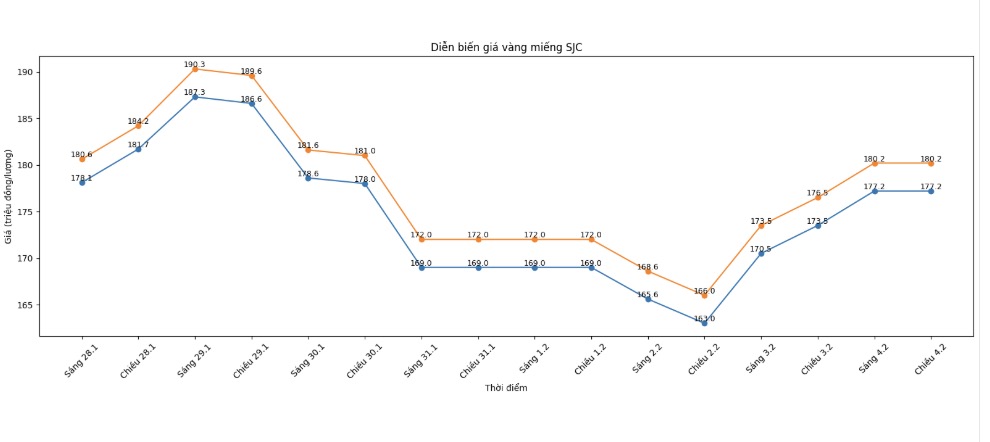

SJC gold bar price

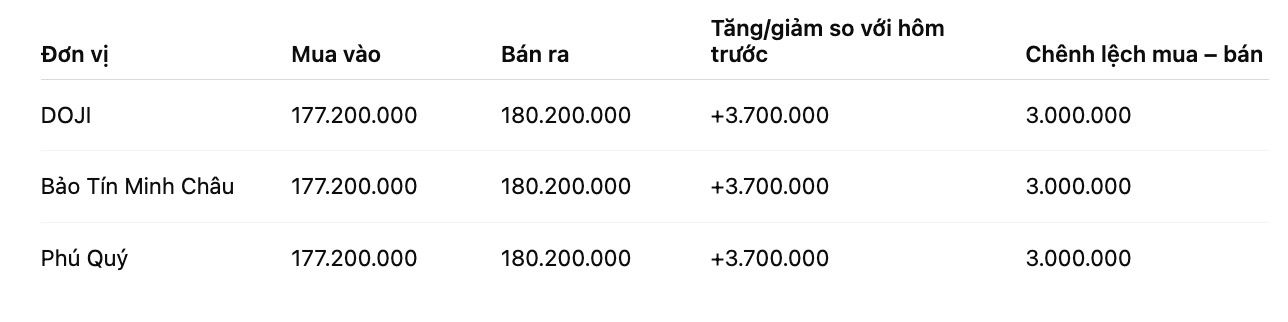

As of 7:30 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 177.2-180.2 million VND/tael (buying - selling); an increase of 3.7 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 177.2-180.2 million VND/tael (buying - selling); an increase of 3.7 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 177.2-180.2 million VND/tael (buying - selling); an increase of 3.7 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

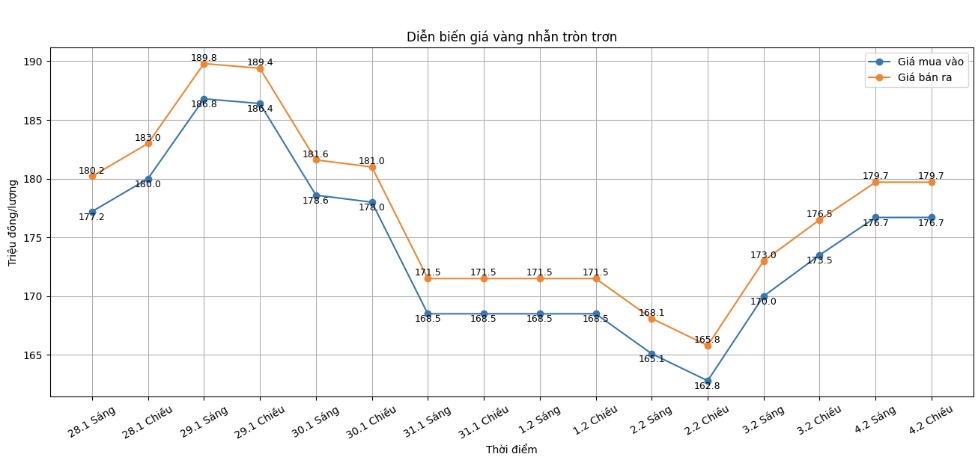

9999 gold ring price

As of 7:30 PM, DOJI Group listed the price of gold rings at 176.7-179.7 million VND/tael (buying - selling); an increase of 3.2 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 177.2-180.2 million VND/tael (buying - selling), an increase of 3.7 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 177.2-180.2 million VND/tael (buying - selling), an increase of 4.2 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

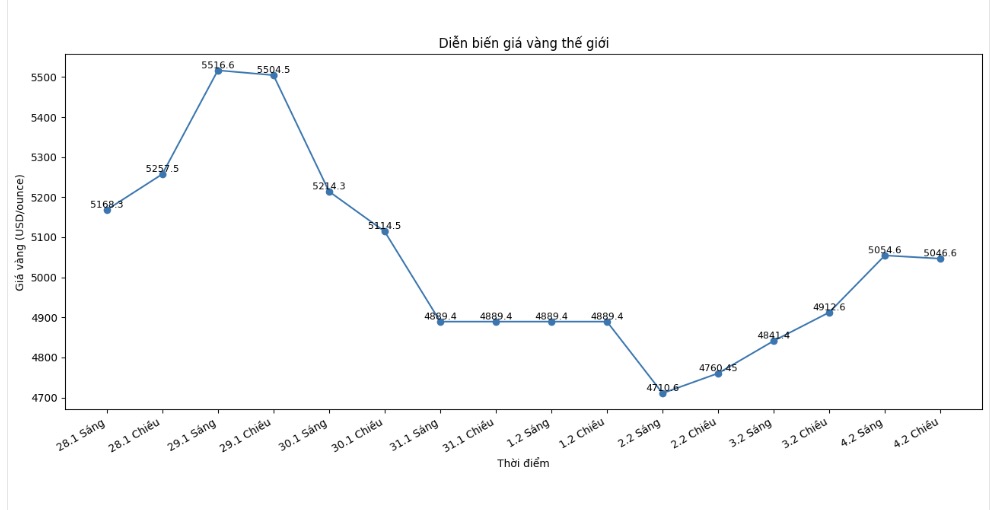

World gold price

At 7:30 PM, world gold prices were listed around the threshold of 5,046.6 USD/ounce; an increase of 134 USD compared to the previous day.

Gold price forecast

After a sharp decline at the end of January, the international gold market is sending a "self-balancing" signal as buying power returns quite quickly in the low price range. The strong recovery in recent sessions shows that safe-haven cash flow is still present, although investor sentiment is more cautious in the face of fluctuations from US monetary policy and geopolitical risks.

According to international news agencies, investment demand and central bank buying activities are expected to continue to be a support for precious metals. The recent adjustment, instead of weakening the trend, has activated the "bottom-fishing" buying force, especially when many funds and individual investors consider gold as an asset preservation channel in the context of persistent inflation and global public debt inflation.

Mr. Bart Melek - Head of Commodity Strategy at TD Securities - said that the foundation for price increases has not disappeared as "inflation is still higher than target, public debt is increasing and investors continue to see precious metals as a channel for portfolio diversification". From this perspective, deep declines may just be a process of "washing away" short-term speculative positions after a period of hot growth.

Some major financial institutions still maintain an optimistic view for the rest of the year. UBS and JP Morgan forecast that gold could head towards the 6,200–6,300 USD/ounce range, while Deutsche Bank set a scenario of 6,000 USD/ounce. However, experts also note that volatility will remain large, especially when the market has witnessed shocking declines before recoiling.

Mr. Michael Hsueh – Head of Metal Research at Deutsche Bank – emphasized that the argument of holding gold is basically unchanged and gold can still reach the $6,000/ounce mark, although investors need to be "cautious because volatility is still high.

On the side of short-term support, the physical gold market is expected to play an important role in establishing a new price level as seasonal demand and purchasing power in Asia gradually improve after the holidays. However, the risk still lies in "leverage releases" if speculative cash flow returns too quickly, causing prices to fluctuate sharply according to interest rate and USD news. Therefore, the main trend is still positive, but the journey to conquer new peaks is likely to be accompanied by unpredictable fluctuations.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...