to 4,844 USD at around 7 pm, gold prices turned around and fell deeply, down to around 4,640 USD just one hour later. The inability to regain the 4,700 USD mark caused prices to break the short-term support zone, falling straight to the week's bottom around 4,450 USD/ounce at around 1:30 am on Monday.

However, as usual, the sharp drop was quickly followed by a recovery with a similar speed. Spot gold prices surged to near the 4,800 USD mark at around 7:45 am (Eastern US time).

Throughout the North American session, gold maintained around the 4,600 USD zone, consolidating this as a solid support zone, thereby creating a premise for another strong increase when the Asian market opens. Accordingly, gold prices surpassed 4,850 USD at around 8:15 PM, then continued to climb to 4,935 USD at around 3:30 AM.

It was the turn of North American traders to contribute to forming the highest trading area of the week, when gold prices held firm above the 4,900 USD/ounce mark throughout the day. After that, buying pressure from Asia pushed gold prices up to nearly 5,100 USD/ounce in the night trading session.

However, this price is considered too high for the North American market. Spot gold price decreased from 5,054 USD/ounce at 8:45 am to double the support zone of 4,900 USD/ounce right before 1:00 pm. This development encouraged investors to try again the effort to conquer the 5,000 USD/ounce mark at the end of the session, but the two-pick pattern around 5,020 USD/ounce right after 7:30 pm on Wednesday pulled gold prices down sharply to 4,800 USD/ounce at around 10 pm.

After that, the trading range continued to narrow. Selling pressure lasted until the end of the North American session, causing gold prices to fall to the lowest level at the end of the week at 4,682 USD/ounce at around 7 pm. However, gold quickly regained the support level of 4,800 USD/ounce.

Friday's trading session witnessed gold moving in line with its familiar "personality" - an upward trend but not explosive as this precious metal increased steadily and ended the week just below the 5,000 USD/ounce mark by about 35 USD/ounce.

Gold price forecast for next week

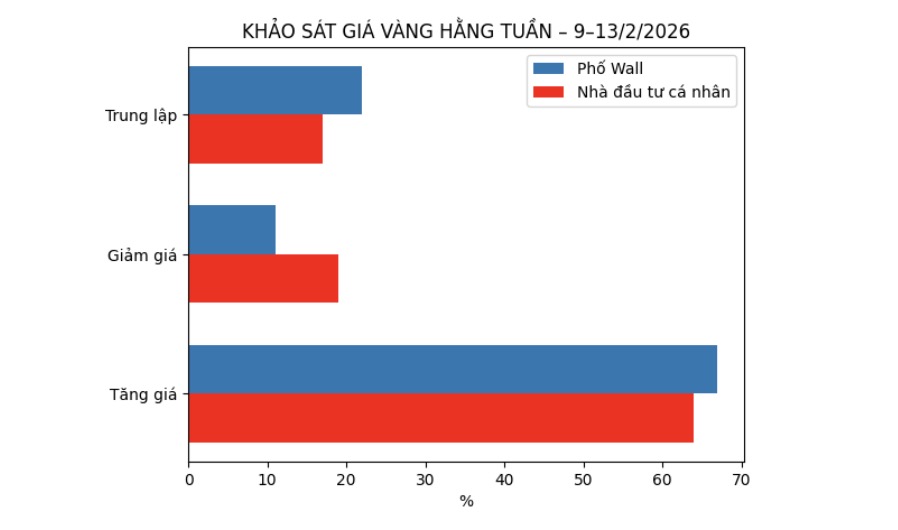

The latest weekly gold survey with Wall Street experts shows that most analysts have regained confidence in the short-term strength of gold prices. While individual investors still maintain a majority of optimistic views, although their sentiment is still affected by losses in the previous week.

This week, 18 experts participated in Kitco News' Gold Survey. The results showed that Wall Street clearly leaned towards a positive scenario after gold prices recovered strongly.

12 experts, equivalent to 67%, predict that gold prices will return above the 5,000 USD/ounce mark next week. Only 2 people, accounting for 11%, believe that gold prices will fall. The remaining 4 analysts, equivalent to 22%, assess the risk of increasing - decreasing at a fairly balanced level in the short term.

Meanwhile, Kitco's online poll attracted 329 votes. Of which, 210 small investors, accounting for 64%, expect gold prices to continue to increase next week.

62 people, equivalent to 19%, predict gold prices will decrease, while the remaining 57 investors (17%) believe that gold prices will remain flat in the upcoming trading week.

Economic data to be tracked next week

Although next week is not the peak period for economic data release, there is still some important information enough to create strong fluctuations for the market.

This Sunday evening, Japan will hold a new government election. The results of this election could significantly affect the Yen, thereby spreading influence on the global currency market as well as the government bond market.

Next, on Tuesday morning, the US market will receive US retail sales data for December. The postponed Nonfarm Payrolls report will be released on Wednesday, followed by the weekly unemployment claims and existing US housing sales in January, expected to be released on Thursday.

The trading week closed with the US releasing the consumer price index (CPI) for January on Friday morning.

See more news related to gold prices HERE...