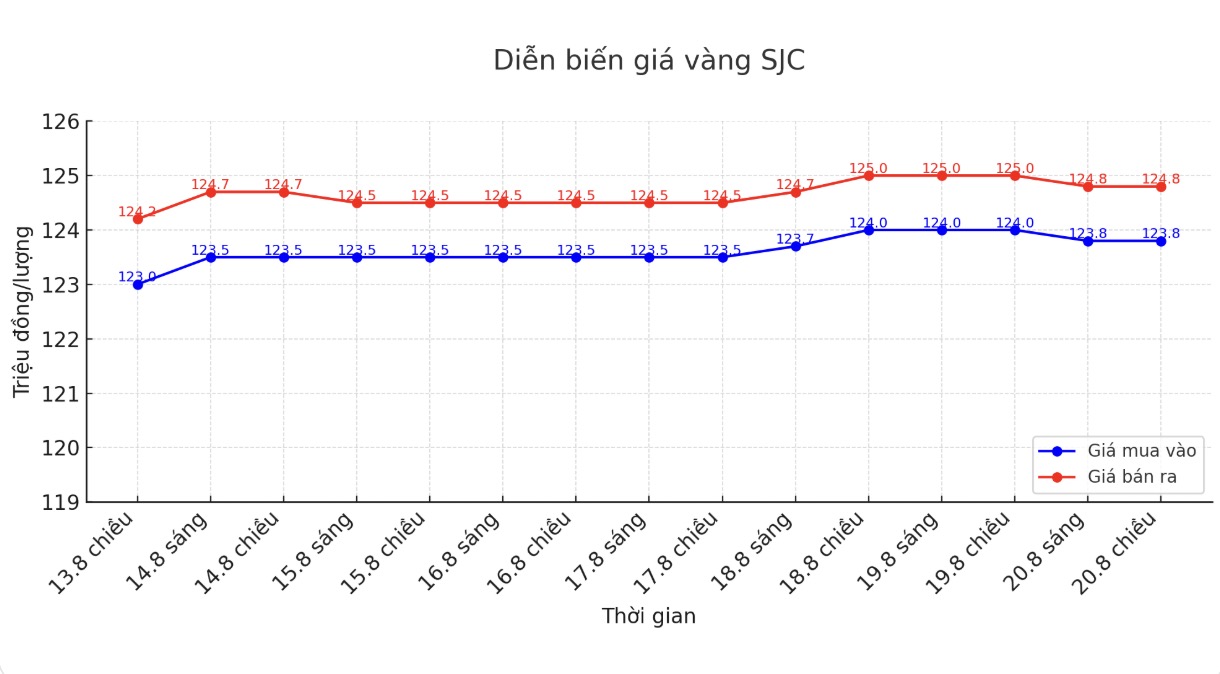

SJC gold bar price

As of 7:40 p.m., DOJI Group listed the price of SJC gold bars at VND123.8-124.8 million/tael (buy in - sell out), down VND200,000/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123.8-124.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.8-124.8 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

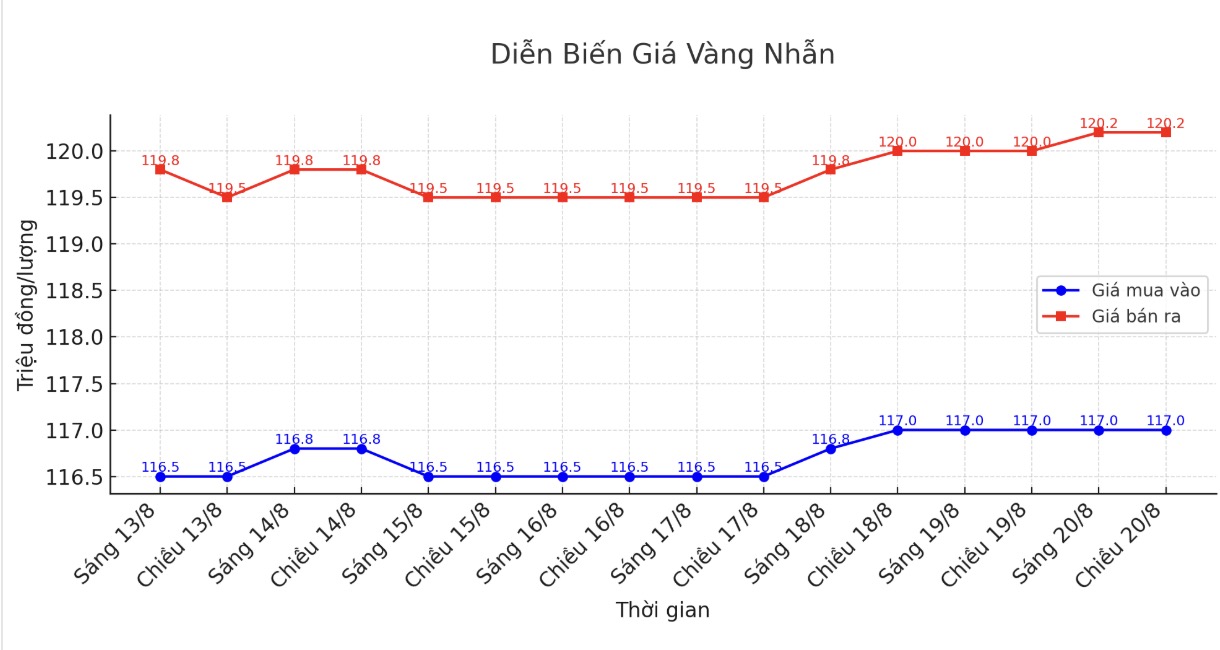

9999 gold ring price

As of 7:40 p.m., DOJI Group listed the price of gold rings at 117-120.2 million VND/tael (buy in - sell out), keeping the same for buying and increasing 200,000 VND/tael for selling. The difference between buying and selling is 3.2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-119 seven million VND/tael (buy in - sell out), unchanged in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

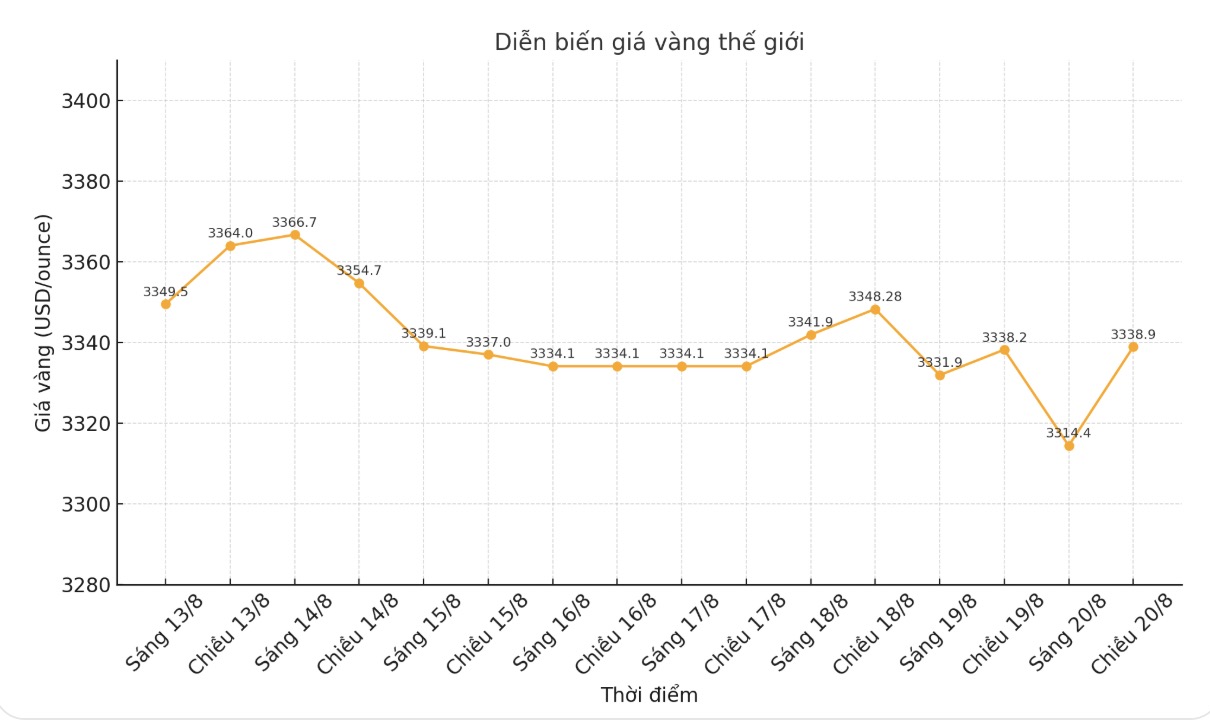

World gold price

The world gold price was listed at 7:42 at 3,338.2 USD/ounce, down 10.5 USD compared to a day ago.

Gold price forecast

Gold prices increased on Wednesday as investors awaited the minutes of the Federal Reserve's (FED) July meeting and the annual meeting in Jackson Hole, Wyoming this week for clues on the possibility of interest rate cuts.

According to Ole Hansen - Head of Commodity Strategy at Saxo Bank, the key speech of US Federal Reserve Chairman Jerome Powell at the Jackson Hole conference on Friday could be the next important signal.

In recent weeks, some US economic data has caused a negative surprise. While the stronger-than-expected producer price index (PPI) has reminded the market that inflationary pressures may still come from Donald Trump's tariff policies.

That data has temporarily eased expectations for a series of quick and strong rate cuts, but the market is still pricing in a possibility of a 25 basis point cut at the September FOMC meeting, although the path after that remains uncertain, Hansen said.

Han Tan - chief analyst at the Nemo.Money trading platform - commented: "Department gold prices are likely to continue moving sideways until the Fed restarts the interest rate cutting cycle, while the USD's resilience since the beginning of the month has also made it difficult for gold to rebound."

The minutes of the Fed's July meeting, due to be released on the same day, are expected to provide more information on economic prospects and monetary policy.

The market will closely monitor disagreements from the recent FOMC meeting. Gold could receive slight support ahead of the Jackson Hole conference if the minutes show stronger-than-expected opposition at the previous policy meeting, Han Tan of Nemo.Money added.

FED Chairman Jerome Powell is scheduled to speak at the Jackson Hole conference hosted by FED Kansas City on Friday. Gold often benefits in a low interest rate environment and times of economic and geopolitical instability.

On geopolitics, US President Donald Trump on Tuesday denied the possibility of deploying infantry to Ukraine but suggested that air support could be part of an agreement to end the war in the region.

Ukrainian President Volodymyr Zelensky called the White House talks a major step forward towards ending the conflict and preparing for a tripartite meeting with Russian President Vladimir Putin and US President Donald Trump.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...