Gold prices fluctuated in the trading session on Thursday, supported by dovish signals from the US Federal Reserve (Fed) but were pressured by the stronger USD, as investors waited for important US inflation data to be released this week. Meanwhile, silver prices hovered near record highs.

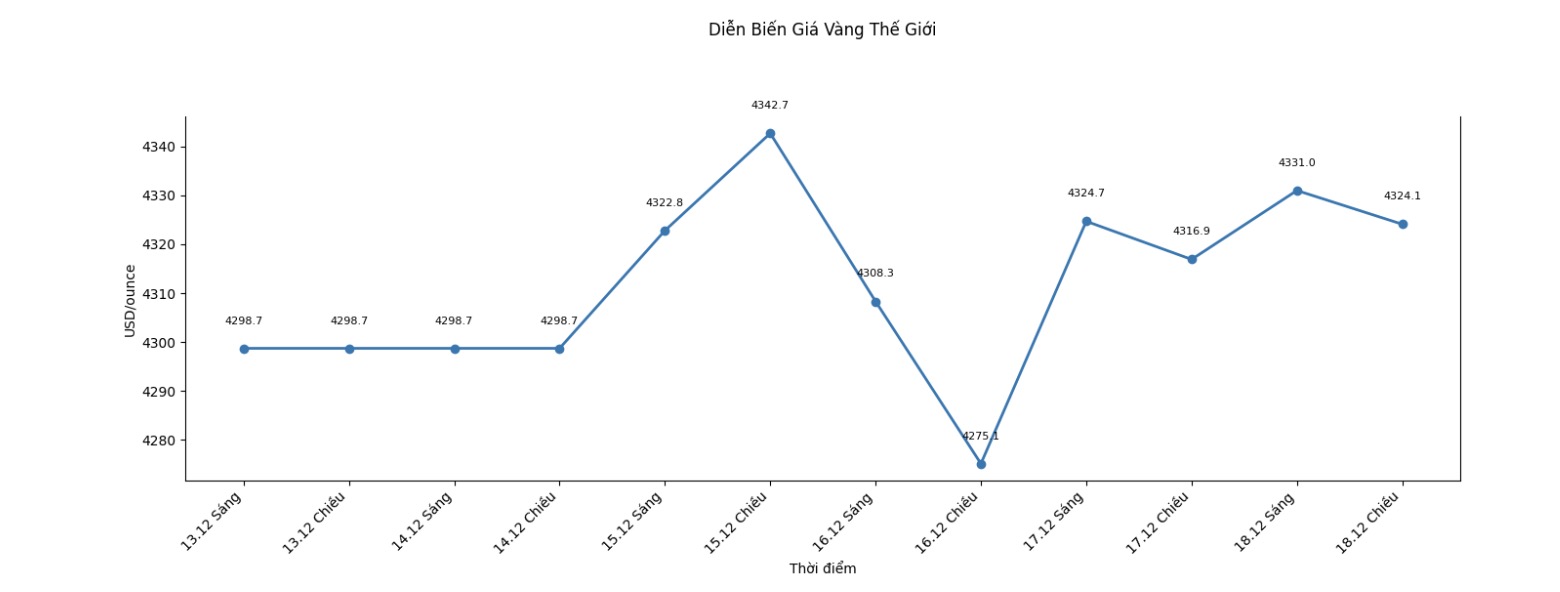

Spot gold fell 0.2% to $4,333.12 an ounce at 6:52 a.m. GMT, after gaining more than 1% late on Wednesday. US gold futures also fell 0.2% to $4,363.60 an ounce.

The USD index maintained its upward momentum after reaching its highest level in nearly a week on Wednesday, thereby limiting the upward momentum of precious metals priced in greenback.

Spot silver prices increased slightly by 0.1% to 66.36 USD/ounce, after reaching a record high of 66.88 USD in the previous session. Since the beginning of the year, silver has increased by about 130%, far exceeding the 65% increase of gold, thanks to strong industrial demand, stable investment cash flow and increasingly tight supply.

Some analysts predict that silver prices could hit $70 an ounce next year, especially if the US interest rate cut continues to support demand for precious metals.

Wallers comments suggest the Fed can maintain the current rate cutting cycle which is supporting both gold and silver, Kelvin Wong, senior market analyst at OANDA, said. However, he also believes that profit-taking may appear at current prices.

Fed Governor Christopher Waller said the US central bank could still cut interest rates as the labor market cooled, while affirming that it would completely protect the Feds independence if challenged.

This statement was made while he awaited an interview with US President Donald Trump regarding the succeition of Fed Chairman Jerome Powell.

Earlier this week, data showed that the US unemployment rate rose to 4.6% in November, higher than the forecast of 4.4% in a Reuters survey and the highest level since September 2021.

The Fed made the third and final 0.25 percentage point interest rate cut last week. Currently, the market is pricing in the possibility of two more interest rate cuts, each of which is 0.25 percentage points, in 2026.

Non-yielding assets such as gold often benefit in a low-interest-rate environment.

Investors are now awaiting US consumer price index (CPI) data for November, expected to be released later in the day, followed by the Personal Consumption Expenditures (PCE) price index on Friday.

In other precious metals, platinum prices rose 4% to $1,973.91 an ounce, the highest level in more than 17 years, while palladium rose 2.4% to $1,687.39 an ounce, the highest level in nearly three years.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.