Gold and silver prices continue to face great pressure as investors are still "digesting" the sharp collapse of the global financial market in the last session of last week. Although precious metal prices still have room to decrease further in the short term, commodity analysts at Societe Generale (one of the largest banks in France and Europe) believe that the risk of price increases for the whole year is still strongly in the positive direction.

This optimistic assessment was made just a week after the French bank strongly raised its gold price forecast, saying that the $6,000/ounce mark by the end of the year is still just a "cautious" scenario.

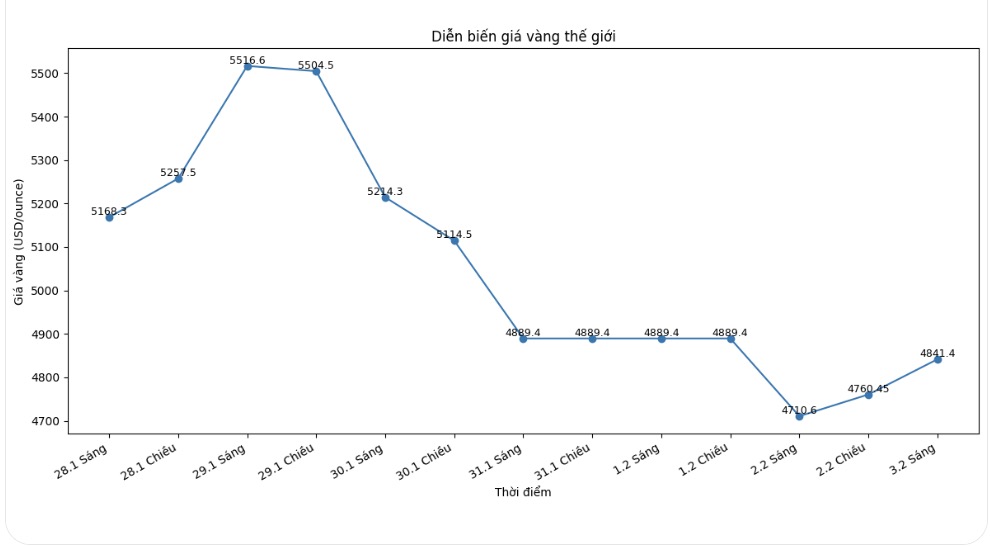

Metal prices were not simply adjusted on Friday – it was a leverage process. Gold fell by 10%, surpassing the largest daily drop since the 2008 global financial crisis and the strongest daily drop since the early 1980s. Meanwhile, silver plummeted by 30%," analysts said. "These extreme fluctuations show that the cause is not fundamental, but due to the investment positioning factor.

SocGen believes that the direct trigger for the sell-off is information that former US Federal Reserve (Fed) Governor Kevin Warsh was nominated by US President Donald Trump as the next Fed Chairman.

This information has created certain support for the USD, which had previously fallen to its lowest level in many years.

Gold in fact does not react to interest rate increases or decreases, but only needs monetary policy not to be as negative as initially feared, and that seems to have happened" - analysts said.

Besides, because gold and silver were previously in an overbought state, just a small boost was enough to trigger a strong sell-off wave in the context of low liquidity.

When positions are stretched, loss-cutting orders are activated, margin calls increase, and system trading funds are forced to reduce risks. The sharp drop in silver is a typical sign of leverage being "cleared out". This development is also amplified by profit-taking activities, VAR limits hitting thresholds, CTA funds losing positions, and the fact that everything happens right at the end of the month. When a domino falls, the price will rush faster than any fundamental factor can explain" - SocGen analyzed.

Regarding the upcoming prospects, Societe Generale said it is closely monitoring the developments in the options market. On the gold market, the bank recorded an increase in put options contracts at a performance price of 4,000 USD/ounce for the December 2026 term.

However, at the same time, there was also a significant increase in call options contracts at 10,000 USD/ounce, even with transactions at 15,000 and 20,000 USD/ounce.

From all perspectives, the risk range of price increases is far exceeding the risk of price decreases" - analysts said - "As written last week, we still maintain an optimistic view of gold, because the underlying drivers for the upward trend remain intact, while an uncertain factor has been eliminated - which is the chaos in the Fed's institution. We have always believed that corrections are necessary and healthy.

For silver, SocGen believes that a similar trend is taking place, but the risk of price decline is more apparent. The bank recorded increased interest in silver buy options contracts at 200 USD/ounce for the May and July 2026 terms. However, the amount of selling options at 75 USD/ounce for the March term increased sharply, followed by levels of 80 and 90 USD/ounce.

We also recorded a large amount of downside betting positions for the July term, especially at prices of 65 and 95 USD/ounce," analysts said. "In the upside, only about 400 buy options contracts were added, showing that investors are still very cautious about the upside outlook for silver.